Bitcoin, the most well-known cryptocurrency, paved the way for the cryptocurrency asset class.

Now the cryptocurrency of choice, its meteoric rise was unlike any other commodity, resource or asset. Bitcoin’s price rose more than 1,200 percent from March 2020 to reach US$69,044 on November 10, 2021.

The currency showcased its famous volatility in the following year, falling as low as US$15,787 by November 2022 amid economic uncertainty and a wave of negative media coverage.

The cryptocurrency started 2024 just below US$45,000 and has seen substantial gains in the first half of this year. Bitcoin reached its new all-time high price of US$73,115 on March 11, 2024.

So, where did Bitcoin start, and what has spurred Bitcoin’s price movements in recent years? Read on to find out.

Founding Blocks of Bitcoin’s Journey

When Bitcoin journeyed into the markets in 2009, its initial price stood at a meager US$0.0009, setting the stage for its remarkable price evolution over the years.

Spawned in response to the 2008 financial debacle, Bitcoin’s inception was elucidated in a nine-page white paper dubbed “Bitcoin: A Peer-to-Peer Electronic Cash System,” emerging on October 31, 2008, through a channel known as Metzdowd.

Carved by an enigmatic figure (or figures) under the alias Satoshi Nakamoto, the visionary(s) postulated a groundbreaking digital currency that would overhaul the monetary system.

Cryptographically shielded, Bitcoin was architected to be transparent and impervious to censorship, harnessing blockchain technology’s potency to forge an unalterable ledger thwarting double-spending. The core enticement for Bitcoin’s early adherents lay in its potential to wrest control from financial institutions and bestow it upon the populace.

Reeling from the aftershocks of the 2008 financial meltdown that reverberated globally, Bitcoin’s advent marked a turning point. Termed the severest financial crisis post the Great Depression, it inflicted a staggering US$7.4 billion blow to the US stock market in under a year, while the global economy reeled from a roughly estimated US$2 trillion shrinkage.

Fast forward to January 3, 2009, the Genesis Block was established, heralding Bitcoin’s blockchain dawn, hosting subsequent blocks. Housing the debut 50 Bitcoins ever minted, the Genesis Block etched a poignant message: “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks.”

Interpreted by many as a clarion call, the message chastised the British government for its subpar remedial actions post the 2007-2008 financial turmoil, especially its failure to resuscitate the stuttering economy.

Emergence of Growth in Bitcoin’s Value

Serenko Natalia / Shutterstock

Ascension of Bitcoin’s Price Trajectory

The onset of January 1, 2016, marked the commencement of Bitcoin’s steadfast price upswing. Opening the year at US$433, it culminated at US$989, registering a 128 percent surge over 12 months.

A slew of catalysts spurred Bitcoin’s ascent towards mainstream acceptance in 2016. The stock market weathered a tumultuous start to 2016, nudging investors toward Bitcoin as a “safe-haven” asset amidst geopolitical and economic tumult.

Noteworthy events in 2016, including the UK’s Brexit referendum in June and Donald Trump clinching the US presidency in November, coincided with Bitcoin’s price uptick.

As Bitcoin continued its upward trajectory, diverse sectors evinced keen interest in blockchain technology, notably the tech and financial realms. In February, a consortium, featuring the likes of IBM (NYSE:IBM), and Goldman Sachs funneled US$60 million into a New York-based firm developing financial services blockchain tech — Dig Asset Holdings. Bitcoin was trading at US$368.12 on February 2, witnessing a marginal dip from January, but soared to US$418 a mere two months later.

In May, Bitcoin experienced a substantial price upswing, culminating in a 21 percent hike to US$539 by month-end, setting the stage for a continued rise.

The Rollercoaster Ride of Bitcoin: A Journey Through the Cryptocurrency Market

In the world of digital currencies, Bitcoin has been the unrivaled champion, weathering storms of both boom and bust. Its storied rise to fame began in 2010, with a value of less than a penny per coin. By 2013, it soared to more than US$1,100 before tumbling back down dramatically and settling in the US$600 range.

An Unlikely Partnership and Ripple’s Triumph

In 2016, landmark collaborations like Microsoft’s venture with Bank of America Merrill Lynch and Ripple’s partnership with 12 banks quickly captured the attention of investors. These strategic moves injected fresh confidence into the market, propelling Bitcoin’s value from US$629 to US$736 within just a month.

The 2017 Bitcoin Explosion

The following year, the cryptocurrency touched new heights, surging from US$1,035.24 in January to a staggering US$18,940.57 by December. The launch of futures trading on the Chicago Mercantile Exchange heralded a new era, establishing Bitcoin as a legitimate investment avenue rather than a passing trend.

The Turbulence of Bitcoin in 2019

The start of 2019 saw Bitcoin at around US$3,800, peaking near US$13,000 in June, but ultimately closing the year at US$7,200. The fluctuating trajectory hinted at the underlying volatility plaguing the cryptocurrency market.

