Diving Into Commvault’s Wall Street Recommendations

The stock market often dances to the tune of Wall Street analysts, whose recommendations can sway investor decisions. But what lies beneath the surface of these brokerage-firm cues, specifically when it comes to Commvault Systems (CVLT)? Let’s embark on a journey to decipher the veracity of these financial oracle pronouncements and how investors can leverage them to their advantage.

The Brokerage Drum for CVLT

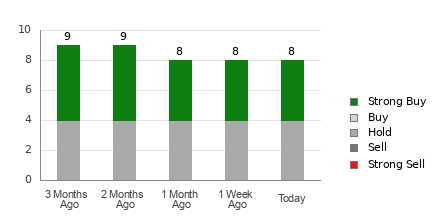

Commvault currently basks in an average brokerage recommendation (ABR) of 2.00, translating to a classic ‘Buy’ status. Delving deeper, out of the eight brokerage firms under scrutiny, four belt out a resounding ‘Strong Buy’, painting a picture of optimism that is hard to miss.

The Tug of War: ABR vs. Zacks Rank

The ABR speaks in one tongue, but the Zacks Rank chimes in with a different melody. While the ABR taps into brokerage whims, the Zacks Rank wades through the tides of earnings estimate revisions to chart a more balanced course towards stock price prediction. A tug of war between vested interests and empirical data unfolds.

Peeling Back the Layers: The Zacks Rank Revelation

The Zacks Rank, a proprietary stock rating tool with an impeccable provenance, segments stocks into a quintet of categories based on their earnings prospects. It stitches together a tapestry of financial performance predictions that speak of whispers in the market wind.

Is Commvault the Golden Fleece for Investors?

As the fortune tellers whisper of unchanged consensus estimates for Commvault, the Zacks Rank casts a specter of ‘Hold’. A cautious optimism hangs in the air – a blend of hope and skepticism, a tightrope act of risk and reward that investors must balance upon.

The Infrastructure Stock Symphony

As the drum beats of infrastructure spending resound across the nation, there emerges a symphony of opportunities. The question beckons: Will you be at the vanguard or the rear guard of this impending financial conquest?

Zacks beckons with a clarion call, offering a roadmap to profit from the infrastructure boom. A treasure trove of insights awaits, as fortunes stand to be made and lost with the shifting sands of construction, transport, and energy realms.