Quarterly Insights

The recently released financial figures from Norsk Hydro showcase a mix of triumphs and setbacks. In the second quarter, the company reported a Non-GAAP EPS of NOK 0.97, alongside a revenue of NOK 50.94 billion. This marked a 5.0% year-over-year decline in revenue, a fact that might raise some cautious eyebrows among investors.

Operational Analysis

The adjusted EBITDA for the second quarter of 2024 stood at NOK 5,839 million, reflecting positive impacts from increasing revenue streams during the period. However, this figure was a drop from NOK 7,098 million in the same quarter the previous year. This shift indicates a potential need for recalibration in Hydro’s operational strategies to navigate the evolving economic landscape effectively.

Financial Health Check

Examining the finer details, we find that Norsk Hydro’s Adjusted RoaCE over the last twelve months settled at 4.4%. Additionally, the company recorded a free cash flow of NOK 2.8 billion. Nevertheless, concerns arise as Hydro’s net debt climbed from NOK 13.9 billion to NOK 16.2 billion within the second quarter of 2024. Adjusted net debt also saw an upward trend, rising from NOK 22.5 billion to NOK 26.1 billion. These figures could be a cause for contemplation among stakeholders regarding the company’s financial stability and debt management strategies.

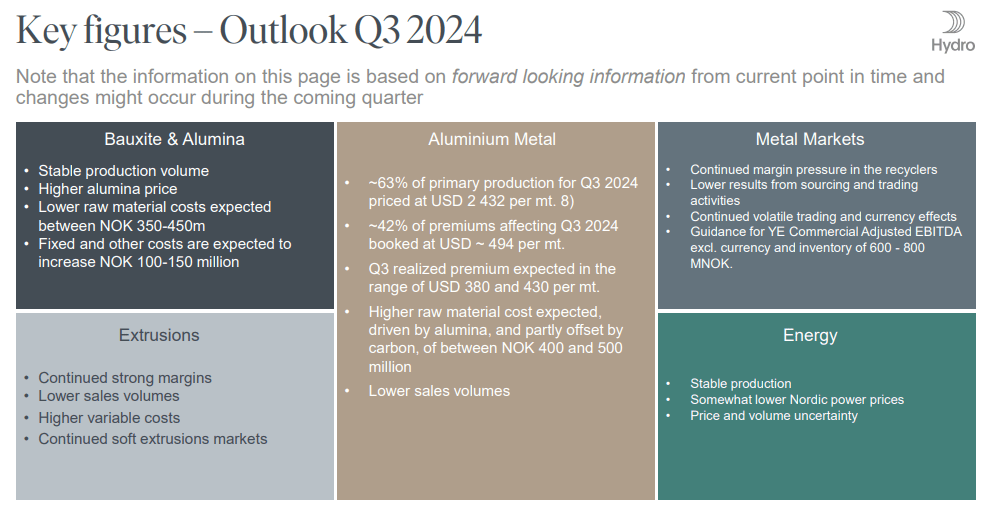

Future Prospects

Looking ahead, as the company initiates its Q3 outlook, there is an air of anticipation surrounding Norsk Hydro’s forthcoming endeavors. The strategic decisions and operational maneuvers executed in response to the current financial landscape could potentially shape the company’s trajectory in the upcoming quarters. Investors and analysts alike are keen to witness how Hydro navigates these waters of financial uncertainty and volatility.