- Discover the power of Investing.com’s latest free stock screener in pinpointing winning stocks with promising technical setups.

- Explore a comprehensive guide on utilizing technical filters to uncover trading opportunities tailored for short and medium-term strategies.

- Unlock the advantages of registering for free to harness the capabilities of Investing.com’s robust stock screener tool.

Delving into the stock market landscape can often feel like navigating a vast ocean, with countless stocks swirling around. Yet, armed with the right instruments, you can transform stock selection from a labyrinth into a well-marked trail, elevating your odds of uncovering winners.

Enter Investing.com’s groundbreaking free stock screener. This potent tool is engineered to assist you in pinpointing stocks exhibiting high-potential technical setups, empowering you with better decision-making prowess.

This versatile tool caters to both the swift maneuvers of day traders, enabling them to spot potential trades through technical indicator screens, and the strategic calculations of long-term investors, who can sift through stocks with robust fundamentals and growth trajectories.

The best attribute? Access to this game-changer comes without a price tag. Merely sign up on the Investing.com platform and unveil a path to shrewder stock selection.

In this narrative, we’ll glide through a step-by-step breakdown of leveraging the Investing.com stock screener to unearth stocks flaunting promising technical setups for swift, profitable transactions.

Let’s plunge in.

Step 1: Initiate Your Journey on Investing.com

To commence, the first stride involves creating a free account on Investing.com. Simply head to the Investing.com website, locate the “Sign Up” button atop the page, and furnish your particulars.

Source: Investing.com

Source: Investing.com

Upon registration, a plethora of features, including the stock screener, will unfurl before you.

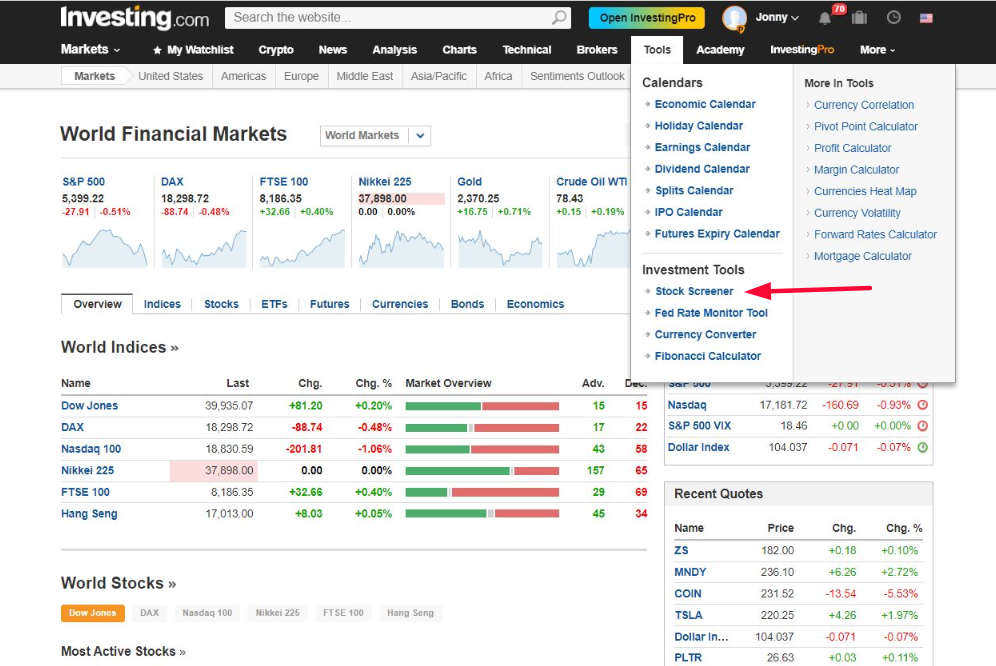

Step 2: Enter the Realm of the Stock Screener

Post login, navigate to the “Tools” section nestled within the main menu and click on “Stock Screener.”

