When the financial tides of the information technology sector are tumultuous, there emerges an opportunity to wade into undervalued companies, cast aside like driftwood on a choppy sea.

One compass through this storm is the Relative Strength Index (RSI), a tool that measures a stock’s vigor on the up days against its fortitude on the down days. It’s akin to a ship’s sextant, guiding traders through the unpredictable waves of the market. A stock is often deemed “oversold” when its RSI drifts below 30, as opined by market oracle Benzinga Pro.

Let us unveil the watchlist of top dogs in this turbulent sea, where the RSI has sounded its alarm bell, signaling potential for a bullish rebound.

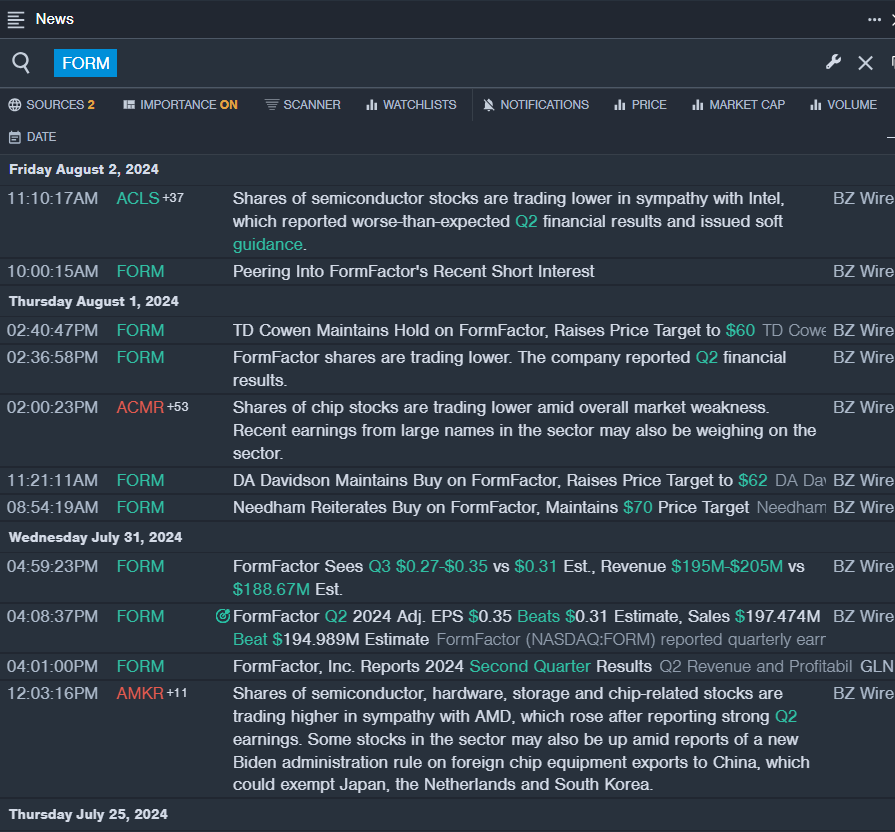

