Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) has emerged as a star player in the global artificial intelligence (AI) arena, catering to the demands of premier AI chipset developers worldwide.

Specializing in a variety of wafer fabrication processes, such as complementary metal-oxide-semiconductor logic, mixed-signal, and radio frequency among others, TSM has positioned itself at the forefront of cutting-edge technologies.

In the second quarter of 2024, Taiwan Semiconductor reported stellar financial results, surpassing both revenue and earnings expectations, driven primarily by the surge in demand for 3-nanometer chipsets.

Premium Client Portfolio

TSM boasts an illustrious clientele, being the primary manufacturer of chipset components for tech giants like NVIDIA Corp., Advanced Micro Devices Inc., Apple Inc., Broadcom Inc., and Intel Corp. This strategic positioning ensures a consistent flow of demand for TSM’s advanced technological offerings.

The company’s comprehensive suite of advanced technologies, particularly in the realm of 3-nanometer and 5-nanometer processes, has garnered significant interest, with the multi-project wafer processing service proving to be a key driver of customer engagement.

Positive Growth Trajectory

Looking ahead to the third quarter of 2024, Taiwan Semiconductor anticipates a surge in demand for its leading-edge process technologies, fueled by the increasing adoption of AI and smartphone technologies. The revenue outlook for the quarter is estimated to be in the range of $22.4 billion and $23.2 billion.

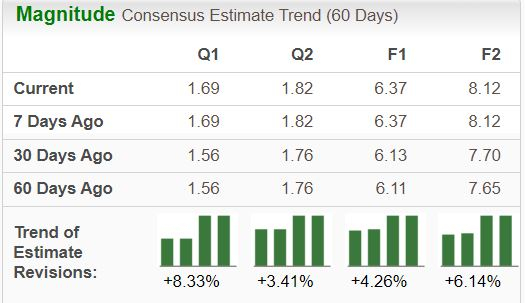

Analysts project a robust growth trajectory for TSM, with revenue estimates for 2024 reflecting a 23% year-over-year increase, highlighting the company’s strong market positioning and demand for high-end chips used in AI applications.

Favorable Valuation

In terms of valuation, Taiwan Semiconductor stands in good stead, trading at reasonable multiples compared to its industry peers. With metrics like forward P/E, Price/Sales (P/S), and Price/Book (P/B) aligning closely with industry averages, TSM’s financial health remains stable.

Despite facing cost pressures due to inflationary factors like rising electricity costs, the company has maintained strong margins, with gross margin, operating margin, and net margin at 53.2%, 42.5%, and 36.8%, respectively, in the last reported quarter.

Potential Upside

After hitting an all-time high in July, Taiwan Semiconductor stock experienced a dip following an AI-related market correction. However, the recent pullback presents a favorable entry point for investors seeking long-term growth opportunities.

With a year-to-date gain of nearly 57%, TSM remains an attractive investment proposition, further supported by an average price target projection indicating a potential increase of 27.7% from the previous closing price, with brokerage targets ranging between $170 and $205.

Image Source: Zacks Investment Research