Revelations echoing from the heart of Omaha, Nebraska unveil a surprising move by Warren Buffett. The Oracle of Omaha saw fit to part ways with a substantial portion of Berkshire Hathaway’s colossal stake in Apple (NASDAQ: AAPL), bolstering the company’s cash hoard by tens of billions. Berkshire Hathaway concluded the last quarter flaunting $277 billion in cash and equivalents, placing it amongst the universe’s most cash-endowed entities.

Berkshire Hathaway’s formerly $84 billion investment in Apple, which once towered at $150 billion, has seen a notable decline. What scheme lurks behind Buffett’s cash-cushioned maneuver? Why has the Apple allure waned in his discerning eye? And does this signal a red flag for your investment portfolio? A closer investigation is paramount.

The Erosion of Apple’s Sales Momentum

Apple’s financial revelations for the second quarter of 2024 spun a familiar yarn, mirroring previous quarters. Hardware sales stagnated, with iPhone, iPad, and Wearables revenue spiraling downwards in comparison to the previous year. Solely the Mac segment savored a modest sales elevation.

In a heartening contrast, Apple’s services revenue charted an upward trajectory, scaling to $71 billion over the past nine months from $63 billion the preceding year. Services stand out as a high-margin domain for Apple, emanating from App Store charges, advertisements, Apple TV, and assorted software retails to its clientele. This narrative has been Apple’s anthem for quite a while. Despite the dismal performance in hardware sales, the burgeoning suite of software offerings is anticipated to steer the company’s growth.

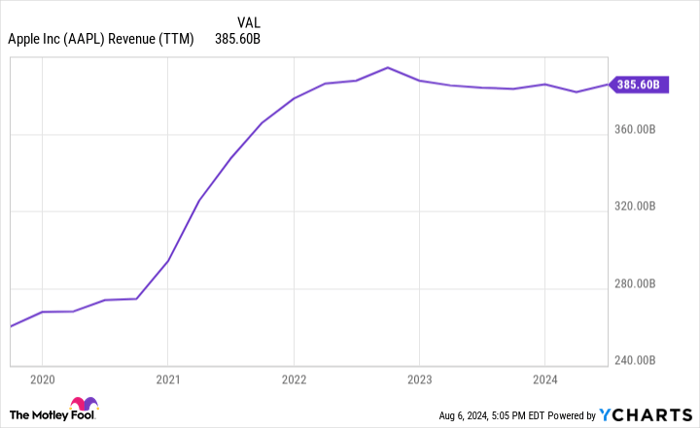

A sweeping view exposes Apple’s stagnant sales tableau that has lingered for an extended spell. Following the ephemeral revenue surge amidst the COVID-19 pandemic, Apple’s earnings have flatlined over trailing twelve-month periods for multiple years. In essence, the revenue remains below its zenith, especially in China, a critical market with a sputtering consumer economy. Revenue standings in China nosedived from $57.5 billion to $52 billion in the opening nine months of the fiscal year.

AAPL Revenue (TTM) data by YCharts

The Looming Uncertainty over Apple’s Services Revenue Stream

Within Apple’s sanctuary of services lies a specter of uncertainty. While the vista appears rosy, with margins ascending, a substantial chunk of Apple’s services revenue comprises a stipend from Google for being the default search engine on Safari. This alliance showers Apple with over $20 billion annually from Alphabet, thriving on nearly a 100% profit margin. Speculations hint that this disbursal might constitute 15% of Apple’s consolidated profit machinery.

An ominous shadow looms as a recent judicial decree branded Google’s default search distribution deals as monopolistic, edging towards the U.S. government in its legal bout against Alphabet. This forebodes misfortune for Alphabet, but Apple stands at the brink of a storm. The jeopardy of losing this lucrative passkey could chip away a chunk constituting 15% of its bounty, inflicting a blow parallel to the tepid topline growth. The sole beacon in their constellation – services – might transmute into a laggard should the courts decree against Apple.

AAPL PE Ratio data by YCharts

The Priced-to-Perfection Predicament

Apple, embroiled in a saga of stagnant revenue and the looming peril over its Google distribution stipend, found its stock cresting towards an all-time pinnacle at the second quarter’s closure. Buffett, prompted by these indicators, opted to prune his Apple stash.

Presently, the stock rate, nudged marginally downward by the broad market’s descent, clutches an exorbitant price-to-earnings ratio (P/E) of 31.5. This stands starkly elevated from the S&P 500’s norm for a company grappling with arrested sales. Buffett traditionally gravitates towards businesses with a P/E hovering near 10 – the realms he trod when acquiring Apple shares eight years past.

Buffett’s unwavering faith in the business remains evinced by Berkshire Hathaway’s stoutest equity possession. However, the stock’s overvaluation at its current juncture is conspicuous. A languid-growth entity besieged by uncertainties surrounding a substantial portion of its earnings and cash streams – the unfolding Google antitrust saga – hardly warrants a premium trading at over 30 times earnings. Even for Apple. Buffett’s discerning acumen discerns this reality, paving his path towards trimming the holding. He opts to nestle in short-term U.S. treasury bills unfurling a guaranteed annual interest of 5%.

Owning Apple should not necessarily translate to instant liquidation based on these cues. Nevertheless, if the stock bulk occupies a dominant position in your investment realm akin to Berkshire Hathaway’s scenario, diversifying your holdings harmonizes with Buffett’s course of action.

Pouring $1,000 into Apple: A Prudent Move?

Prior to embarking on an Apple stock acquisition spree, contemplation is due:

The Motley Fool Stock Advisor luminary brigade recently unveiled their curated list spotlighting the top 10 equities ripe for investors’ plucking… and Apple failed to secure a spot. The panorama illuminates ten stocks deemed capable of catalyzing formidable returns in the forthcoming years, an accolade that eluded Apple.

Reflect on Nvidia’s meteoric rise post its inclusion in this list on April 15, 2005… An investment of $1,000 during our prompt then would have burgeoned to an astounding $641,864 today! Stock Advisor unfurls a user-friendly roadmap to success, brandishing mentorship on portfolio construction, analyst updates, besides two novel stock enticements each month. The Stock Advisor ace has trumped the S&P 500 yield by a staggering fourfold since 2002.

*Stock Advisor returns as of August 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool retains positions in and advocates for Alphabet, Apple, and Berkshire Hathaway. The Motley Fool abides by a disclosure policy.