The ongoing 2024 Q2 earnings season gains momentum as it progresses through a diverse range of companies. Notably, the spotlight falls on the cloud computing segment, featuring major players like Microsoft (MSFT) and Amazon (AMZN).

Alphabet’s Encouraging Performance

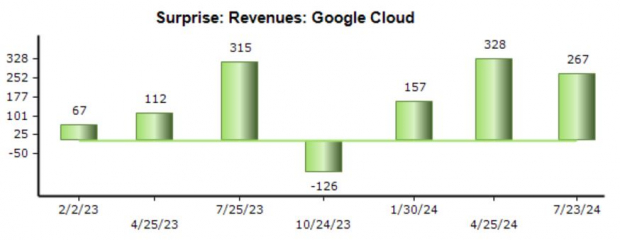

Alphabet recently released its quarterly earnings, demonstrating significant positivity. The company experienced a 31% surge in EPS with sales rising by nearly 14%, surpassing consensus estimates. Notably, its cloud segment exhibited robust growth, achieving revenues of $10.3 billion, marking a nearly 30% increase year-over-year and setting a quarterly record. Google Cloud’s operating income also witnessed a substantial leap reaching $900 million compared to $191 million in the corresponding period last year.

Microsoft’s Cloud Continues to Impress

Microsoft’s latest earnings report surprised investors with a 23% year-over-year growth in cloud revenue, indicating stability after a few quarters of slower growth. Expectations for earnings and revenue have remained relatively steady, projecting 8% growth in EPS alongside a 14% increase in sales. The company has consistently outperformed consensus forecasts, with an anticipated 20% surge in revenue to $28.7 billion for the upcoming quarter.

Amazon’s Cloud Performance Anticipated

Amazon Web Services (AWS) delivered strong results in its previous fiscal period, with net sales amounting to $25 billion, reflecting a 17% year-over-year growth, breaking away from a recent trend of disappointing figures. Projections for the upcoming quarter suggest Cloud revenue could reach $25.9 billion, a 17.2% increase. Despite modest expectations for earnings and revenue, Amazon is poised for substantial growth, with expected EPS rise of 63% on 10% higher sales. Efficiency enhancements and cost reductions have substantially bolstered profitability, leading to significant margin expansion.

Key Considerations Going Forward

With several major players in the cloud industry releasing their earnings this week, including Amazon and Microsoft, a keen focus will be placed on their year-over-year growth rates. Any deceleration in these figures could trigger apprehension among investors. Conversely, exceeding growth expectations might usher in positive market sentiment post-earnings, although other operational metrics are equally crucial in shaping market reactions.