Source: Investing.com

This portal leads you to the stock screener interface, opening the gates to tailor your search criteria.

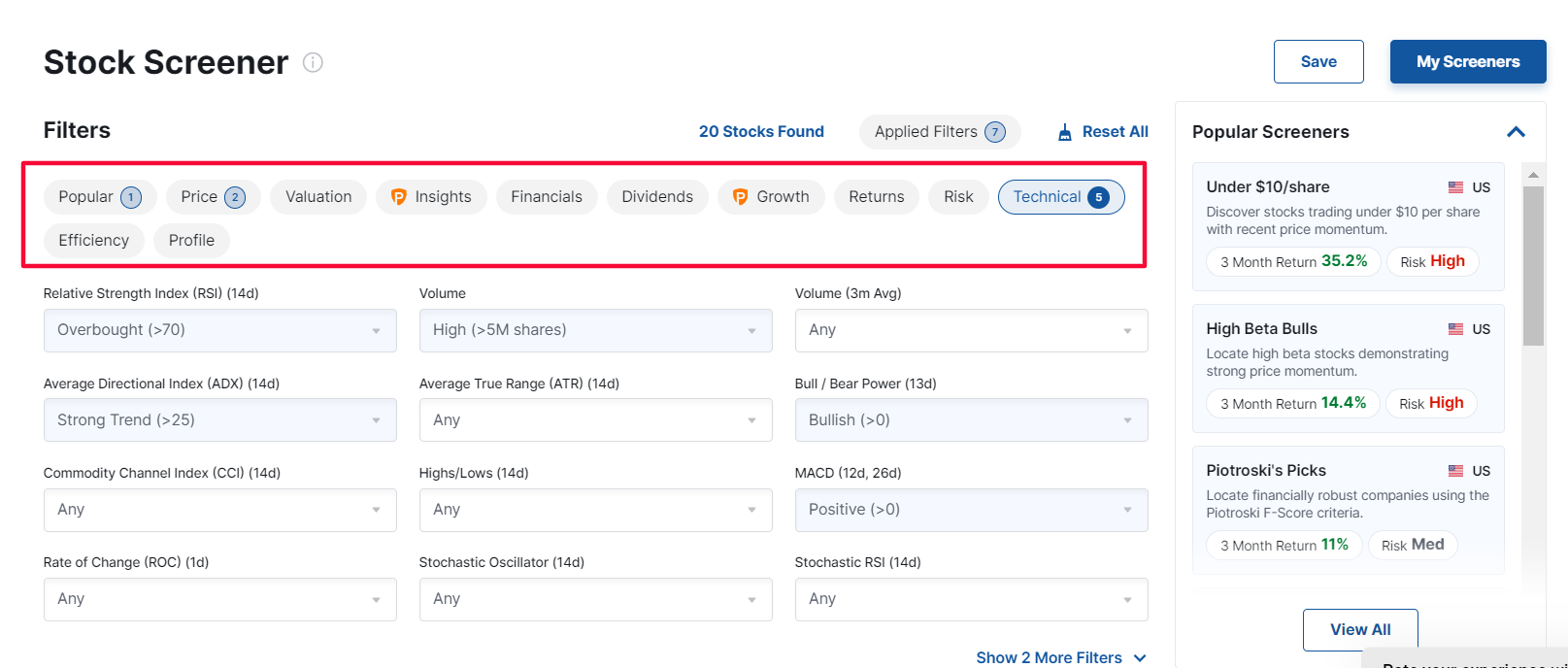

Step 3: Configure Your Technical Filters

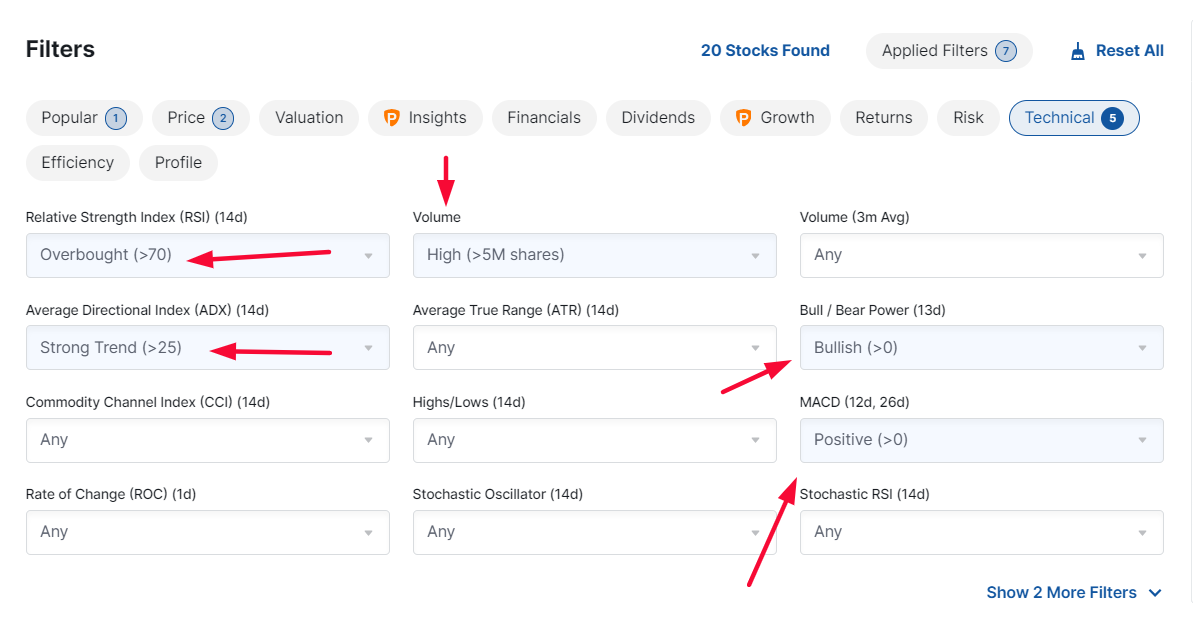

The Investing.com stock screener equips you with the authority to sieve stocks based on diverse technical parameters to refine your quest. To unveil stocks boasting sturdy technical setups, switch to the “Technical” tab.

Source: Investing.com

Within this realm, you can calibrate filters like:

- Moving Averages: Crucial pointers of a stock’s trend direction. Opt for stocks trading above their 50-day and 200-day moving averages, signaling a bullish trend.

- Relative Strength Index (RSI): Aids in spotting overbought or oversold territories. Seek stocks with an RSI between 30 and 70 denoting neutrality.

- Technical Indicators: Cherry-pick stocks heralding buy signals from eminent technical indicators like MACD, Stochastic Oscillator, and Bollinger Bands.

