Wealthy investors have taken a dim view of Upstart Holdings, sending bearish signals rippling through the market.

But this isn’t just a tale for the elite; retail traders should pay attention.

Today, the curtains were pulled back on some significant options activity for Upstart Holdings, revealing intriguing patterns in the market landscape.

Whether these maneuvers belong to institutional giants or deep-pocketed individuals remains shrouded in mystery. However, when seismic shifts like these occur with Upstart, savvy observers know to brace for impact.

Today, Benzinga’s analytical lens captured 8 notable options trades pertaining to Upstart Holdings.

This kind of commotion isn’t business as usual.

The prevailing sentiment among these magnates of the market appears starkly divided, swirling with 12% optimism and 87% pessimism.

Diving deeper into the numbers, we unearthed 1 put option valued at $29,325, accompanied by 7 call options amounting to $245,392.

Delving Into the Forecasted Price Spectrum

A thorough examination of the Volume and Open Interest in these transactions unveils a focal point for the big players, charting a path from $15.0 to $37.5 in Upstart Holdings’ anticipated price corridor over the previous quarter.

Unpacking Volume & Open Interest Trends

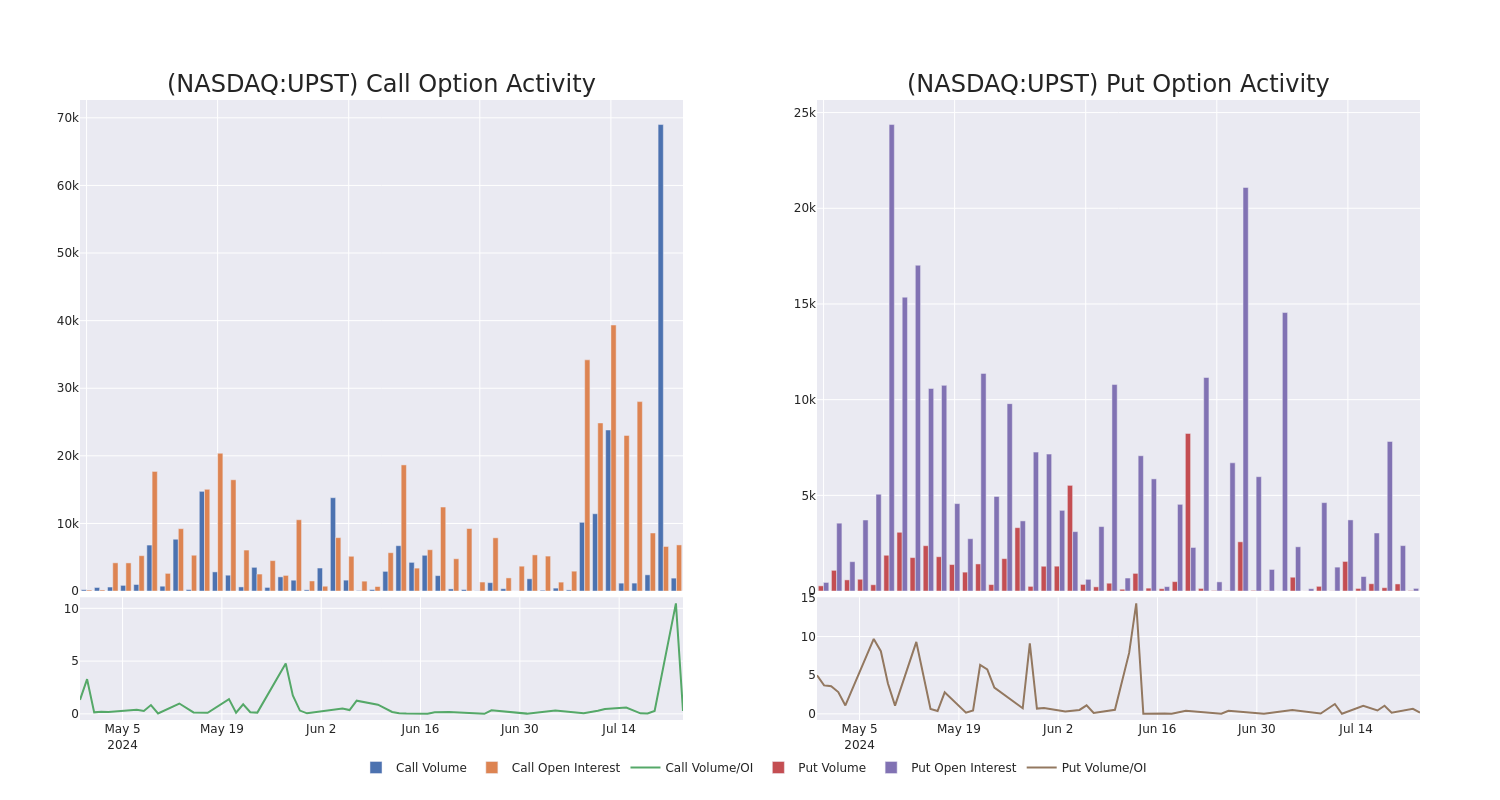

Amid today’s bustling market scenario, the mean open interest for Upstart Holdings’ options hovers at 994.57, with a total volume notching 1,937.00. The corresponding graphic illustrates the ebb and flow of call and put option volume and open interest in substantial trades concerning Upstart Holdings, residing within the strike price boundaries of $15.0 to $37.5, over the bygone 30 days.

Decoding Upstart Holdings’ Options Maneuvers: A Month in Review

Spotting Noteworthy Options Transactions:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPST | CALL | TRADE | BEARISH | 08/02/24 | $1.68 | $1.64 | $1.64 | $28.00 | $65.6K | 649 | 446 |

Exploring the Realm of Upstart Holdings

Upstart Holdings Inc operates in the arena of credit services, boasting a cutting-edge, AI-infused lending platform. This cloud-based marvel serves as a conduit, bridging the gap between consumer loan requests and Upstart’s network of AI-powered banking collaborators. Embracing personal loans, automotive financing, home equity lines of credit, and microloans, Upstart’s platform spans a broad financial spectrum.

As we sift through the labyrinth of options trading surrounding Upstart Holdings, a new chapter unfolds, delving into the company’s market position and trajectory.

The Current Market Position of Upstart Holdings

- Bolstered by a trading volume tallying 1,881,192, UPST’s value registers a 0.14% uptick, climbing to $27.69.

- RSI pointers suggest a potential overbought scenario for this underlying stock.

- The imminent release of quarterly earnings looms on the horizon, scheduled in a mere 14 days.

Options trading dances on a tightrope, offering both perilous pitfalls and dazzling triumphs. Seasoned traders navigate these treacherous waters by fortifying their knowledge base, adapting strategies on the fly, monitoring an array of indicators, and keeping an unwavering gaze on the shifting market landscape. Stay attuned to the latest whirlwinds in Upstart Holdings’ options rhythms with real-time alerts from Benzinga Pro.