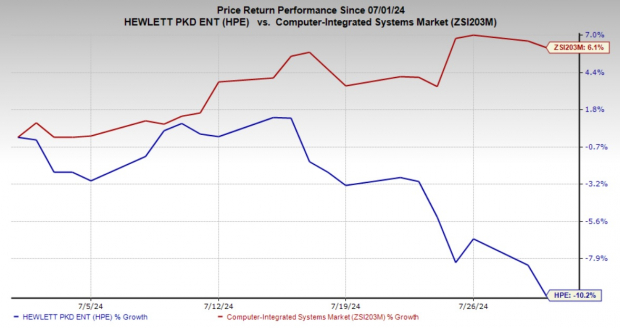

Amidst the tumultuous tides of the stock market, Hewlett Packard Enterprise (HPE) has weathered a significant storm, witnessing a sharp 10.2% decline in its stock price over the past month. This plunge surpasses the broader Computer – Integrated Systems industry’s downturn of 6.1%, signaling a challenging period for tech companies like HPE.

Market Volatility and Strategic Resilience

Various macroeconomic factors, such as inflation anxieties, high interest rates, and an overall murky economic horizon, have contributed to HPE’s recent stock slide. However, it is crucial for investors to look beyond short-term fluctuations and focus on the long-term prospects of the company.

Hewlett Packard Enterprise’s strategic direction, characterized by a laser focus on emerging technologies like artificial intelligence (AI) and cloud computing, positions the company at the vanguard of industry trends. The stalwarts of AI and edge computing have fueled HPE’s growth, with its AI systems garnering substantial traction, evident from $4.6 billion in cumulative AI system orders in the second quarter of fiscal 2024.

Growth Initiatives and Innovation

Continual innovation is the lifeblood of success in the tech realm, and HPE is not lagging. The GreenLake platform, a scalable as-a-service model for cloud and hybrid IT solutions, is rapidly gaining momentum, with a 9% sequential increase in customer organizations leveraging its benefits.

Moreover, strategic alliances with industry giants like Microsoft and NVIDIA have fortified HPE’s competitive edge, particularly in the AI and hybrid cloud sectors, promising robust growth potential.

Networking Power Play

HPE’s impending acquisition of Juniper Networks heralds a significant development, augmenting the company’s networking portfolio with cutting-edge technologies in networking and cybersecurity. This synergy is poised to bolster HPE’s market presence and offer enhanced networking solutions, ideally suited for the evolving needs of modern enterprises.

As businesses pivot towards intricate IT structures, the demand for secure and high-functioning networking solutions has surged, making HPE’s move timely and strategic.

Financial Resilience and Value Proposition

Despite the recent stock downturn, Hewlett Packard Enterprise’s fiscal fortitude remains unassailable. The company’s strong balance sheet, with $2.68 billion in cash and cash equivalents as of April 30, 2024, underscores its financial robustness. Consistent cash flow generation and shareholder-friendly initiatives like dividends and share repurchases further validate HPE’s sound financial health.

From a valuation perspective, HPE’s current P/E ratio signals an appealing entry point for value investors, with the stock trading below the industry average. This presents an attractive option for those seeking undervalued opportunities in the tech sector.

Investment Outlook and Conclusion

While short-term market gyrations may instill trepidation, astute investors recognize the opportunity within HPE’s recent setback. The company’s strides in AI innovation, cloud solutions, and networking expansion, coupled with its sturdy financial framework, position it favorably for future growth.

With a compelling blend of strategic foresight, market agility, and financial strength, Hewlett Packard Enterprise emerges as a promising investment avenue in the tech landscape. Despite the recent stock stumble, HPE shines as a beacon of resilience and innovation in turbulent times.

For those eyeing a prudent investment with the potential for robust returns, Hewlett Packard Enterprise beckons as a beacon amid market volatility.

Analyzing the Potential of a Top Stock Pick: A Closer Look

Unveiling a Promising Stock

From a sea of stocks, 5 Zacks experts meticulously singled out their top choices, each forecasted to surge by over 100% in the approaching months. Among these, Director of Research Sheraz Mian has singled out one with the most explosive growth potential.

Company Overview and Revenue Stream

This company has set its sights on capturing the attention of millennial and Gen Z audiences, raking in nearly $1 billion in revenue in just the last quarter. Despite a recent downturn, the present moment presents an opportune time to set sail on this investment journey.

Surpassing Expectations in the Stock Market

While not all elite selections turn out to be winners, this particular pick might well outshine previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which soared by an impressive +129.6% in a little over 9 months.