Source: Investing.com

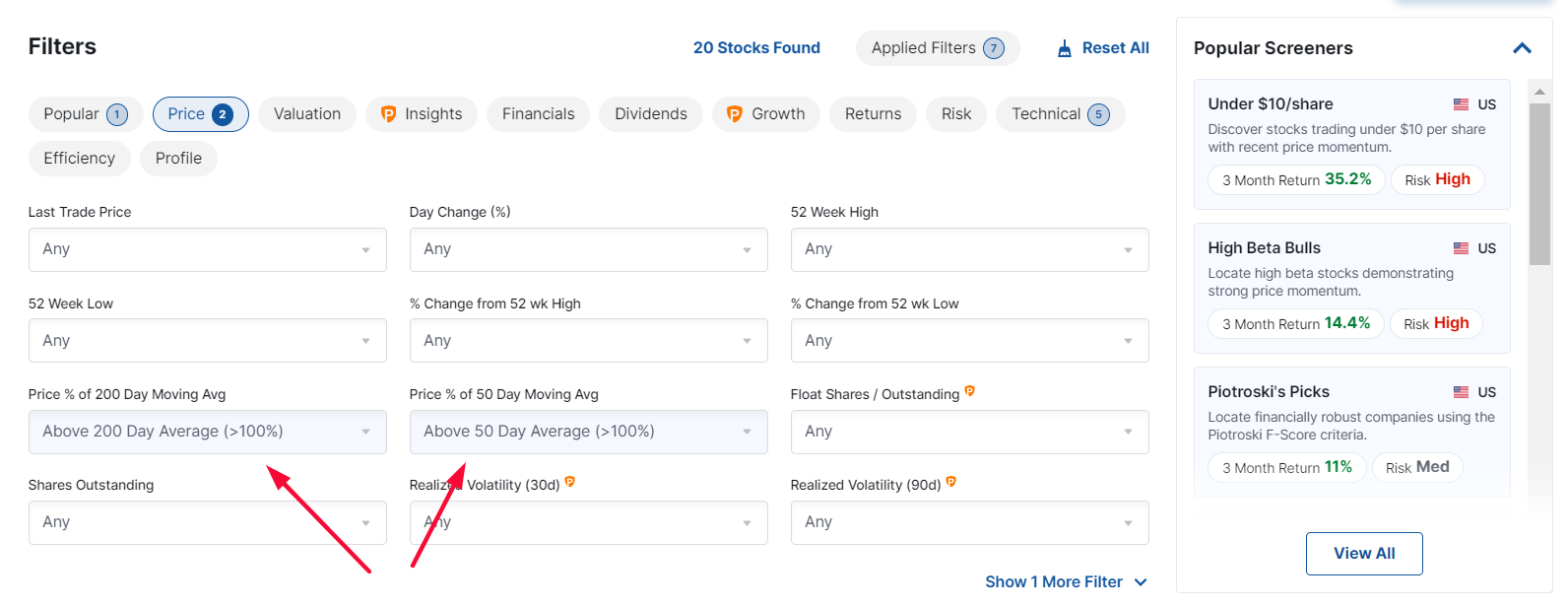

Step 4: Tailor Additional Filters

Beyond technical filters, you can further enhance your search by engrafting supplementary filters like market capitalization, sector, and industry. This curation sharpens your focus on stocks aligning with your investment benchmarks.

- Market Capitalization: Handpick the market cap range of interest (e.g., mid-cap, large-cap).

- Sector and Industry: Zoom into sectors or industries holding growth promises.

- Price Range: Sift stocks within a specific price band matching your financial realm.

