The Rise of Lisata Stock

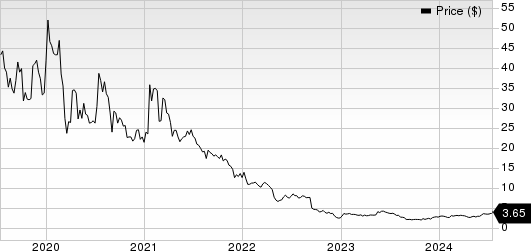

Amidst the tumultuous waves of the stock market, Lisata Therapeutics, Inc.’s stock (LSTA) has emerged as a beacon of hope, rallying an impressive 33.7% year to date (YTD). This growth stands in stark contrast to the industry’s decline of 2.7%, showcasing Lisata’s robust performance.

The Power of Certepetide

Certepetide, the flagship lead pipeline candidate of Lisata Therapeutics, Inc., has carved a path of promise in the realm of cancer treatment. Previously known as LSTA1, certepetide is a groundbreaking investigative drug candidate designed to combat a spectrum of solid tumors.

In a recent preclinical study, certepetide demonstrated remarkable potential in treating intrahepatic cholangiocarcinoma, a formidable type of cancer characterized by a bleak prognosis. The study revealed a glimmer of hope as certepetide, when paired with standard-of-care chemotherapy and immunotherapy, exhibited enhanced survival rates in mice afflicted with this aggressive cancer.

The allure of certepetide lies in its unique ability to facilitate the entry of co-administered anti-cancer drugs into solid tumors through an innovative uptake pathway. This mechanism not only augments drug penetration but also promises to transform the tumor microenvironment, rendering it more susceptible to immunotherapy. Such prowess positions certepetide as a potential game-changer in the oncology landscape.

The Path Forward

Lisata’s march towards excellence continues unabated with the ongoing phase IIa BOLSTER study, which delves into certepetide’s efficacy in conjunction with standard-of-care chemotherapy as a frontline treatment for cholangiocarcinoma. The company’s recent decision to expand the study to include certepetide in combination with chemoimmunotherapy underscores its commitment to exploring novel treatment modalities.

Buoyed by the positive preclinical outcomes, Lisata Therapeutics is now positioning itself to enrich the BOLSTER study with a fresh arm, dedicated to assessing certepetide’s impact on intrahepatic cholangiocarcinoma patients. This bold stride not only exemplifies Lisata’s dedication to innovation but also serves as a testament to its unwavering pursuit of therapeutic breakthroughs.

Future Prospects

The horizon appears luminous for Lisata as certepetide emerges as a multi-faceted gem in the field of oncology. With ongoing evaluations as a combinatorial therapy in diverse cancer indications, including metastatic pancreatic ductal adenocarcinoma, certepetide’s potential knows no bounds.

The recent Orphan Drug designations granted by the FDA for treating osteosarcoma further underscore certepetide’s significance in addressing unmet medical needs. Noteworthy designations, such as Rare Pediatric Disease Designation and Fast Track designation, for various cancer types reaffirm certepetide’s standing as a beacon of hope for patients battling malignancies.

Anticipated clinical data readouts in the upcoming months hold the promise of catapulting Lisata Therapeutics to new heights. Should these endeavors bear fruit, the trajectory of Lisata’s growth stands poised for an upward ascent, promising investors a slice of the burgeoning success.

Final Thoughts

As investors continue to ride the tide of Lisata’s stock rally, the underlying narrative of certepetide’s transformative impact on cancer treatment unfolds. Lisata Therapeutics’ unwavering commitment to pioneering innovation amid the challenging terrain of oncology cements its position as a formidable player in the biotech landscape.

The Zacks Rank & Top Picks

Lisata currently holds a Zacks Rank #3 (Hold). Among the notable contenders in the biotech domain, ANI Pharmaceuticals, Inc. (ANIP), Adaptive Biotechnologies Corporation (ADPT), and RAPT Therapeutics, Inc. (RAPT) shine bright with a Zacks Rank #2 (Buy).

As we reflect on the past 60 days, ANI Pharmaceuticals’ stellar performance in both 2024 and 2025 earnings per share estimates, along with notable stock growth, merits attention. On the flip side, Adaptive Biotechnologies and RAPT Therapeutics tread a divergent path, showcasing nuanced trajectories that underscore the dynamic nature of the biotech sphere.

The journey ahead for Lisata and its industry counterparts promises an enthralling saga of innovation, growth, and resilience in the ever-evolving landscape of biotechnology.