Amid the tempestuous seas of the market, savvy investors seek solace in dividend-yielding stocks, the steadfast vessels of stability. These stocks, laden with the treasure of high free cash flows, generously bestow their shareholders with bountiful dividend payouts.

For those navigating these treacherous waters, scrutinizing analyst recommendations can serve as a reliable compass. As the markets ebb and flow, insightful insights into the tech and telecom sectors can illuminate potential opportunities, guiding investors towards profitable horizons.

Navigating the Seas of Tech and Telecom Stocks

Let’s embark on a voyage to discover the high-yielding treasures hidden in the communication services sector, as unearthed by Wall Street’s most astute analysts.

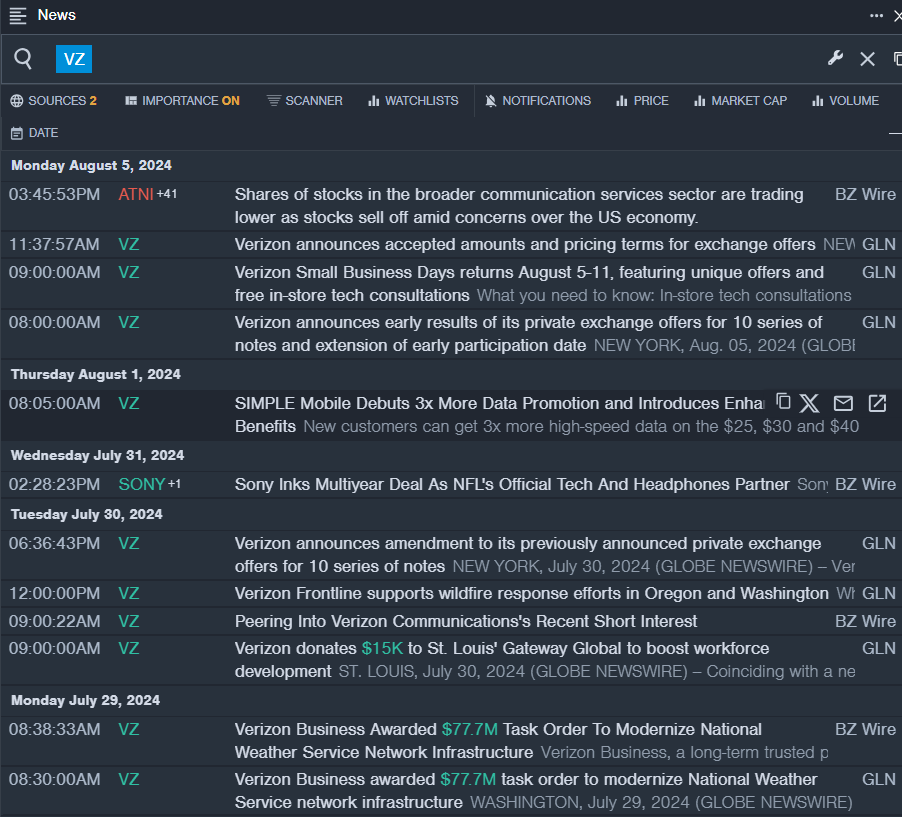

Verizon Communications Inc. (VZ)

- Dividend Yield: 6.68%

- TD Cowen analyst Dan Brennan set a bullish course with a Buy rating, steering the price target from $48 to $51 on July 27. This adept navigator boasts an impressive accuracy rate of 71%.

- Tigress Financial analyst Ivan Feinseth hoisted the Buy flag and raised the price target from $50 to $52 on May 17, showcasing a precise accuracy rate of 71%.

- Recent News: On July 22, Verizon announced private exchange offers for 10 series of notes, aiming to secure up to $2.5 billion in new notes, a strategic move akin to adjusting the sails for a prosperous journey.

- Through Benzinga Pro’s real-time newsfeed, investors were tethered to the latest developments in Verizon’s voyage.

