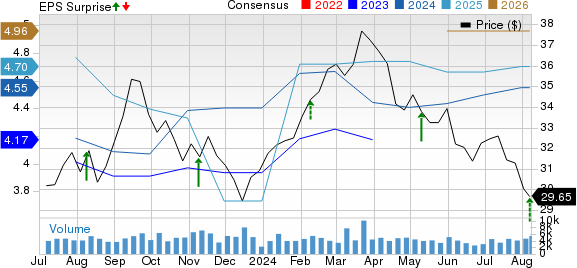

Honda HMC exceeded expectations in the first quarter of fiscal 2025 with earnings of $1.57 per share, beating the Zacks Consensus Estimate of $1.19. However, this marks a decline from the previous year’s $1.60 per share profit. Despite the dip in bottom-line figures, quarterly revenues stood at an impressive $34.7 billion, surpassing both the Zacks Consensus Estimate and the revenue from the same period last year of $33.7 billion.

Evaluating Segmental Performance

In the three-month period ending on June 30, 2024, Honda’s Automobile segment saw a significant 14.8% rise in revenue to ¥3.43 trillion ($22.03 billion). This increase outpaced projections as sales surged in major markets, excluding Asia. The segment recorded an operating profit of ¥222.8 billion ($1.43 billion), a 26% jump from the same quarter in fiscal 2024.

Meanwhile, revenues in the Motorcycle segment reached around ¥937.7 billion ($6 billion), showcasing a 23.8% year-over-year growth. The segment’s operating profit hit ¥177.6 billion ($1.14 billion), marking a 24% increase from the previous year. Additionally, Financial Services reported revenues of ¥938.1 billion ($6.02 billion), rising 21.3% year on year with an operating profit of ¥85 billion ($545.1 million).

Conversely, revenues from the Power Product and Other Businesses segment totaled ¥104.9 billion ($673 million), reflecting a 4% decline year over year. Despite the revenue drop, it managed to beat projections, but incurred an operating loss of ¥753 million ($4.83 million) against a profit of ¥4.4 billion in the previous year.

Analyzing Financials & Future Outlook

Honda reported consolidated cash and cash equivalents of ¥4.98 trillion ($30.93 billion) as of June 30, 2024, with long-term debt climbing to ¥6.16 trillion ($38.3 billion) compared to ¥6.06 trillion the previous quarter.

Looking ahead to fiscal 2025, Honda anticipates consolidated sales volumes in the Motorcycle, Automobile, and Power Products segments to reach 13.06 million units, 2.97 million units, and 3.66 million units, respectively. Although Motorcycles and Automobile units are expected to grow by 7% and 4% year over year, Power Product Unit sales are projected to decline by 4% for the fiscal year.

Revenue forecasts for fiscal 2025 stand at ¥20.3 trillion, indicating a marginal 0.6% decrease compared to the previous year. Operating profit is projected to reach ¥1.42 trillion, signaling a 2.8% increase year over year. However, pretax profit is expected to decline by 9.9% to ¥1.48 trillion. In addition, the company plans to pay an interim and year-end dividend of ¥34 per share each in fiscal 2025.

Comparison with Other Automakers’ Quarterly Releases

General Motors (GM) reported a strong second quarter in 2024, with adjusted earnings of $3.06 per share, surpassing estimates. Similarly, Ford (F) reported adjusted earnings per share of 47 cents, though missing estimates. On the other hand, Toyota (TM) posted earnings of $6.35 per share, topping expectations.

Overall, despite the year-over-year decline in earnings, Honda’s diversified segments demonstrate strong performance. The company’s strategic forecasts and financial stability pave the way for future growth and investor confidence amidst the challenging automotive landscape.