The Allure of Analyst Recommendations

Investors frequently turn to analyst recommendations to guide their investment decisions, seeking insight into whether to buy, sell, or hold a stock. The opinions of brokerage analysts, though influential, may not always be as reliable as they appear on the surface.

Amidst the chatter of brokerage ratings, the spotlight often falls on sentiments towards Alibaba (BABA) from seasoned Wall Street professionals.

Brokerage Version vs. Reality

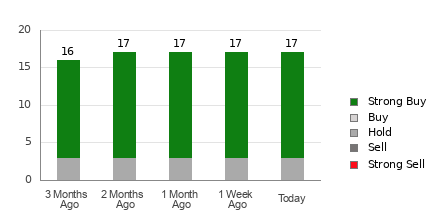

Alibaba currently boasts an average brokerage recommendation (ABR) of 1.35, leaning towards a Strong Buy on a scale where 1 indicates a Strong Buy and 5 indicates a Strong Sell. Of the 17 brokerage recommendations contributing to this ABR, a staggering 82.4% stand as Strong Buy ratings.

Despite the optimism portrayed by these recommendations, studies have shown that reliance solely on brokerage suggestions may not necessarily lead to fruitful investment decisions.

The Zacks Rank: A Reliable Alternative

Contrary to the brokerage bias, the Zacks Rank emerges as a trusted beacon for investors. This tool categorizes stocks into five groups from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) based on earnings estimate revisions, providing a more balanced and data-driven perspective.

While brokerage analysts often veer towards positivity due to vested interests, the Zacks Rank’s correlation between earnings estimate trends and stock price movements offers a refreshing insight untainted by such biases.

Diverging Paths: ABR vs. Zacks Rank

While the ABR solely depends on brokerage whims, the Zacks Rank delves deep into earnings estimate revisions, offering a more meaningful analysis for investors. The Zacks Rank maintains a timelier essence, swiftly reflecting changes in business trends and always standing at the forefront of market movements.

Forecasting Alibaba’s Future

Alibaba’s recent journey through the stock market landscape has witnessed a decline in the Zacks Consensus Estimate for the current year by 0.1% to $8.20. The unanimity among analysts in revising EPS estimates downward raises caution flags for investors, leading to a Zacks Rank #4 (Sell) for Alibaba.

Considering the recent shift in consensus estimates, aligning the Buy-equivalent ABR for Alibaba with the Zacks Rank analysis may perhaps unveil a clearer investment path.