The Microsoft Marvel

Microsoft Corporation (MSFT) has been a stalwart in the technology industry, constantly evolving and expanding its product offerings. With a remarkable return of 879.8% over the last decade, MSFT has cemented its status as a solid investment choice.

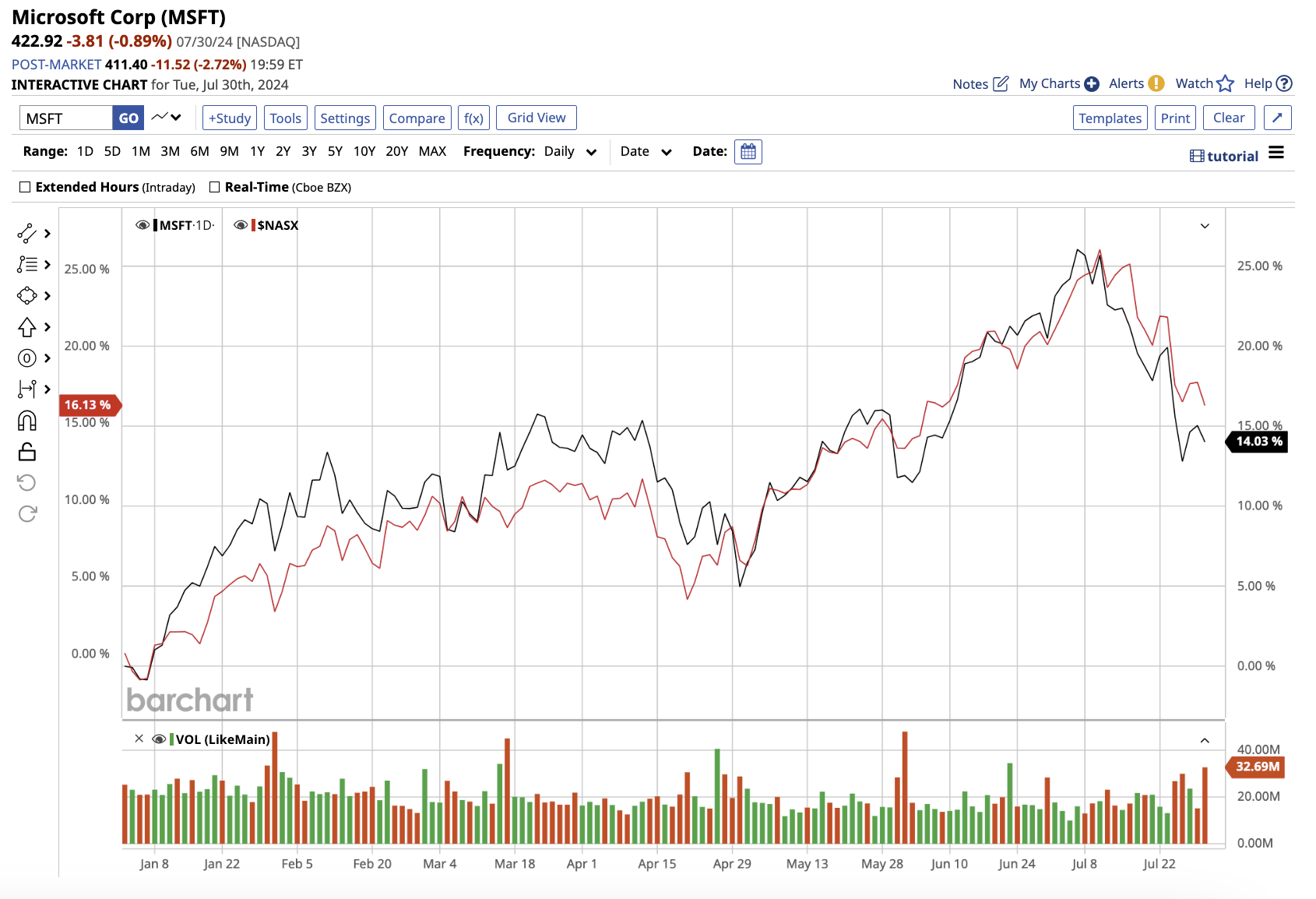

Valued at $3.14 trillion, MSFT stock has seen a 11.3% Year-to-Date (YTD) growth, slightly shy of Nasdaq Composite’s 17.2% gain.