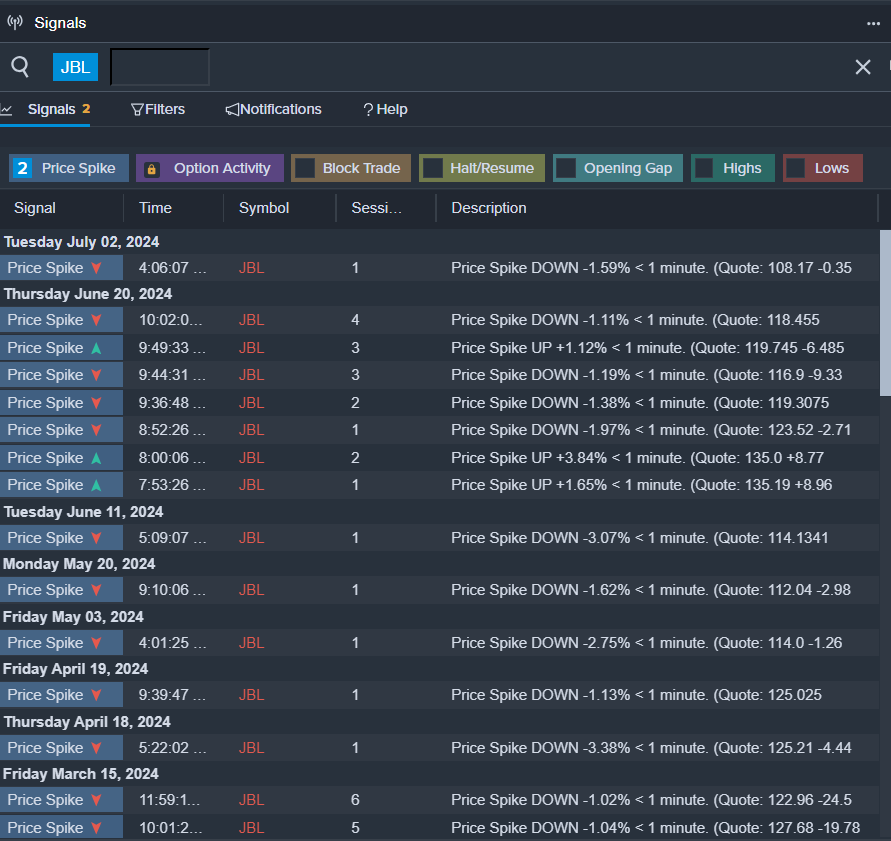

Setting Sail with FORM

- On July 31, FormFactor hoisted its quarterly earnings like a triumphant pirate flag. “FormFactor set an all-time record for DRAM probe-card revenue in the second quarter, driven by sequential doubling of high-bandwidth-memory revenue and steady DDR5 new-design activity,” roared Captain Mike Slessor, at the helm of FormFactor, Inc. The stock has taken a plunge of around 21% in the last five days, clinging to a 52-week low of $29.71.

- RSI Value: 27.73

- FORM Price Action: Shares of FormFactor edged 1.1% higher to anchor at $41.36 on Monday.

- Rumors from Benzinga Pro’s crow’s nest foretold the latest news surrounding FORM.

