The unexpected turbulence in the market caused by the lackluster results of United Parcel Service (UPS) on Jul 23 has cast a shadow over the transportation sector. Investors, feeling the weight of caution, now ponder over whether it’s wise to seize the opportunity and venture into the dip.

UPS Falters in Q2

Despite achieving volume growth in the United States after a long hiatus, UPS found itself falling short of expectations. The company’s earnings per share stood at $1.79, missing the Zacks Consensus Estimate of $1.98 by a wide margin and marking a 29.5% decline from the previous year. Additionally, revenues, totaling $21.8 billion, lagged behind the Zacks Consensus Estimate of $22.31 billion. This setback was attributed to higher labor costs in a subdued demand environment, following an e-commerce boom triggered by the pandemic.

Revising its revenue guidance to $93 billion for the year, UPS reduced its operating margin projection from 10-10.6% to 9.4%. These adjustments reflect the challenges the company faces in navigating the current economic landscape.

Ripple Effect in the Market

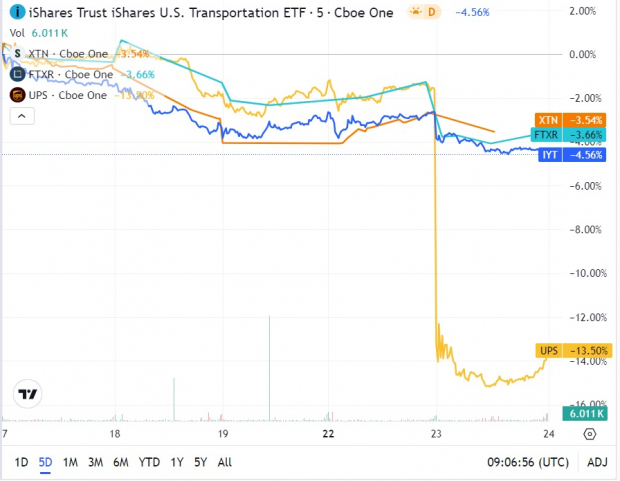

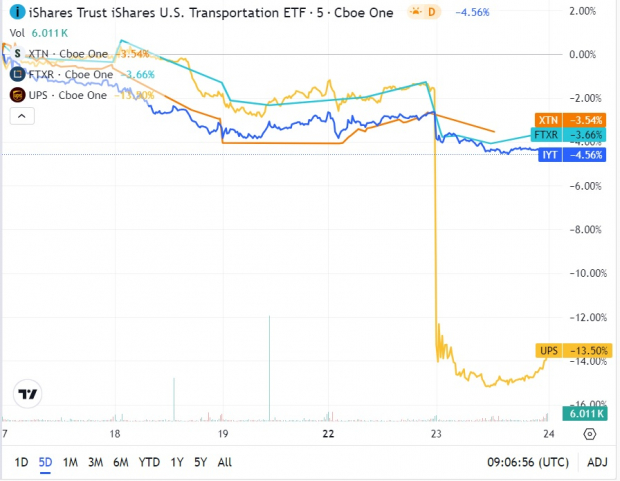

The impact of UPS’s performance reverberated in the market, with the company experiencing its most substantial drop in 25 years at a staggering 12%. The repercussions were also felt in the ETF sphere, as major funds like the iShares U.S. Transportation ETF IYT, First Trust Nasdaq Transportation ETF FTXR, and SPDR S&P Transportation ETF XTN saw declines of 1.9%, 2.6%, and 0.9% respectively.

Image Source: Zacks Investment Research

Looking Ahead

Despite the somber outlook for UPS and the transportation sector at large, investors are advised not to discount transportation ETFs entirely. These funds offer diversified exposure to various industries like railroads, airlines, and trucking, which can help cushion the impact of underperformance by key players.

For example, IYT allocates 27.2% to railroads and nearly 21.5% to airfreight & logistics. FTXR has a significant holding in automobiles at 26.9%, while delivery services make up 16% of its portfolio. XTN, on the other hand, is heavily invested in cargo ground transportation and passenger airlines with 31.4% and 24.6% share, respectively.

While UPS holds a 9.3% share in the IYT portfolio and a 6.7% share in the FTXR portfolio, XTN follows an equal-weight approach. IYT, the most popular and liquid among the three, contrasts with XTN, which boasts a lower expense ratio of 35 bps annually.

All three ETFs hold a Zacks ETF Rank #2 (Buy), indicating potential outperformance compared to the broader market in the upcoming months. However, it’s important to note that the transport sector’s earnings are projected to decline by 12.6%, per the Zacks Earnings Trend report, which could weigh down on the ETFs once again.

Curious about the latest ETF insights?

Zacks’ complimentary Fund Newsletter provides weekly updates on market analysis and top-performing ETFs directly to your inbox.