Amidst the ever-fluctuating tides of the stock market, investors have set their sights on small-cap stocks, anticipating a windfall in the wake of an impending Federal Reserve rate cut cycle.

The month of July has been nothing short of transformational, as small caps have outshone their larger counterparts by a significant margin, particularly within the tech sector. This newfound dominance of small caps has come at the heels of a nearly two-year tech bull market.

The Russell 2000 index has been a beacon of success, soaring nearly 9% month-to-date, juxtaposed against a 3.6% dip in the tech-heavy Nasdaq 100 as of July 25.

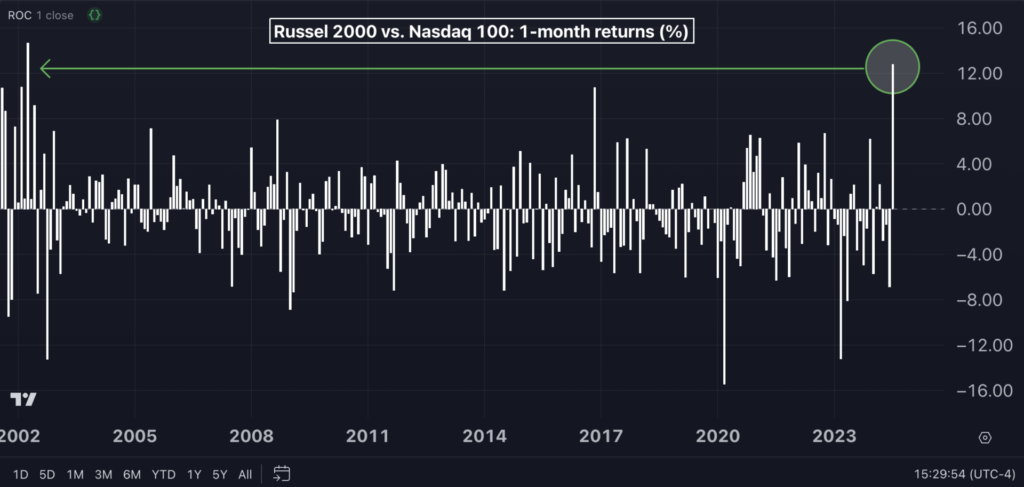

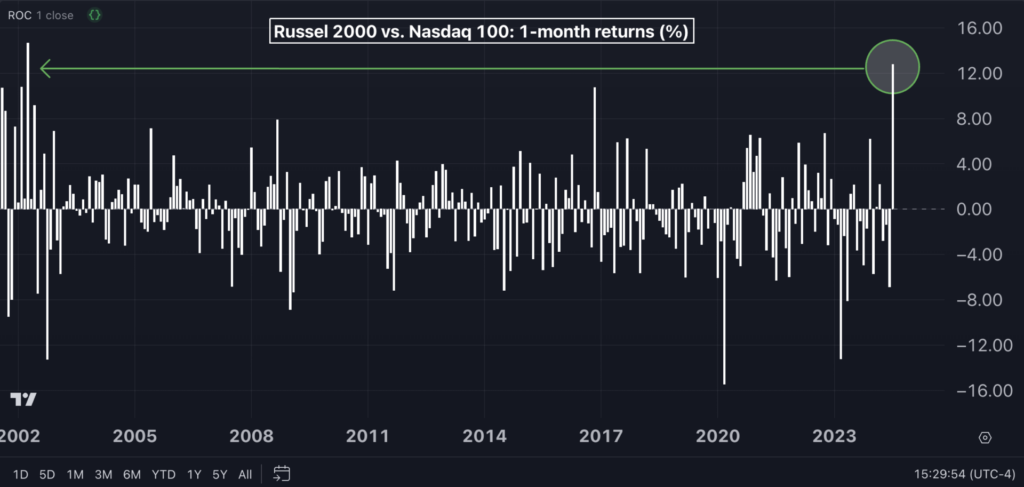

The staggering performance divergence of almost 13 percentage points in favor of the Russell 2000 over tech in this short span echoes what experts would frame as the best month for the “long small cap, short tech” exchange since April 2002, showcasing the decisive nature of the ongoing market reorientation.

Charting Two Decades’ Best Month for ‘Long Russell 2000, Short Nasdaq 100’

Robust Inflows Into Small-Cap ETFs

The remarkable performance of small-cap stocks has been mirrored by substantial flows of capital into prominent small-cap-focused ETFs.

The iShares Russell 2000 ETF IWM, a behemoth among ETFs tailing the U.S. small-cap index, has seen over $6 billion in net inflows so far this month, marking a record influx in 2024 as per data from Etfdb.com.

Several other small-cap ETFs have also been beneficiaries of considerable investor interest this month:

- iShares Core S&P Small-Cap ETF IJR: $645 million in net inflows

- Avantis U.S. Small Cap Value ETF AVUV: $553.28 million in net inflows

- Invesco S&P SmallCap Momentum ETF XSMO: $350 million in net inflows

- SPDR Portfolio S&P 600 Small Cap ETF SPSM: $188 million in net inflows

Year-to-date, the Vanguard Small-Cap ETF VB and the Pacer US Small Cap Cash Cows 100 ETF CALF have been the primary magnets for investor capital, raking in $3.1 billion and $2.9 billion respectively.

A Contrarian Viewpoint

However, amidst the fervor surrounding the Russell 2000 index’s triumphant run and the substantial influx into small-cap ETFs, some voices of reason are urging caution.

“Investors and analysts are pinning their hopes on the conclusion of the Federal Reserve’s tightening regimen to herald bright prospects for smaller enterprises, especially those reliant on debt for operational funding. But we remain skeptical,” cautioned seasoned Wall Street guru Ed Yardeni in a recently penned note.

Yardeni argues that larger corporations, particularly in the tech domain, hold key advantages that their smaller counterparts may struggle to replicate.

For instance, major tech players boast significant cash reserves, affording them the capacity to fuel substantial capital investments and Research & Development budgets, thereby preserving their competitive edge.

Illustrating this, Alphabet Inc. GOOGL closed the last quarter with a cash hoard of $111 billion. Amazon.com Inc. AMZN and Microsoft Corp. MSFT boasted cash reserves of $87 billion and $80 billion, respectively.

This financial flexibility empowers them to strategically acquire smaller entities housing pivotal new technologies or business lines. Microsoft’s $10-billion stake in OpenAI, the brains behind ChatGPT, from last year serves as a prime paradigm of this acumen.

Yardeni posits that the swiftly expanding, high-potential companies may have already forged alliances with large-cap firms or private equity players.

“In consequence, it is posited that the slower companies will be relegated to the S&P 400 and S&P 600—implying that investors may pivot back to larger-cap options sooner than anticipated,” he concluded.

Read Now:

Fascinated by small-cap equities and ETFs? The Benzinga Small Cap Conference scheduled for October 10 in Chicago is a can’t-miss event. Click here for additional details.

Image generated using artificial intelligence via MidJourney.