Deciphering Stock Trends

Apple Inc. (AAPL) has been under the watchful eye of investors, with shares showing a strong return of +6.9% over the past month compared to the market’s +1.1% change. The company operates in the Computer – Mini computers industry, which has seen a 4.6% increase in the same period. As the stock trends, investors are left wondering about its future trajectory.

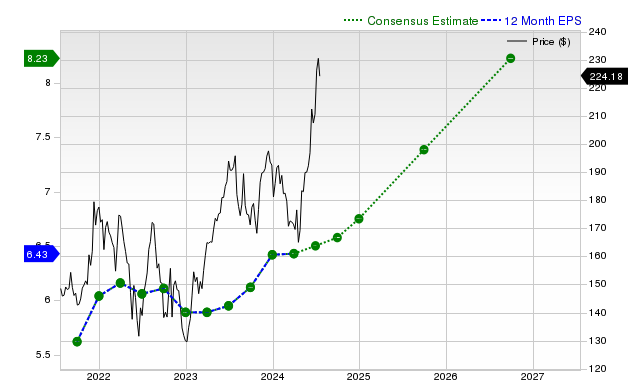

Unveiling Earnings Estimate Dynamics

When analyzing stock performance, focusing on earnings estimates is paramount. The present value of a company’s future earnings plays a pivotal role in determining its fair value and subsequent stock movement. With Apple, earnings estimates for the current and upcoming quarters display promising figures, hinting at potential growth.

Peering into Revenue Growth

While earnings showcase financial health, revenue growth is equally essential for sustainable success. Apple’s projected revenue estimates for upcoming quarters indicate positive year-over-year changes, shedding light on its revenue potential for the future.

Examining Financial Metrics

Valuation metrics such as P/E ratios and P/S ratios provide insights into a company’s true value. In Apple’s case, relative to its peers, the stock is trading at a premium, suggesting further analysis into its valuation compared to industry standards.

Assessing the Big Picture

As investors navigate the stock market landscape, a comprehensive understanding of factors influencing stock movements is crucial. While market buzz surrounds Apple, its Zacks Rank #2 indicates potential outperformance compared to the broader market in the short term.

The Infrastructure Stock Surge

A revitalization of U.S. infrastructure looms on the horizon, promising substantial investments and lucrative opportunities. Investors seek to identify key stocks positioned to capitalize on this infrastructure boom, aiming to secure early entry into high-growth potential ventures.