Microsoft – The Underrated Powerhouse

While everyone is reveling in Nvidia’s meteoric rise, Microsoft has quietly flexed its muscles as the second-best performer among the Magnificent Seven stocks. With a robust 22% surge in 2024, Microsoft has shown resilience in the ever-evolving tech landscape.

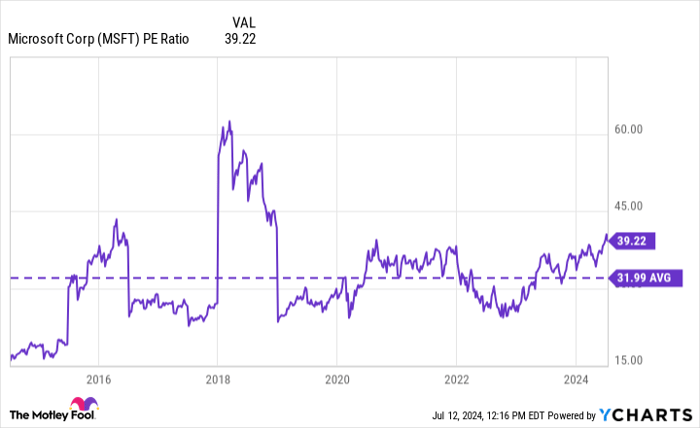

Despite its lofty price-to-earnings ratio around 39, Microsoft’s expansive ecosystem sets it apart from the herd. Catering primarily to businesses with a suite of essential products like Azure, Office, and LinkedIn, Microsoft enjoys a unique position. This customer base shields it from abrupt market fluctuations, offering a semblance of stability amidst the tech frenzy.

For cautious investors wary of valuation concerns, adopting a dollar-cost averaging strategy could mitigate risks without missing out on Microsoft’s long-term growth trajectory.

Alphabet – Google’s Dominance Unshaken

Alphabet, despite a robust 34% climb in 2024, presents an enticing opportunity for investors seeking a slice of tech pie. Google’s unparalleled dominance in the search space, boasting a staggering 90% market share globally, underpins Alphabet’s revenue streams.

The cash cow, Google advertising, fuelled Alphabet’s coffers with $61.7 billion in Q1 revenue, with Google search alone contributing $46.2 billion. Despite being an advertising juggernaut, the emergence of Google Cloud as a lucrative revenue source cannot be overlooked. Google Cloud’s operating income skyrocketed by 371% to $900 million in Q1, marking its turning point towards profitability.

Alphabet’s recent foray into dividend payouts coupled with its robust search and cloud businesses positions the tech titan for sustained growth in the long haul.

Amazon – Clouding over the Competition

Amazon, a retail behemoth turned tech giant, has strategically diversified its revenue streams beyond e-commerce, epitomizing resilience and foresight in a competitive landscape.

Embracing the potential of cloud computing early on, Amazon Web Services (AWS) has emerged as the undisputed leader in the cloud arena, contributing significantly to Amazon’s bottom line. AWS, generating over 17% of Amazon’s revenue but a whopping 61% of its operating income in Q1, exemplifies the allure of high-margin cloud services.

With AI innovations on the horizon and AWS’ unwavering dominance in cloud computing, Amazon’s profitability is poised for continued growth, offering investors a diversified tech stock to ride out market fluctuations.

The Rise of Amazon’s Diversified Revenue Streams

In the vast ocean of e-commerce and cloud services, Amazon has solidified its position as a formidable titan, weaving a complex web of interconnected offerings that reach far beyond its humble origins. With a focus on developing a comprehensive suite of cloud and artificial intelligence solutions, Amazon has orchestrated its investments in e-commerce and cloud infrastructure to pave the way for innovative revenue streams.

Unlocking New Frontiers: Supply Chain by Amazon

One prime example of Amazon’s expansion is the Supply Chain by Amazon service, a seamless end-to-end supply chain solution that empowers sellers to tap into Amazon’s extensive logistics network. This offering not only enhances operational efficiency but also showcases Amazon’s versatility in catering to various business needs, positioning it as a one-stop shop for all things cloud and AI.

Seizing the Future: A Beacon of Sustained Growth

Amazon, with its penchant for forward-thinking strategies, stands as a beacon of sustained growth in the corporate landscape. Investors eyeing the long game find solace in the company’s ability to adapt, evolve, and continuously chart new pathways to prosperity. As Amazon leans into its diverse portfolio of services, investors are presented with an opportunity to ride the wave of its relentless expansion.

Charting a Profitable Course

Amidst the sea of investment choices, the allure of Amazon’s growth trajectory remains undeniable. Its strategic decisions and expansive portfolio set a compelling stage for investors seeking robust returns. The narrative of Amazon’s ascent serves as a reminder of the potential latent in tech giants willing to diversify and innovate.