The Resilience of Bitcoin Amidst the Pandemic

The COVID-19 pandemic in 2020 delivered a severe blow to global markets, causing Bitcoin to plummet to US$4,841.67 from an initial US$6,950.56 in March. However, this setback proved to be a silver lining as Bitcoin bounced back stronger, closing the year at an impressive US$29,402.64.

The Meteoric Rise and Fall of Bitcoin in 2021 and 2022

By 2021, Bitcoin had reached an all-time high of US$68,649.05, fueled by growing investor appetite for risk and the impact of increased money supply due to the pandemic. Nonetheless, 2022 was marred by uncertainties, with Bitcoin prices dipping below US$20,000 amid the alarming collapse of Terra Luna and Celsius network.

The industry’s seismic quake hit in November 2022 when revelations surfaced about mismanagement and fund borrowing by Alameda Research, causing a mass exodus of investors and triggering a liquidity crisis across the market.

Exploring Bitcoin’s Rollercoaster Ride in 2024

Bitcoin Reaches Record High of US$73,737.94

Bitcoin, the poster child of the cryptocurrency world, hit a milestone on March 14, 2024, by soaring to its highest-ever recorded price of US$73,737.94 per BTC. This historic peak was a testament to the digital currency’s resilience and market dominance, especially after enduring the aftershocks of the FTX scandal that rocked the sector and triggered a downward spiral in 2022.

Bitcoin’s Price Rally Amid Sector Uncertainty

Despite the dark clouds of uncertainty hovering over the cryptocurrency industry in the wake of the FTX turmoil, Bitcoin’s price trajectory in 2023 and 2024 displayed remarkable resilience and tenacity. The concerns surrounding traditional banking systems coupled with regulatory challenges ignited a rally in Bitcoin’s value, propelling it to US$73,737.94 from its lows below US$17,000, showcasing the crypto’s ability to weather storms and emerge stronger.

Impact of Institutional Investments and ETF Approvals

The latter part of 2023 witnessed a surge in institutional interest in Bitcoin, hinting at a potential shift in the perception of the digital asset from a speculative investment to a more mainstream financial instrument. BlackRock’s move to file for a Bitcoin exchange-traded fund with the SEC marked a pivotal moment, paving the way for further institutional investments and laying the groundwork for Bitcoin’s ascent to US$73,737.94 in 2024.

The 2024 Bitcoin Halving: A Double-Edged Sword?

As Bitcoin enthusiasts eagerly awaited the 2024 halving event, which saw miner rewards slashed from 6.25 to 3.125 Bitcoin, the impact on Bitcoin’s price was a topic of much speculation. While historical trends hinted at a price surge before halving events, the aftermath of the 2024 halving brought a mixed bag of results, with Bitcoin experiencing fluctuations in trading volume and price.

The Evolution of Bitcoin as a “Risk-On” Asset

With Bitcoin’s increasing integration into traditional financial products and the growing institutional interest in the cryptocurrency, its status has evolved from a niche, volatile investment to a “risk-on” asset. This shift reflects a changing landscape where Bitcoin’s value is not only driven by market sentiment and investor confidence but also influenced by broader economic conditions.

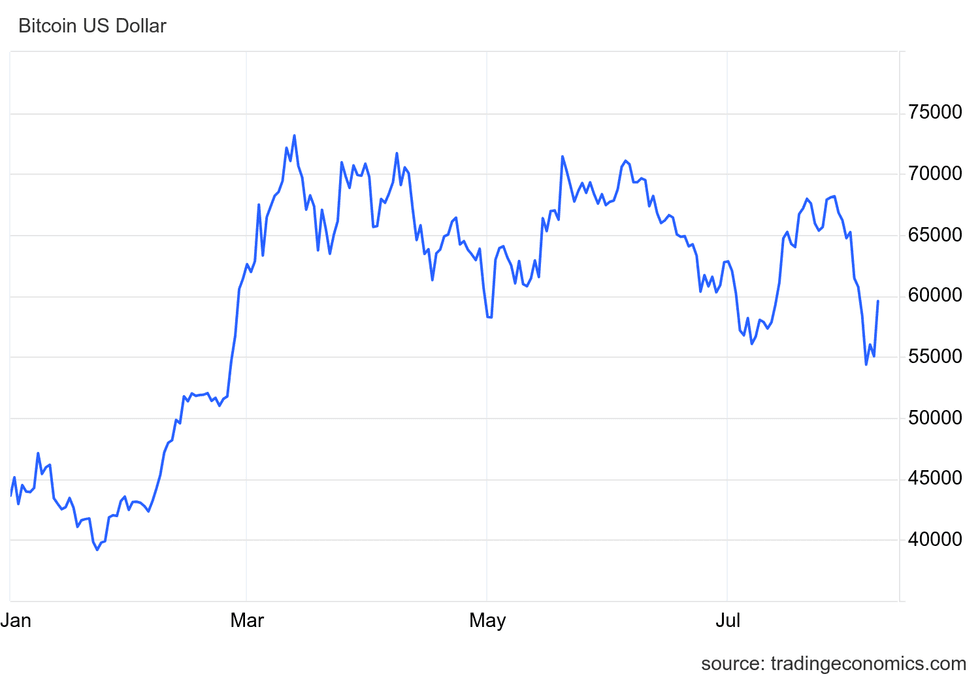

Bitcoin price chart via TradingEconomics.com.

