Nasdaq NDAQ caused a stir recently by unveiling plans to tighten delisting procedures for companies falling short of listing criteria, particularly those delving into penny stock territory. The proposed adjustment, targeting entities lacking the requisite minimum bid price of $1, signifies a move to swiftly remove underperforming entities from the stock exchange.

Should a company listed on Nasdaq fail to uphold the minimum bid price for 30 consecutive trading sessions, it faces the label of non-compliance. Despite being granted a 180-day grace period to address the issue, failure to restore compliance within this timeframe results in the possibility of removal. The proposal suggests that entities whose shares dip below $1 for a sustained period of 360 market sessions could face immediate suspension from trading.

Furthermore, companies implementing a reverse stock split within a year of their share price plummeting below $1 might trigger an accelerated review for delisting. By demanding stricter listing standards, Nasdaq aims to elevate the caliber of small-capitalization firms listed, spotlighting only the most robust enterprises in a move that could positively impact the performance of the Russell 2000 index.

Notably, amidst this regulatory backdrop, lesser-known companies are stirring up enthusiasm in the market. Small-cap stocks experienced a notable upswing in value recently, potentially reflecting a shift away from dominant large-cap players like Big Tech and a resurgence of interest in smaller, promising ventures.

The Direxion ETFs

For investors positioning themselves within this market shift, Direxion offers two leveraged exchange-traded funds catering to different market sentiments. The Direxion Daily Small Cap Bull 3X Shares TNA seeks to deliver daily returns equivalent to 300% of the Russell 2000 index performance for bullish traders. Conversely, the Direxion Daily Small Cap Bear 3X Shares TZA offers a 300% inverse exposure to the same index for bearish investors.

It should be noted that these ETFs serve as short-term speculation tools, ideal for traders with daily horizons. Due to the daily compounding of leverage, coupled with the heightened volatility characteristic of small-cap stocks, prolonged holding periods may expose investors to value erosion.

Performance Overview

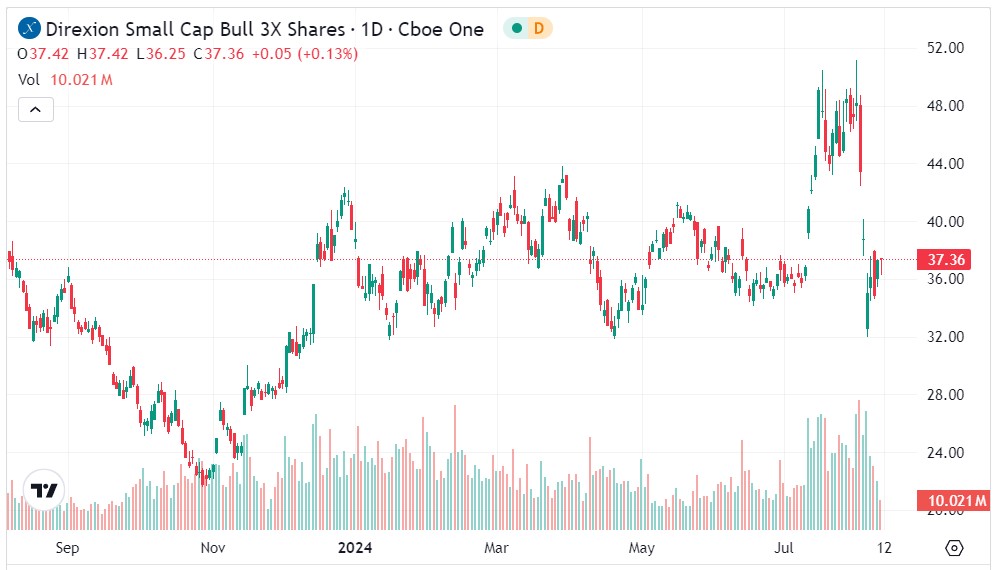

The TNA Chart: Recently, TNA exhibited significant price fluctuations, hitting a peak of $49.09 in the past month before retracing to slightly above $37 presently. The ETF encountered volatility including a dip below its 200-day moving average, although subsequent price action propelled it back above this critical indicator of intermediate market health.

- For bullish TNA investors, consolidating support around $38 and advancing toward the psychological threshold of $40 emerge as immediate objectives.

The TZA Chart: In a parallel narrative, TZA underwent substantial fluctuations, dwindling to a low of $13.51 before recovering to near $17 recently. It confronted challenges breaching its 50-day moving average and 20-day exponential moving average, emphasizing ongoing struggles to regain upward momentum.

- For those with bearish sentiment on small caps, securing $18 support and targeting the pivotal $20 level constitute principal milestones.

Image Credit: Mohamed Hassan from Pixabay