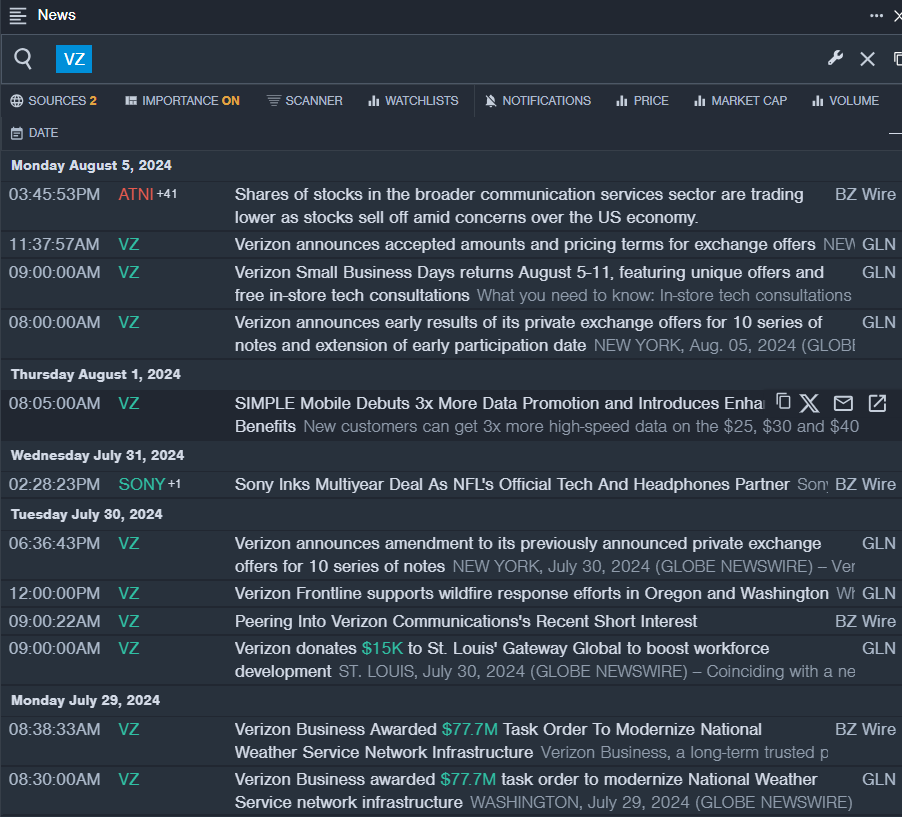

AT&T Inc. (T)

- Dividend Yield: 5.87%

- Scotiabank analyst Jeff Fan, a seasoned mariner of the markets, maintained a Sector Outperform rating and steered the price target from $23 to $24 on July 25, showcasing a stalwart accuracy rate of 75%.

- Oppenheimer analyst Timothy Horan hoisted the Outperform flag and navigated the price target from $21 to $23 on July 25, exhibiting an accuracy rate of 75%, a testament to his adept navigation skills through market turbulence.

- Recent News: On August 5, NICE and AT&T expanded their collaboration, crafting integrated solutions for emergency communications centers, akin to fortifying the ship’s hull for stormy weather.

- Through the intuitive charting tool offered by Benzinga Pro, investors could chart the course of AT&T’s stock, foreseeing potential turbulent waters.