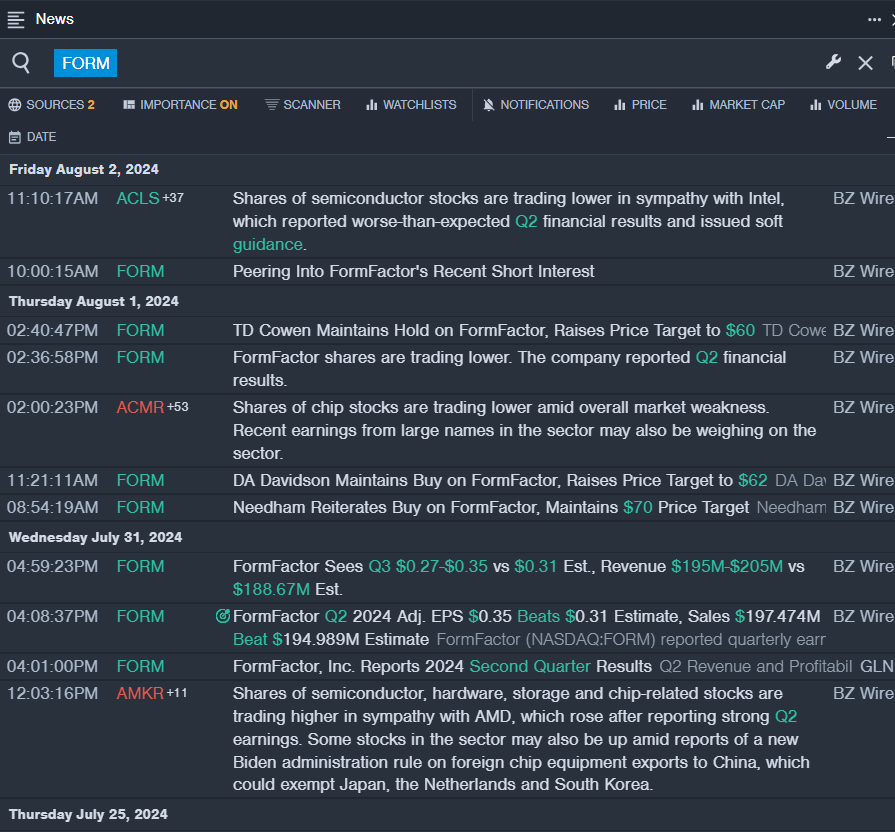

Navigating with RMBS

- On July 29, Rambus weathered a storm of mixed second-quarter financial results. “We delivered solid second quarter results with robust growth in product revenue and excellent cash from operations,” announced Admiral Luc Seraphin, helmsman of Rambus. The stock took on water with a 21% decrease in the past five days, nearing a 52-week low of $38.91.

- RSI Value: 28.71

- RMBS Price Action: Shares of Rambus dropped 0.6% to drift at $41.84 on Monday.

- Warnings from Benzinga Pro’s lookout revealed the changing winds affecting RMBS.

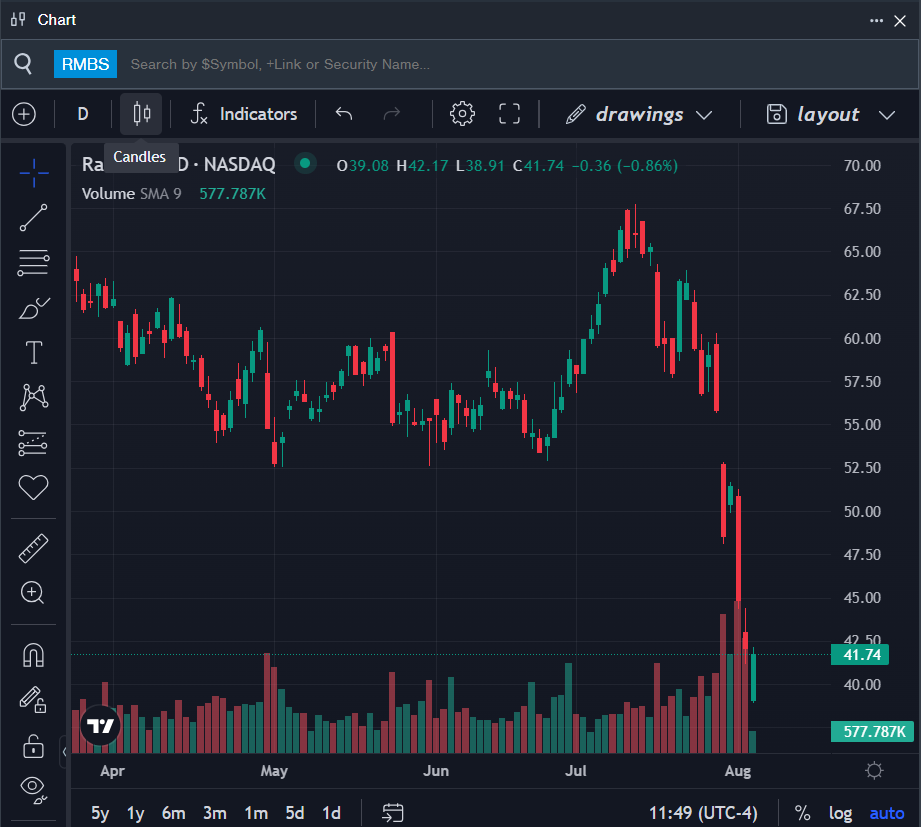

Plotting a Course with JBL

- On July 18, Jabil hailed a quarterly dividend of 8 cents per share of common stock to shareholders, reminiscent of a generous pirate sharing the spoils of the sea. The stock walked the plank with a 10% decline over the last five days, drifting close to a 52-week low of $95.84.

- RSI Value: 29.02

- JBL Price Action: Shares of Jabil skimmed 1.2% downwards to settle at $98.43 on Monday.

- Signals from Benzinga Pro’s spyglass hinted at a potential shift in JBL’s fortunes.

Read More: