Arm Holdings plc will reveal its first-quarter fiscal 2025 results on July 31, after the bell.

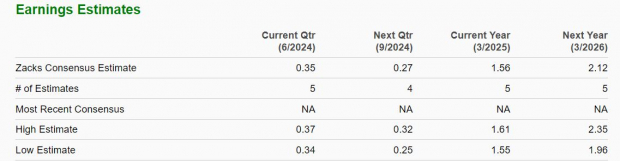

The Zacks Consensus Estimate projects earnings of 35 cents for the upcoming quarter, with revenue estimated at $920 million.

On the run-up to the report, one estimate for the quarter has seen an upward shift while the Zacks Consensus Estimate for earnings has seen a modest increase in the past 30 days.

Performance Forecast

The prevailing model does not definitively forecast an earnings beat for ARM this quarter. While a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 (Hold) typically augurs well for an earnings beat, ARM currently has an Earnings ESP of +5.71% and a Zacks Rank of #4 (Sell).

Factors Predicting Results

ARM is at the forefront of AI-driven chip designs and software tools, vital for applications in smartphones, automobiles, and data centers. Major players like Apple, Nvidia, and Qualcomm rely on ARM’s chip designs. Strong revenue performance is anticipated in the upcoming quarter, driven by robust Royalty and License revenues. The company expects revenues between $875 million and $925 million, indicating notable year-over-year growth.

With a forecast of a 20% year-over-year growth in Royalty revenues for the quarter, ARM foresees higher adoption of Armv9, a product line with higher royalty rates. The company also projects a sequential increase in Licensing revenues, driven by backlog revenue.

Market Trends

Over the past six months, ARM has seen a significant 107% surge in stock price, with a 47.2% increase in the last three months. However, a recent dip of 6.2% in the past month, and a 10% decline in the past five days indicates the stock may be entering a correction phase.

Six-Month Stock Performance

Further analysis shows the stock’s roller-coaster ride over the past six months, with fluctuations mirrored in the market sentiment.

Investment Outlook

While ARM’s revenue growth has been steady in recent years, an uptick is expected with AI technologies spearheading sales growth. Initial margin pressures, reflected in operating margins contracting from over 26% to nearly 3%, signify ongoing investments in research and development. These investments hint at future growth and innovation prospects.

Strategic Approach

Investors are advised caution in the current scenario due to potential risks stemming from subpar operating performance and escalating costs. Despite a strong footing in the AI hardware sphere and progressive chip design innovations, market timing is crucial for optimizing returns.

Considering the recent stock correction phase, now may be an opportune time for investors with substantial gains to consider profit booking.

Free Report – 3 Stocks Sneaking Into Hydrogen Energy

Dive into the projected $500 billion clean hydrogen energy market by 2030 with three stealthy contenders poised for substantial growth. The future of renewable energy awaits.