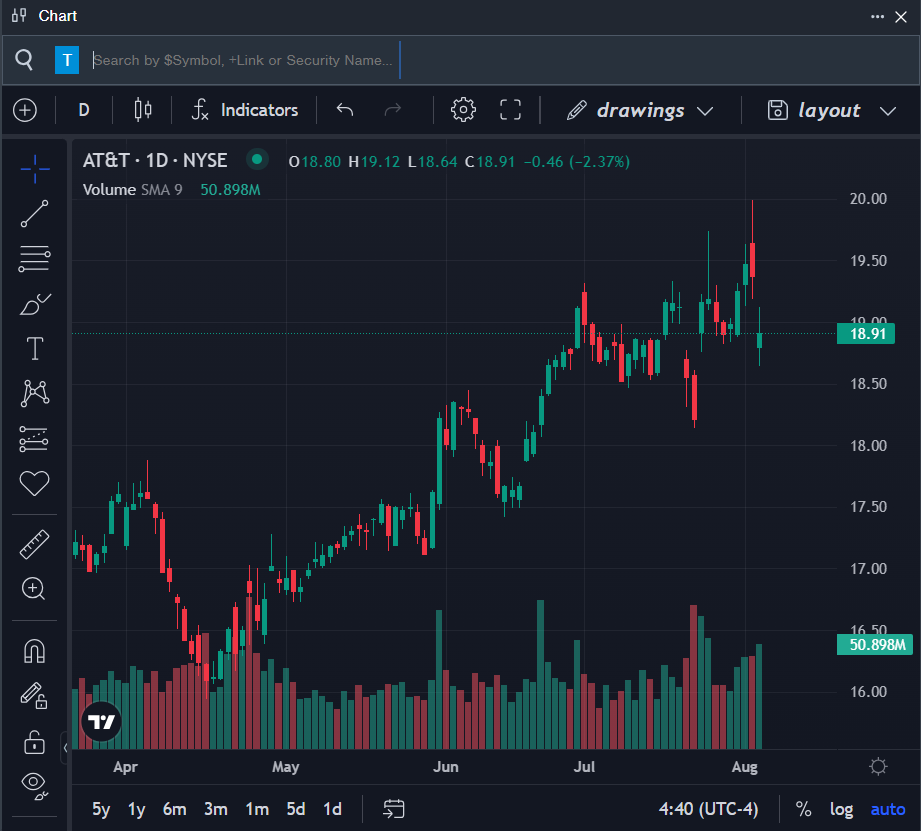

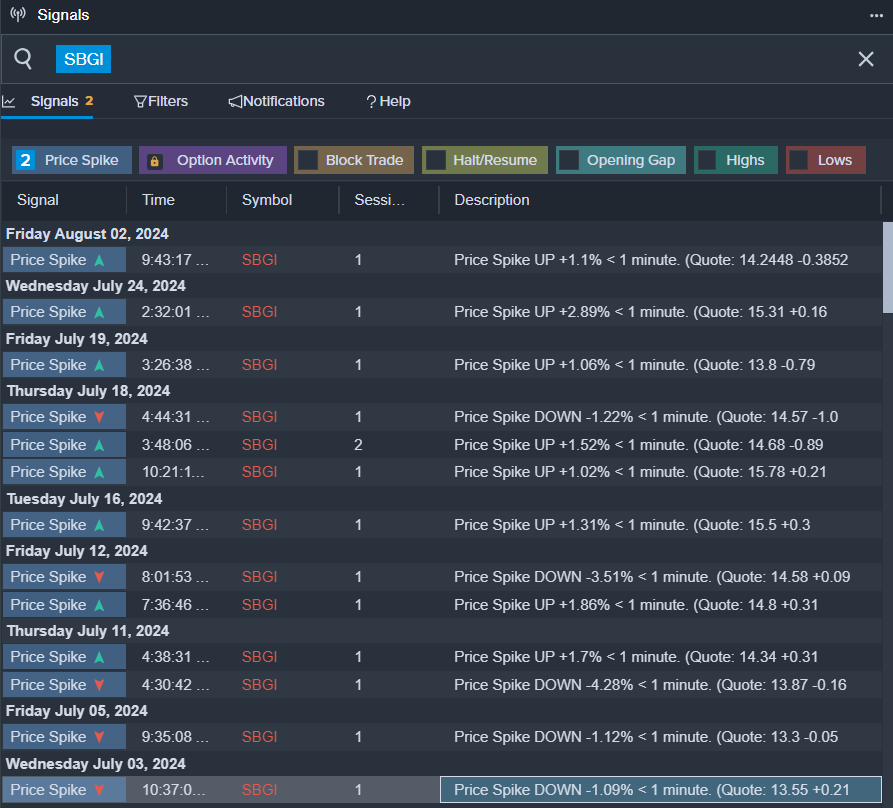

Sinclair, Inc. (SBGI)

- Dividend Yield: 7.96%

- Guggenheim analyst Curry Baker, an experienced navigator in the financial seas, maintained a Buy rating despite adjusting the price target from $30 to $20 on November 3, 2023. Baker’s accuracy rate of 65% underscores the challenges of predicting market waves.

- Benchmark analyst Daniel Kurnos reiterated a Buy rating, setting sail with a price target of $25 on August 23, 2023, showcasing an accuracy rate of 73%, a testament to his keen eye for spotting hidden investment treasures.

- Recent News: On July 30, Sinclair appointed Dean Ditmer as Vice President/General Manager of KATU and KUNP in Portland, OR, a strategic move akin to securing new crew members for the voyage ahead.

- Through the signals feature on Benzinga Pro, investors were alerted to potential breakouts in SBGI shares, akin to receiving warning signals of upcoming market swells.

As you navigate the unpredictable waters of the stock market, consider the insights provided by these seasoned analysts to chart a steady course towards profitable shores.

Read More: