Financial Projections in the Spotlight

General Motors is expected to reveal its second-quarter 2024 results on July 23, a date circled on the calendar of many investors. The Zacks Consensus Estimate hints at promising numbers with anticipated earnings of $2.59 per share and revenues reaching $45 billion. What does this mean for potential investors?

Analyzing the Historical Performance

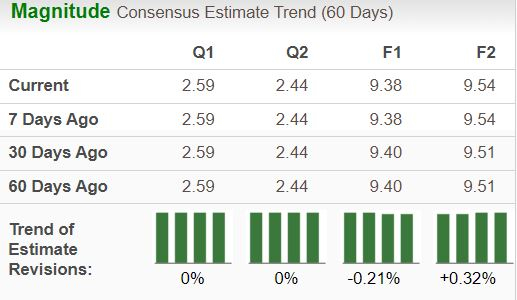

With the bottom-line projection showing a 35% year-over-year growth and revenues expected to grow by a modest 0.4%, General Motors seems to be on a positive trajectory. This follows a trend of consistently surpassing EPS estimates, boasting an average earnings surprise of 17.75% over the past four quarters.

Zooming In on Earnings Whispers for Q2

Despite our model not indicating an earnings beat for GM this quarter, all eyes remain on the company’s performance. The Earnings ESP of 0.00% and Zacks Rank #3 may not be the perfect recipe for a beat, but surprises are not uncommon in the world of finance.

Factors Shaping GM’s Q2 Results

The standout performance in the U.S. market, primarily fueled by robust sales of full-size pickup trucks and EVs, presents a mixed picture for GM. While North America showcases strength, challenges in China could weigh on overall revenue figures.

Performance & Future Potential

General Motors’ market share has seen a notable ascent of 44% year-to-date, asserting itself as a strong contender in the automotive industry. The company’s favorable valuation metrics further add to its appeal, trading at a discount compared to industry peers, a potential draw for value investors.

Strategic Insights for Investors

GM’s innovative approach to EVs and a resilient balance sheet, coupled with concerns over meeting ambitious EV production targets, present a nuanced scenario for investors. CEO Mary Barra’s cautionary comments and external challenges underscore the intricacies of the market environment.

Investment Outlook and Final Thoughts

While GM’s attractive valuation and strategic positioning may catch the eye of investors, caution is advised in light of recent developments. Understanding the broader industry landscape and GM’s upcoming earnings reveal could shed more light on the road ahead.

The Significance of Earnings Reports on Investment Choices

Evaluate Market Trends Cautiously

It might be wise to exercise restraint and prudence before finalizing any investment decisions. In the financial realm, hesitation can often be a virtue. One should always maintain a watchful eye on market trends, considering all available data before committing to any course of action.

Historical Context of Presidential Years and Market Performance

Since 1950, elections in presidential years have exhibited robust market performance. This historical perspective sheds light on the potential impact of impending electoral outcomes on market dynamics. Projections for 2024, considering this historical context, are critical for informed decision-making.

Key Stocks to Watch

The present landscape showcases specific stocks that are gaining attention. Noteworthy among these are a prominent medical manufacturer that has experienced significant growth, a rental company leading its sector, an energy giant with ambitious dividend growth plans, an aerospace and defense entity securing substantial contracts, and a semiconductor titan expanding its manufacturing facilities within the United States.

Importance of Earnings Reports

Given the upcoming election and the historical trends associated with such periods, it is crucial to await the release of earnings reports before finalizing any investment decisions. These reports provide crucial insights into the health and performance of companies, enabling investors to make informed and strategic choices.

Prudent Strategy Moving Forward

One of the key strategies for investors during periods of high market anticipation, such as election years, is to ensure a thorough analysis of all available information. By carefully considering factors such as earnings reports, historical data, and market trends, investors can position themselves advantageously in the often turbulent and unpredictable world of financial markets.