As Advanced Micro Devices (AMD) gears up for the release of its second-quarter 2024 results on Jul 30, investors find themselves at a crossroads. Amidst a backdrop of uncertain market conditions, the looming question remains: to buy or not to buy?

Performance Preview

AMD anticipates second-quarter 2024 revenues to hit $5.7 billion, reflecting a year-over-year increase of approximately 6%, with sequential growth around 4%. The Zacks Consensus Estimate aligns closely, projecting revenues at $5.71 billion, marking a 6.54% growth rate over the prior year. Earnings are expected to climb to 67 cents per share, up slightly from the previous 30 days.

Industry Dynamics

AMD faces challenges in the near future, particularly in its Embedded and Gaming segments. Projections reveal a looming decline in the revenues of these sectors. Despite this, Data Center and Client segments are expected to show promise, driven by product strength and broader partner adoption.

Competition from NVIDIA remains stiff, with both companies enjoying a strong position among investors. The surge in demand for GPU chips from the AI sector has been a core driver for both, albeit NVIDIA’s intensified annual chip release strategy presents a challenging landscape for AMD.

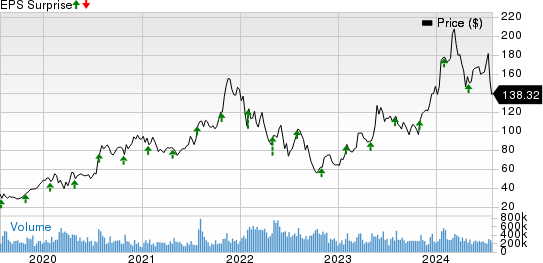

Stock Performance

AMD shares have faltered, experiencing a 6.2% decline, notably underperforming the Computer & Technology sector’s 18.7% gain and the S&P 500’s 14.1% rise.

When we take a deeper dive into the stock’s valuation, concerns arise. With a Value Style Score of D and a higher forward 12-month Price/Sales ratio compared to industry averages, caution is urged.

Outlook on AMD

Despite the current challenges, AMD’s long-term outlook appears promising, given the robust investment in AI chips. As the market for AI semiconductors grows exponentially, AMD’s strategic moves to expand its portfolio and acquisitions in the AI realm position the company for sustained growth.

However, investors are cautioned on the risk associated with AMD’s current valuation and the competitive landscape. The company’s Zacks Rank #3 (Hold) implies a prudent approach to entry points into the stock. Existing investors, on the other hand, may find solace in the company’s long-term growth trajectory.

As we await the outcome of AMD’s Q2 earnings, the final decision to buy or not to buy rests on a delicate balance of current performance and future potential.