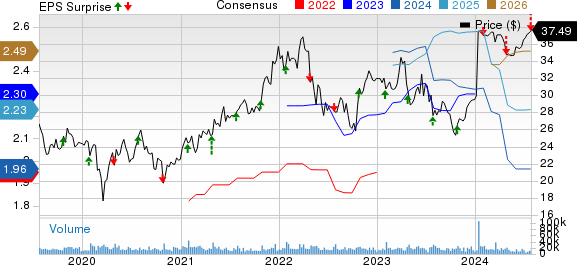

Juniper Networks, Inc. (JNPR) fell short in the second quarter of 2024, with earnings and revenues failing to meet the Zacks Consensus Estimate. The company faced a decrease in revenues year over year, primarily due to weakened demand for Wide Area Networking solutions. Despite this challenge, the company saw growth in cloud orders and an increase in demand for Mist systems, which provided some support to the top line.

Net Income Report

On a GAAP basis, the company reported net income of $34.1 million or 10 cents per share in the second quarter, marking a 40% year-over-year increase. This growth was fueled by reduced operating expenses. However, non-GAAP net income stood at $101.6 million or 31 cents per share, lower than the figures recorded in the prior-year period. The bottom line missed the Zacks Consensus Estimate by 13 cents.

Revenue Analysis

Juniper’s quarterly revenues amounted to $1.189 billion, down from $1.43 billion in the same period last year. This decline was primarily attributed to challenges in Service Provider verticals, influenced by macroeconomic conditions and the ongoing digestion of previous client orders. Despite the overall decrease, annual recurring revenue from renewable contracts showed a positive trend, reaching $424 million, marking a 33% increase year over year.

While product revenues dropped by 29% to $681 million, service revenues increased by 9% to $508 million. Cloud revenues declined, but the company reported a surge in cloud orders, indicating normalized customer inventory levels. Segment-wise, revenues from the Americas, Europe, the Middle East, Africa, and the Asia Pacific all experienced a year-over-year decline.

Operational Insights

Gross profit for the period was lower compared to the prior year, while non-GAAP gross margin increased to 59.2%. The rise was attributed to favorable software revenue mix, productivity enhancements, and reduced inventory-related expenses. Juniper’s non-GAAP operating margin declined, but operating expenses saw a decrease from the previous year.

Cash Flow Status

Juniper reported a cash utilization of $9 million in the second quarter of 2024, a significant variance from the $343 million cash generation in the same quarter the year before. The company held $1.4 billion in cash, cash equivalents, and investments as of June 30, 2024, with $1.6 billion in long-term debt.

Market Outlook and Zacks Rank

Despite the recent performance, Juniper currently holds a Zacks Rank #2 (Buy). Investors may also consider other stocks like NVIDIA Corporation (NVDA) and Motorola Solutions Inc. (MSI), both of which have shown a positive earnings track record in recent quarters and boast a Zacks Rank #2.

Silicon Motion Technology Corporation (SIMO), another Zacks Rank #2 company, has demonstrated consistent earnings performance. Each of these companies operates in different sectors, providing diverse investment opportunities for interested parties.

While Juniper faced challenges in the past quarter, its strategic positioning and product portfolio remain critical factors for investors to monitor as the company navigates market dynamics and operational challenges.