Source: Investing.com

Source: Investing.com

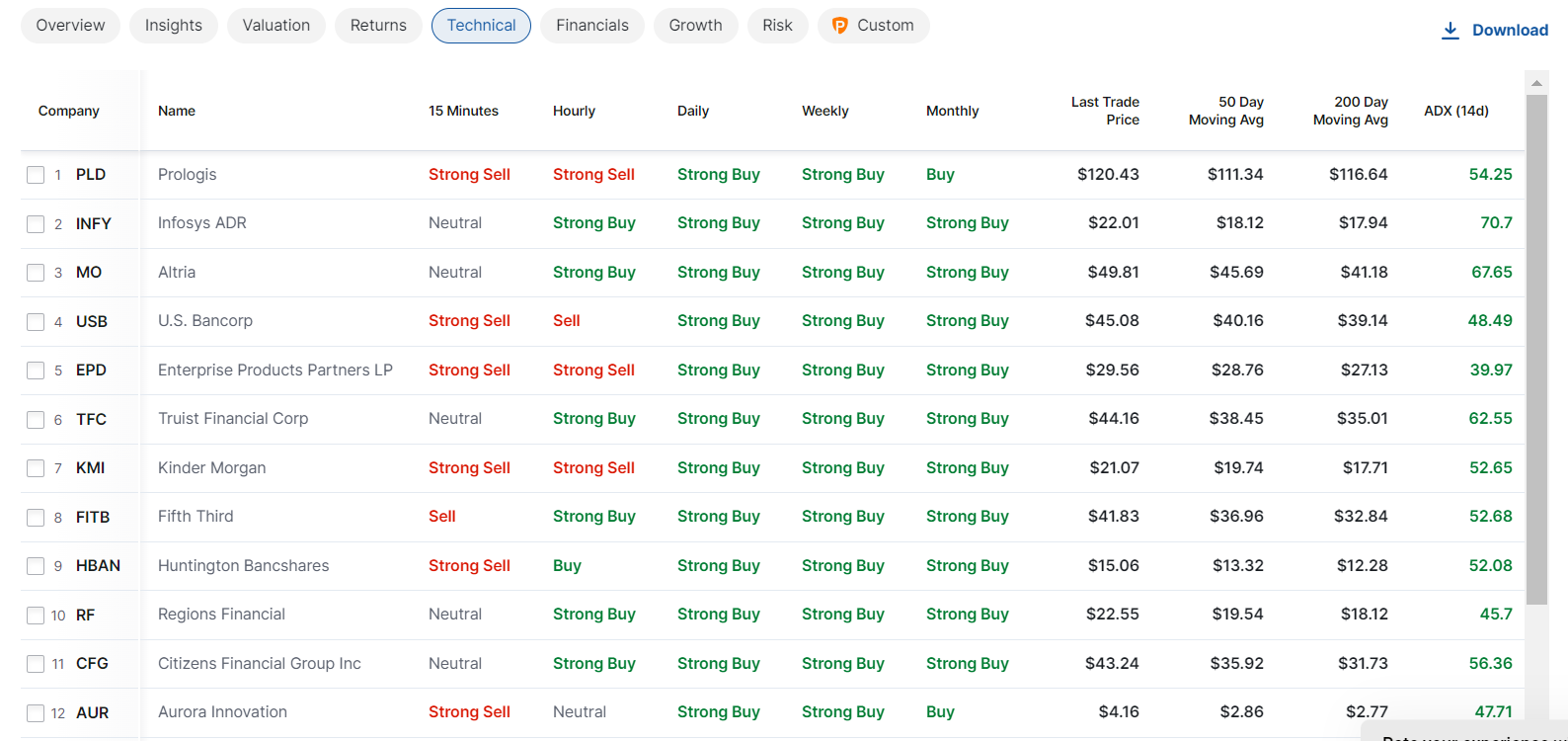

Step 5: Scrutinize and Assess the Outcomes

Post filter calibration, press the “Search” trigger to unveil a roster of stocks aligning with your criteria. The outcomes, neatly arrayed in a tabular format, will furnish crucial data such as the stock’s current valuation, technical indicators, and performance metrics.