Bitcoin price chart in US dollars from January 1, 2024, until August 8, 2024.

The Rollercoaster Ride of Bitcoin Prices Amidst Recent Events

The Surge and Fall

Bitcoin’s price soared from US$57,899 to US$66,690 in the aftermath of the July 13 assassination attempt on US presidential candidate Donald Trump. The market was swayed by speculation surrounding Trump’s support for the crypto industry, which seemed to bolster his election odds. However, the landscape swiftly shifted when President Joe Biden chose to withdraw from the race, replaced by Vice President Kamala Harris. Despite these fluctuations, Bitcoin prices remained remarkably steady.

A Bumpy Ride in August

Bitcoin faced a tumultuous period in early August, witnessing a significant drop in value as global markets were shaken by economic uncertainty. A chain of events, including underwhelming economic data and an unexpected interest rate hike in Japan, triggered a widespread sell-off. The Asian market turmoil, coupled with fears of an impending recession in the US, led investors to liquidate high-risk assets, including Bitcoin.

In a swift turn of events, Bitcoin’s value plunged by over 18 percent within 24 hours, briefly dipping below US$50,000 for the first time since February. However, as investors cautiously gauged the long-term impact of the economic scenario, the market began to stabilize, offering a glimmer of hope amidst the chaos.

Insight Into Bitcoin’s Present Value

As of 4:00 p.m. EDT on August 8, Bitcoin was valued at US$59,490, showcasing a partial recovery from the recent downturn. The cryptocurrency market, accompanied by traditional stock exchanges, collectively grappled with the repercussions of the economic upheaval, striving to find balance amid the turmoil.

FAQs for investing in Bitcoin

The Heart of Blockchain

A blockchain serves as a decentralized digital ledger recounting all cryptocurrency transactions. As a pivotal component of various industries, including banking, cybersecurity, and supply chain management, blockchains continue to revolutionize business operations, offering transparency and security across the digital realm.

The Bitcoin Halving Phenomenon

Unlike traditional currencies, Bitcoin’s supply is finite, with a total of 21 million coins set to be in circulation. The halving process, occurring approximately every four years, plays a crucial role in regulating Bitcoin’s scarcity and value. With halving events triggerin every 210,000 blocks, miners witness a proportional decrease in new coin issuance, lending stability to Bitcoin’s ecosystem.

Coinbase – The Gateway to Cryptocurrency

Coinbase Global stands as a secure online exchange platform, facilitating the effortless purchase, sale, and storage of cryptocurrencies like Bitcoin. Offering a user-friendly interface, Coinbase has become a go-to platform for investors seeking a seamless crypto experience.

Deciphering Crypto’s Impact on Banking

Cryptocurrencies have emerged as a disruptive force within the traditional banking sector, captivating a younger demographic seeking digital assets beyond conventional financial frameworks. With a surge in ownership among individuals aged 18 to 34, the industry embodies a shift towards decentralized, privacy-centric financial avenues.

The Evolution of Cryptocurrency Investments

Bitcoin’s Volatility: Is it Still a Lucrative Investment?

Despite Bitcoin’s staggering rise to prominence in 2024, its reputation for volatility remains unchanged. While risk-embracing investors thrive in the cryptocurrency realm, history underscores both gains and losses. As Bitcoin recuperates value post the 2022 plummet, conservative investors may seek stability elsewhere.

For detailed insights on current Bitcoin investment prospects, explore the article: Is Now a Good Time to Buy Bitcoin?

The Enigmatic Bitcoin Holder: Satoshi Nakomoto’s Vast Holdings

Deep-rooted in the mysteries of cryptocurrency origins, Satoshi Nakomoto is reputed to be the largest Bitcoin holder. Evidenced through early Bitcoin wallet scrutiny, Nakomoto is speculated to possess over 1 million of the nearly 19.5 million Bitcoins in circulation.

Elon Musk’s Crypto Foray: A Billionaire’s Dalliance with Digital Assets

Renowned for his association with Bitcoin and the quirky Dogecoin, Elon Musk exerts a potent influence on cryptocurrency trajectories. Musk’s public declarations unveil his personal stakes in Bitcoin, Dogecoin, and Ether in a cloudburst of revelations since September 2023.

Tesla’s foray into Bitcoin investment, with a staggering US$1.5 billion acquisition in 2021, followed by a 75% divestment the ensuing year, underscores the crypto erraticism. By February 2024, Tesla’s Bitcoin reserves amounted to 9,720, securing a prominent position as the third-largest publicly traded company holding Bitcoin.

Musk’s Twitter confession in January 2024, unravels, “I still own a bunch of Dogecoin, and SpaceX owns a bunch of Bitcoin,” encapsulating his entrenched crypto involvement.

This article is an updated rendition of an earlier piece by the Investing News Network in 2021.

Stay updated with real-time insights, follow us on Twitter @INN_Technology!