Unveiling ServiceNow’s Options Craze

Big players in the financial world have made a bold move in the realm of ServiceNow options. Upon scrutinizing the history of ServiceNow’s options trading, a revelation of 8 exceptional trades emerged.

An in-depth analysis uncovered that 25% of traders exhibited a bullish outlook, while an equal 25% leaned towards a bearish sentiment. Within the realm of these trades, 5 were put options, amounting to $346,325, while 3 were call options valued at $90,632.

Predicted Price Range for ServiceNow

An evaluation of trading volumes and Open Interest reveals a targeted price range of $550.0 to $850.0 for ServiceNow, spanning the past three months.

Insights on Volume & Open Interest Trends

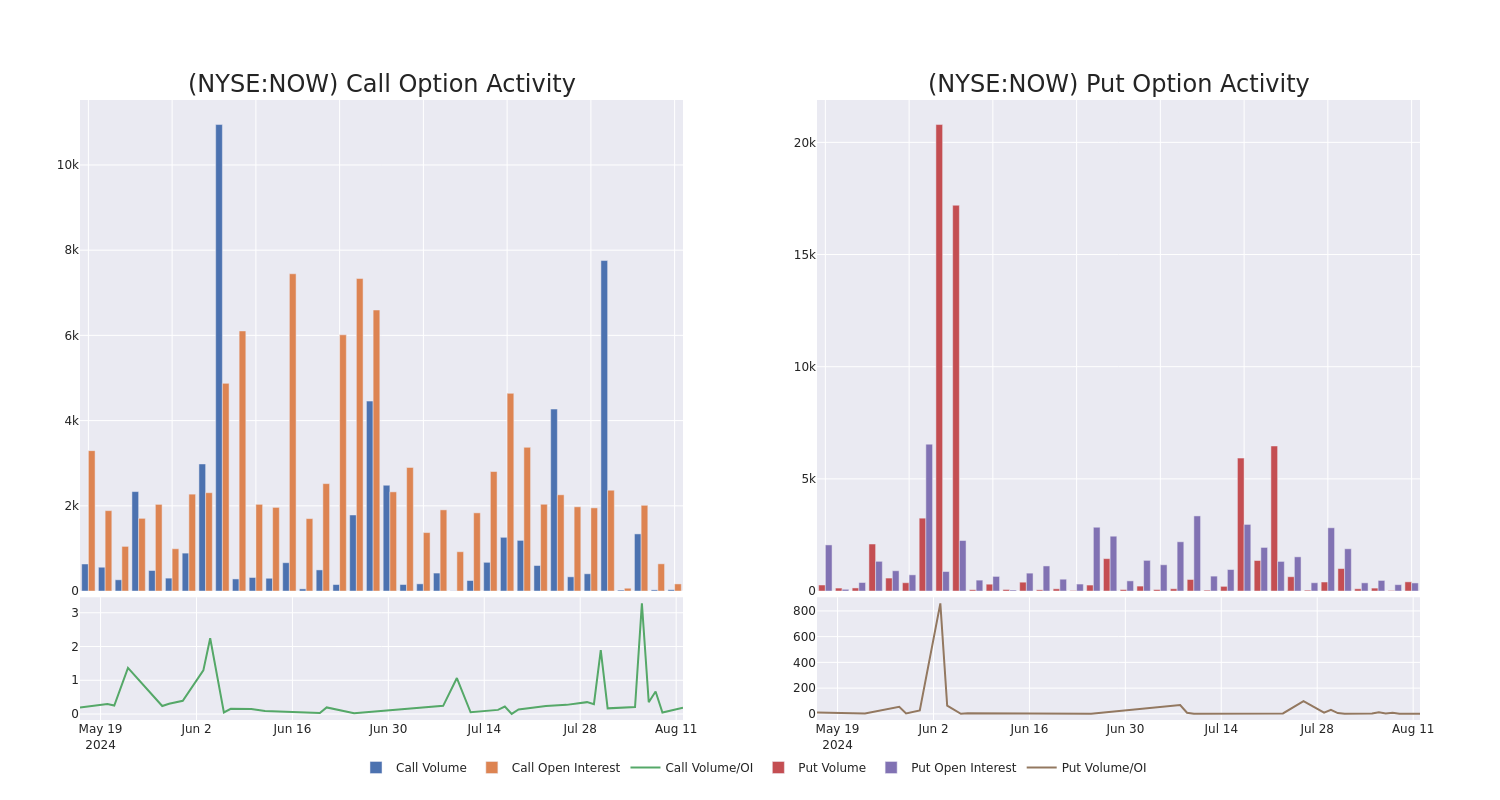

Scrutinizing the volume and open interest unveils crucial insights when assessing a stock.

This data serves as a valuable tool to gauge the liquidity and interest in ServiceNow’s options at specific strike prices.

The chart below illustrates the evolution of volume and open interest for calls and puts within the strike price range of $550.0 to $850.0 over the past 30 days.

Snapshot of ServiceNow’s 30-Day Option Volume & Interest

Unearthing Significant Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | PUT | SWEEP | NEUTRAL | 09/20/24 | $34.8 | $32.8 | $34.81 | $810.00 | $110.7K | 218 | 170 |

A Glimpse into ServiceNow

ServiceNow Inc. is a provider of software solutions that streamline and automate various business processes through a SaaS delivery model. Initially concentrating on IT service management for enterprise clients, the company has since broadened its scope to encompass other functional areas like customer service, HR service delivery, and security operations. ServiceNow also boasts an application development platform as a service.

Having explored the realm of options trading in the context of ServiceNow, our journey now steers towards a detailed examination of the company, delving into its current positioning and performance.

Present State of ServiceNow

- With a trading volume of 233,889, the stock price for NOW has dipped by -0.76%, settling at $804.91.

- Current Relative Strength Index (RSI) readings hint at a potential overbought scenario for the stock.

- The upcoming earnings report is slated 72 days from now.

Expert Opinions on ServiceNow

Over the past 30 days, a group of 5 pro analysts have shared their perspectives on the stock, setting an average price target of $887.0.

- Amid consistent evaluations, a TD Cowen analyst maintains a Buy rating on ServiceNow with a target price of $900.

While options entail higher risk compared to traditional stock trading, they also offer increased profit potential. Seasoned options traders navigate this risk through continuous education, strategic trade entries and exits, multi-indicator analysis, and vigilant market monitoring.

Stay informed about the latest ServiceNow options trades via Benzinga Pro, your gateway to real-time options trade alerts.