Interactive Brokers recently unveiled its list of most-traded stocks, revealing Nvidia’s resurgence to the top spot, outshining Tesla. This turn of events occurred amidst Tesla’s turbulent period following dismal earnings results, triggering a significant 12.3% plunge in its shares. The subsequent postponement of its Robotaxi event further exacerbated the situation, leading to a broader decline in the tech sector, notably impacting the Nasdaq.

Expressing astonishment at Nvidia’s ascension despite Tesla’s setback, IBKR’s strategist, Steve Sosnick, highlighted the unwavering interest in AI and semiconductor equities, emphasizing the enduring strength of this sector.

In addition to Nvidia and Tesla, the list also featured the Direxion Daily Semiconductor Bull 3X Shares ETF, AMD, and Taiwan Semiconductor. Sosnick underscored the continued investor appetite for stocks, despite the recent downturn in tech shares.

Remarkably, CrowdStrike secured the third position on the list following a significant IT outage caused by a faulty update, leading to a nearly 25% decline in its share value over a brief span. Serve Robotics also made the list after experiencing a surge in its stock price due to Nvidia’s investment. Sosnick noted the unusual occurrence of such a small stock ranking highly and attributed the upsurge to Nvidia’s involvement, which attracted tech-savvy traders.

Projected Price Target for Nvidia (NVDA)

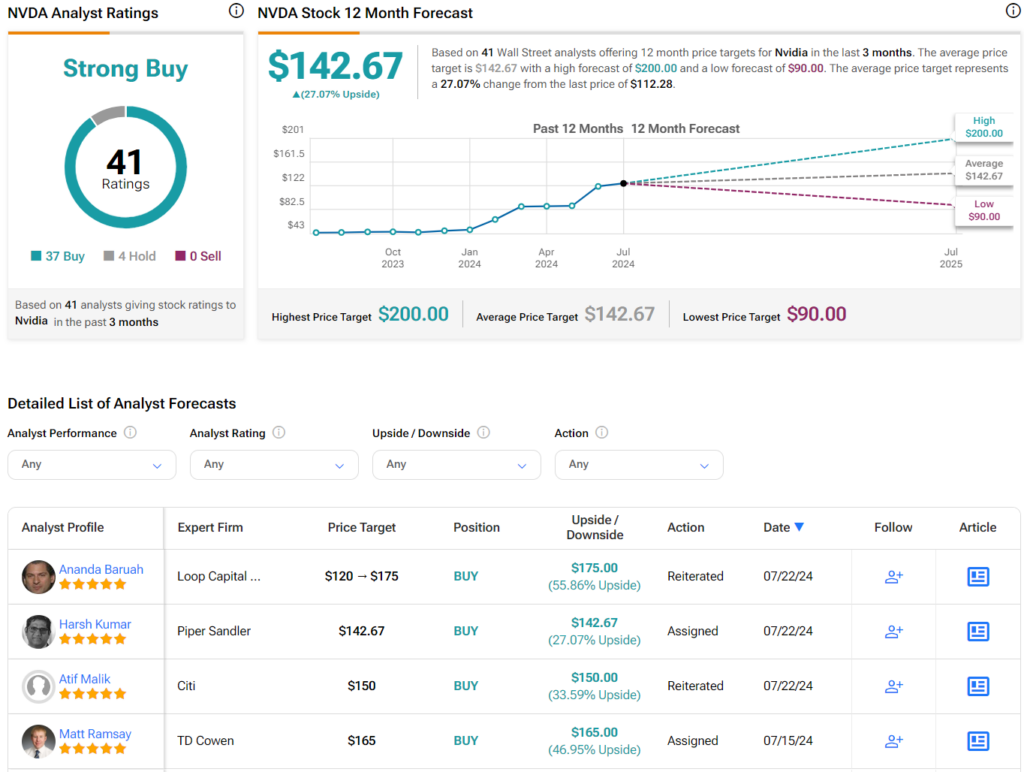

Analysts on Wall Street have assigned Nvidia stock a Strong Buy consensus rating based on 37 Buy recommendations, four Holds, and zero Sells over the past three months. This positive sentiment is supported by an impressive 147% surge in Nvidia’s share price over the last year. Forecasts indicate an average price target of $142.67 per share for Nvidia, suggesting a potential upside of 27.07% from the current level.

Explore more Nvidia analyst ratings here