When contemplating investment decisions, investors often turn to brokerage recommendations for guidance. These recommendations, originating from analysts at brokerage firms, hold significant sway over stock prices. But how much weight should one give to these recommendations?

Before delving into the reliability of brokerage suggestions and how investors can leverage this information, let’s first scrutinize what the Wall Street experts are advising for TJX on the NYSE.

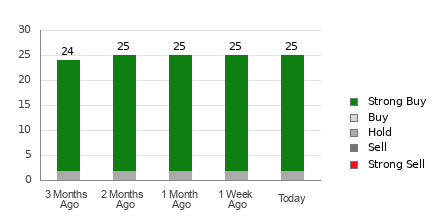

TJX presently commands an average brokerage recommendation of 1.16 on a scale from 1 to 5, with 25 brokerage firms contributing their Buy, Hold, or Sell verdicts. An average brokerage rating of 1.16 suggests a stance between Strong Buy and Buy.

Of the 25 recommendations factoring into this average, a substantial 23 are Strong Buy, constituting a noteworthy 92% of all endorsements.

Unveiling the Trends in Brokerage Recommendations for TJX

Basing investment decisions solely on the Average Brokerage Rating (ABR) might not be prudent. Numerous studies have underscored the limited effectiveness of brokerage recommendations in selecting stocks with the highest potential for price appreciation. These stock experts have a penchant for displaying a strong positive bias towards the companies they cover, usually inundating them with optimistic ratings.

As such, investors may find the true value of these recommendations in cross-validating their own research efforts or utilizing them as a complementary tool to identify stocks with promising price trajectories.

Enter Zacks Rank, an internally vetted stock evaluation metric that assigns stocks to five distinctive categories – from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool has demonstrated a strong track record in predicting near-term stock price movements, offering investors a trustworthy compass in turbulent markets.

Deciphering Zacks Rank from ABR

Despite sharing a numerical scale from 1 to 5, ABR and Zacks Rank are fundamentally dissimilar concepts.

Brokerage recommendations are the sole input for calculating ABR, typically represented in decimals like 1.28. In contrast, Zacks Rank leverages earnings estimate revisions as its foundation, portrayed in whole numbers from 1 to 5.

Unlike the rosy forecasts from brokerage analysts, Zacks Rank derives its efficacy from observable trends in earnings estimate revisions, manifesting a strong correlation with short-term stock price fluctuations.

Moreover, Zacks Rank categorizes all stocks based on current-year earnings estimates provided by brokerage analysts, ensuring an equitable distribution across its five distinctive ranks.

Another critical distinction lies in the dynamism of the two metrics. While ABR may lag in real-time updates, Zacks Rank rapidly responds to evolving business dynamics, making it a reliable barometer for forthcoming price shifts.

Evaluating TJX as an Investment Opportunity

Regarding earnings estimate revisions for TJX, the Zacks Consensus Estimate for the ongoing year has held steady at $4.09 over the past month.

The consistent stance among analysts on the company’s earnings prospects, showcased by the unchanged consensus estimate, offers a compelling rationale for TJX to align with broader market trends in the immediate future.

Factoring in recent estimate adjustments and additional indicators linked to earnings forecasts, TJX currently garners a Zacks Rank #3 (Hold), signaling a nuanced stance for potential investors.

This nuanced evaluation underscores the importance of exercising vigilance despite TJX’s favorable ABR equivalent.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.