Microsoft’s foray into Artificial Intelligence (AI), particularly through Azure, has been a significant driver of its financial success. In the fourth quarter of fiscal 2024, its Cloud revenue surged by 21% to $36.8 billion, with all segments showing double-digit growth.

The Alphabet Advantage

Alphabet (GOOGL), the parent company of Google, holds a robust position in the tech industry with its legacy portfolio. GOOGL stock has observed a substantial uptick, growing by 22.8% YTD and outperforming the Nasdaq Composite.

Google Search, commanding a market share of roughly 91.06%, remains the world’s go-to search engine, with revenue surging by 13.8% to $48.5 billion in the second quarter of 2024.

Google Cloud, Alphabet’s fastest-growing segment, expanded by 28.7% to $10.3 billion, challenging the dominance of AWS and Azure. The advertising arm also showed resilience, raking in $64.6 billion in ad sales, up 11.1% year on year.

Market Pulse

Microsoft’s strong financial performance is reflected in its forward valuation at 32.5x fiscal 2025 earnings and 11.2x sales.

On the other hand, Alphabet’s dominance across search, advertising, and cloud services positions it as a formidable player in the tech arena, with a market value of $2.1 trillion growing by 22.8% YTD.

Analyst Insights

Wall Street is bullish on Microsoft, with a plethora of analysts rating it as a “strong buy.” The average price target of $501 suggests a notable 20% potential upside, while the Street’s high-end projection of $600 envisages a staggering 43.4% climb over the next year.

Alphabet’s prowess in digital advertising, cloud services, and search engine dominance underlines its robust performance.

The Rise of Alphabet’s AI Dominance Amidst Market Competition

In a market poised to swell to $1.3 trillion by 2027, Alphabet finds itself at a pivotal juncture. The infusion of Artificial Intelligence (AI) has long been a cornerstone of Google’s arsenal, permeating products from Gmail to Google Maps. Nevertheless, the tech titan has grappled to match strides with rivals such as Microsoft and OpenAI in the AI realm.

Despite this, Alphabet stands at a precipice, fortified by a robust financial standing and an arsenal of resources at its beck and call. Concluding the second quarter, the behemoth boasted a formidable $110.9 billion in cash, coupled with marketable securities and cash equivalents, offset by a manageable long-term debt figure of $13.2 billion. Notably, a staggering $13.4 billion in free cash flow was amassed during the quarter.

Presently, the GOOGL stock is traversing at 22.2 times the forward 2024 estimated earnings and 6.04 times the forward sales.

Insights into Alphabet’s Financial Trajectory

Analysts’ crystal ball reflects a promising outlook for Alphabet’s financial landscape in the forthcoming two years:

- In 2024, a 12.9% surge in revenue and a 31.9% upswing in earnings are anticipated.

- By 2025, revenue is earmarked to ascend by 11.1%, accompanied by a 13.8% augmentation in earnings.

Wall Street’s Verdict on Alphabet

Collectively, Wall Street deems GOOGL stock a “strong buy.” Among the cohort of 44 analysts scrutinizing GOOGL, 34 nod in favor of a “strong buy” rating, three advocate a “moderate buy,” while seven opine for a “hold.”

The mean price target rests at $204.47, signaling a potential upside of approximately 19.2% from current levels. Notably, the loftiest target price hovers at $240, projecting a whopping 40% upturn within the ensuing 12 months.

Deciphering the Superior Investment: Alphabet versus Microsoft

Microsoft’s commendable fiscal performance, strategic acquisitions, relentless innovation, and unwavering commitment to shareholder returns render it a reliable and enticing investment avenue. Parallelly, Alphabet’s dominance in the search landscape, diverse revenue channels, and entrenched brand equity position it as a sanctuary for investors eyeing growth and stability.

Both stalwarts have etched their mettle in the market, heralding a promising trajectory ahead. In my reckoning, both Alphabet and Microsoft emerge as stellar long-term investments. Nonetheless, in a hypothetical scenario demanding selection, my backing veers towards Alphabet, deeming it a judicious acquisition amidst current market dynamics.