Source: Investing.com

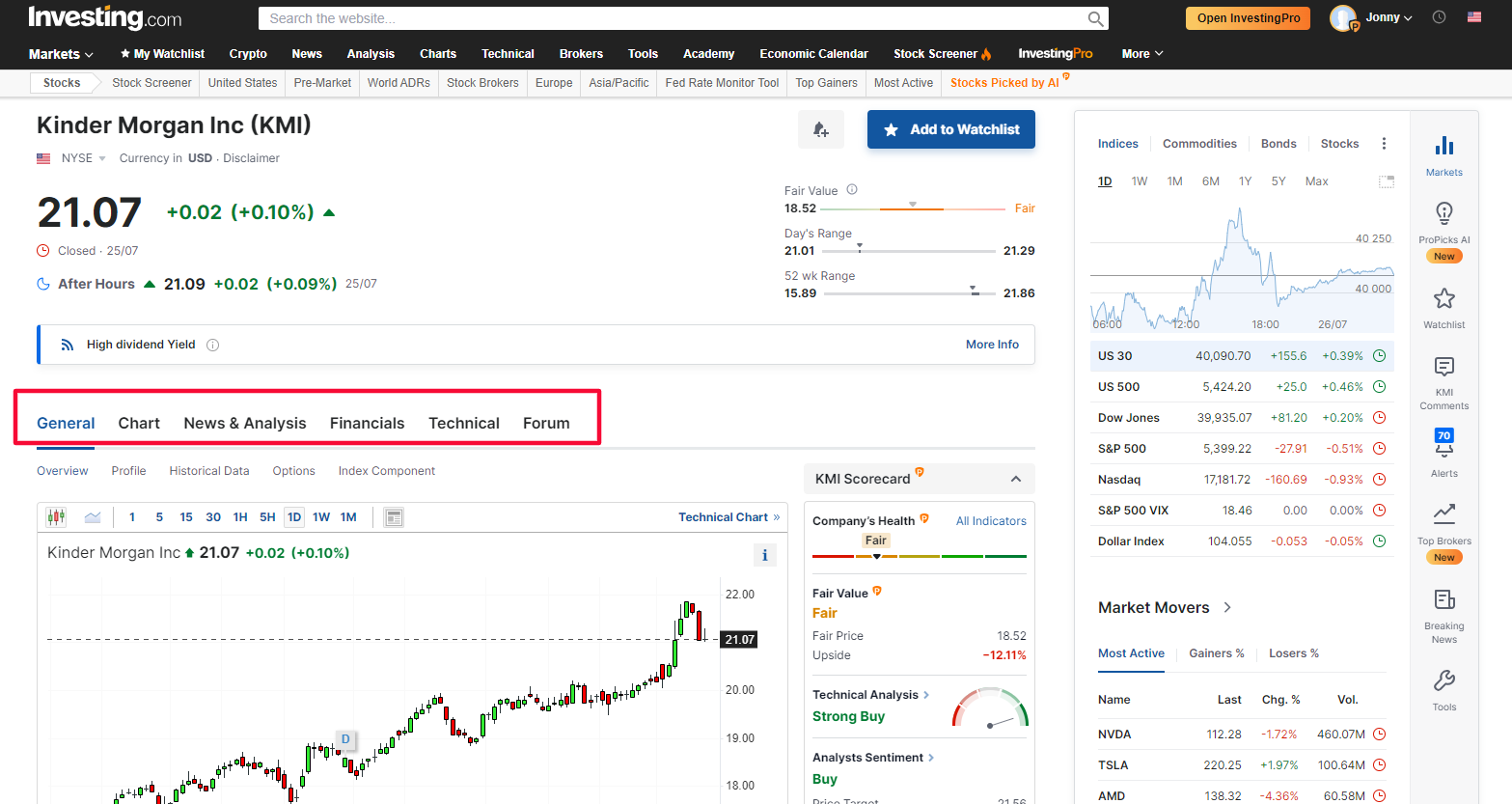

Step 6: Plunge into Individual Stocks’ Depths

For a detailed examination, tap on the stock moniker. This action unveils a detailed profile brimming with comprehensive data, encompassing:

- Charts: Peruse historical price trajectories and technical indicators.

- Technical Analysis: Gain insights into technical patterns and signals.

- Financials: Peek into the company’s financial robustness and performance metrics.

- News: Stay abreast with the latest stock-related tidings via Investing.com’s news hub.

Source: Investing.com

This voyage will aid in crafting a well-informed decision regarding whether to invest in the stock.

