The 2024 Q2 earnings season continues its march forward, with the upcoming week teeming with noteworthy reports. The climate thus far remains favorable, with even the colossal banks failing to stir unease.

As we look ahead to next week’s schedule, a lineup featuring several Mag 7 heavyweights, including Meta Platforms (META), Amazon (AMZN), and Apple (AAPL), stands out. These three stocks have been star performers in 2024, prompting speculation about the sustainability of their growth.

Lets delve into how these giants are positioned as they gear up for their earnings releases.

Apple Eyes China Sales Performance

Apple’s stock faced scrutiny for a sluggish start in 2024 but has rallied impressively since, boasting a 14% year-to-date increase. Concerns over its presence in China and AI capabilities trailing peers had weighed on its performance but seem to have alleviated for the moment.

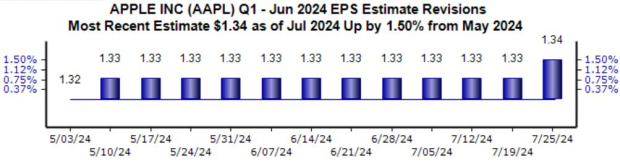

The stock holds a Zacks Rank #2 (Buy), with expectations for upcoming earnings trending upwards over recent months. Projected earnings of $1.34 indicate a 6% rise from the previous year, and sales are anticipated to climb by 2.7% year-over-year.

The China market presented challenges for Apple in the past period, but performance was closer to expectations compared to previous instances, missing consensus estimates by $220 million versus a $2.5 billion shortfall earlier.

Moreover, positive news on iPhone shipments in China has emerged recently, calming fears. Investors are keenly watching Apple’s Services segment, which has been a key growth driver and helped reduce dependency on iPhone sales.

Amazon’s AWS Impresses

Amazon excelled in its most recent period, with a remarkable 220% year-over-year surge in operating income to $15.3 billion. Notably, AWS delivered strong results, with net sales of $25 billion reflecting a 17% increase year-over-year, ending a recent string of underwhelming figures.

There were concerns of a slowdown in cloud services, which were perceivable in prior periods, but the latest results paint a positive picture for the upcoming release.

Meta Platforms Focuses on CapEx

META’s enhanced operational efficiencies have significantly bolstered its bottom line, leading to robust EPS growth in recent quarters.

Investors are eager for insights on CapEx trends related to AI, a focal point in Alphabet’s recent quarterly report. Earnings expectations for the upcoming release have risen steadily, with an anticipated $4.69 per share, reflecting an impressive 45% year-over-year growth.

The Zacks Consensus Estimate for Advertising revenue at META stands at $37.5 billion, a substantial 20% increase from the same period last year. Noteworthy is Alphabet’s Advertising segment, which showcased strong performance, with sales climbing 12% year-over-year to $64.6 billion.

META shares took a hit following its last quarterly results, with concerns revolving around a higher CapEx guidance for the current fiscal year. This development will be closely watched by investors, especially after Alphabet’s spooking over unexpectedly high CapEx.

Concluding Thoughts

The 2024 Q2 earnings season is in full swing, with a packed reporting agenda this week. Another wave of positivity is anticipated, propelled by solid performances, particularly from the Tech sector.

This week sees the reporting of several Mag 7 powerhouses, including Meta Platforms (META), Amazon (AMZN), and Apple (AAPL). Their results are poised for intense scrutiny, given the momentum they have sustained in 2024, potentially marking a pivotal week in the Q2 reporting cycle.

Analysts might be underestimating potential stars among these stocks, with the prospective for considerable price surges upon earnings announcements. Something to keep an eye on indeed.