Nektar Therapeutics NKTR faced setbacks in the second quarter of 2024, with a loss per share of 25 cents that missed the Zacks Consensus Estimate of a 21-cent loss.

Despite this, the company’s total revenues of $23.5 million exceeded expectations, showcasing a 14.6% increase year over year.

Quarterly Performance Breakdown

Product sales saw a robust 42.5% rise to $6.6 million, outperforming predicted figures. Meanwhile, non-cash royalty revenues grew to $16.8 million, surpassing estimates as well.

The company kept a tight lid on Research and Development expenses, which remained consistent at $29.7 million, while General and Administrative expenses escalated to $20.5 million.

In response to these mixed results, Nektar’s stock dipped by 4.9% during after-hours trading on August 8th.

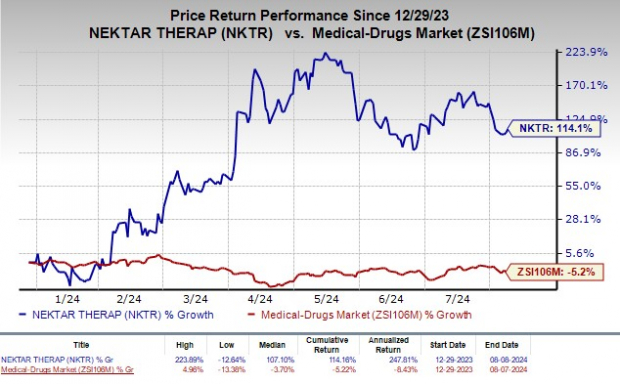

Year to date, Nektar’s shares have surged by a whopping 114.1%, overshadowing the industry’s decline of 5.2%.

Future Prospects and Pipeline Updates

Nektar’s key pipeline asset, rezpegaldesleukin (rezpeg), now under full ownership following its reacquisition from Eli Lily, holds promise in treating various autoimmune and inflammatory conditions.

Ongoing Phase IIb studies on patients with atopic dermatitis and alopecia areata aim to yield valuable insights by early-2025 and mid-2025, respectively.

Strategic Insights

The road ahead, though challenging, presents ample opportunities for Nektar to leverage its pipeline and navigate the competitive biotech landscape.