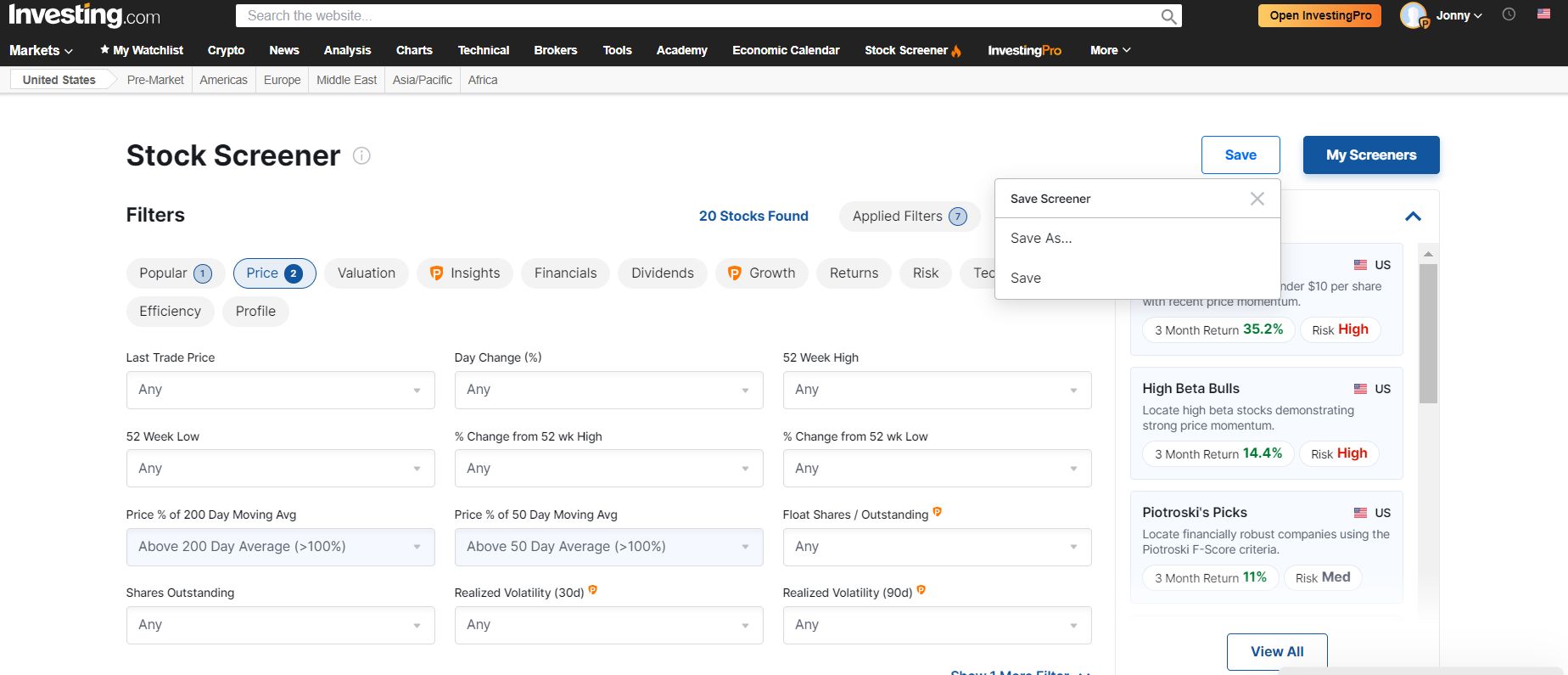

Step 7: Preserve Your Screeners

Investing.com extends the functionality to conserve your screener settings for future utility. Merely tap on the “Save Screener” tab and christen your screener. This tactic ensures swift access to your preferred screeners without reconfiguring the filters time and again.

Source: Investing.com

Plus, there are a couple of pre-crafted screeners catering to long and short strategies attuned to market conditions:

Evoke your screener creation wizardry and share your masterpiece with us in the comments!

So, What’s Holding You Back?

The Investing.com stock screener emerges as a potent instrument enabling you to pinpoint stocks boasting robust technical setups, simplifying and enlightening your investment deliberations.

By enrolling on Investing.com for free, you unleash the full might of this tool, propelling your stock market escapades to greater heights.

Embark on your voyage with the Investing.com stock screener today and unearth the prowess of astute stock selection!

*For a seamless user experience with the new screener, ensure you are logged into Investing.com on all your devices.

***

Disclosure: At present, I maintain positions in the S&P 500, through the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). Additionally, I am vested in the Technology Select Sector SPDR ETF (NYSE:).

I routinely adjust my portfolio composed of individual stocks and ETFs based on continuous risk evaluations of both the macroeconomic backdrop and corporate financials. The opinions shared in this narrative solely represent the author’s viewpoint and should not be construed as investment counsel.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for further stock market musings and insights.