As the dust settles on the recent turmoil surrounding AI chip stocks such as ASML, AMD, and MU, astute investors find themselves at a crossroads, seeking to discern which among the littered carnage presents the most lucrative opportunity for revival. In the tumultuous realm of stock investments, where fortunes are made and dashed in the blink of an eye, the recent plummet of these chip stocks unveils a potential feast for the discerning contrarian.

Amidst a backdrop of plummeting prices lies an uncharted territory ripe for exploration by steadfast investors. While the eulogies of bygone bullish sentiments echo in the chambers of the stock exchanges, the sagacious few survey the dimly lit terrain with optimism and anticipation, recognizing the latent promise within the perishing embers of these once-radiant AI chip stocks.

Analyzing ASML

ASML, a European juggernaut in semiconductor equipment manufacturing, witnesses a staggering descent of 23% from its erstwhile zenith scarcely a month ago. The precipitous decline, although indicative of a potential “double-top” pattern in technical parlance, fails to deter the stalwart resolve of analysts like Georges Debbas of BNP Paribas, who extols ASML stock as a premier purchase amidst the tempestuous seas of the market. The unanimous endorsement by a legion of analysts propels ASML as a beacon of resilience amid the crumbling cliffside of AI chip stocks.

Beneath the veneer of a diminished valuation, ASML emerges as a phoenix of newfound vigor, bolstered by recent forays into technological innovation. The unveiling of the High Numerical Aperture Extreme Ultraviolet (EUV) lithography machine signals a step-change in chip manufacturing, promising smaller, faster, and more energy-efficient chips. In this epoch of relentless pursuit of technological advancement, ASML beckons as a bastion of progress.

The Fortunes of ASML Stock

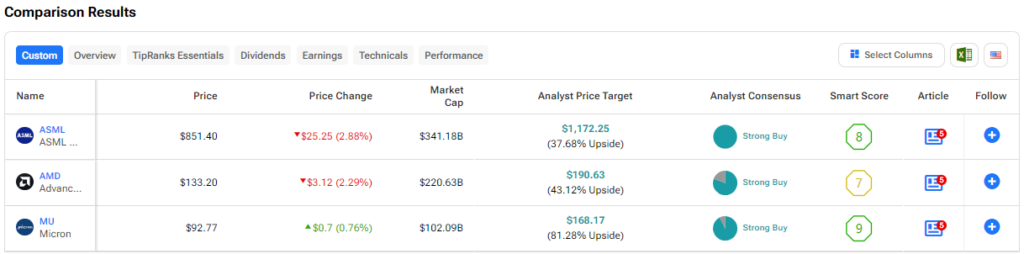

ASML stock stands adorned with a laurel wreath of a Strong Buy, endorsed by a chorus of analysts with unwavering Buy ratings in the preceding quarter. The average price target of $1,172.25 heralds a potential upside of 37.6%, signifying a clarion call to discerning investors seeking to partake in the resurgence of a fallen titan.

Exploring Advanced Micro Devices (AMD)

Entrepreneurial spectacles are cast upon AMD as the CPU and GPU magnate witnesses a freefall of 41% from its pinnacle in March 2024. Against the backdrop of Intel’s tumultuous travails, AMD emerges as a budding suitor for the affections of discerning investors. Piper Sandler’s optimistic overtures hint at Intel’s travail paving the golden road for AMD’s ascendancy, while the specter of Blackwell production delays at Nvidia casts a propitious light on AMD’s fortunes.

The wheel of fortune spins in AMD’s favor as the tides of market sentiment ebb and flow. At a 41% discount from its zenith, AMD’s allure as a bargain beckons to eager investors seeking to partake in a technological renaissance. The stratospheric price target of $250 per share unveils a banquet of potential gains, enticing intrepid investors to venture forth into the uncharted realms of technological resurgence.

The Trajectory of AMD Stock

AMD stock shines resplendent in the firmament of Strong Buy endorsements, with a consortium of analysts furnishing 25 Buy ratings and six Holds in the recent quarter. The average price target of $190.63 stands as a testament to the latent potential, promising a substantial upside of 43.4% for those audacious enough to seize the reins of opportunity.

The Rise of Memory Chip Maker Micron Amidst Market Turmoil

Latest Developments at Micron

Micron, the memory chip maker, is defying market volatility with its robust performance. Despite undergoing a significant drop, analysts remain optimistic about Micron, pointing to its resurgence in the face of adversity. Recently, the company resumed its share repurchase program, a move that has bolstered confidence in its strategy.

The launch of Micron’s 9th-generation (G9) NAND chips has garnered attention for being 73% denser than its competitors. This technological advancement is a testament to Micron’s commitment to innovation and staying ahead in the ever-evolving market landscape.

Financial Resilience

Micron’s strong free cash flow generation of $425 million in the last quarter showcases its solid financial footing. This, coupled with its focus on technological advancements, positions Micron as a frontrunner in the industry. Despite the recent stock price decline, investors view this as an opportunity to capitalize on Micron’s long-term growth prospects.

The Price Target for MU Stock

Analysts have designated Micron (MU) stock as a Strong Buy, with 25 Buy ratings and two Holds in the past three months. The average price target for MU stock stands at $169.04, reflecting an impressive 82.3% upside potential, indicating a positive outlook for the company’s stock performance.

The Takeaway

Amidst industry challenges, Micron stands out for its resilience and potential for growth. Alongside advancements in chip technology, the company’s commitment to innovation and financial stability make it a compelling investment opportunity. In contrast to market sentiment, analysts continue to advocate for Micron’s upside potential, making it a standout choice in the current market environment.