The Defensive Power Trio Emerges

When the market unpredictably staggers, investors seek refuge in the tried-and-true haven of defensive stocks. Amidst the tumultuous waters of market fluctuations, the allure of undervalued stalwarts beckons like a lighthouse in a storm. Let’s navigate the terrain together and unearth the gems waiting to rescue the portfolios of the discerning.

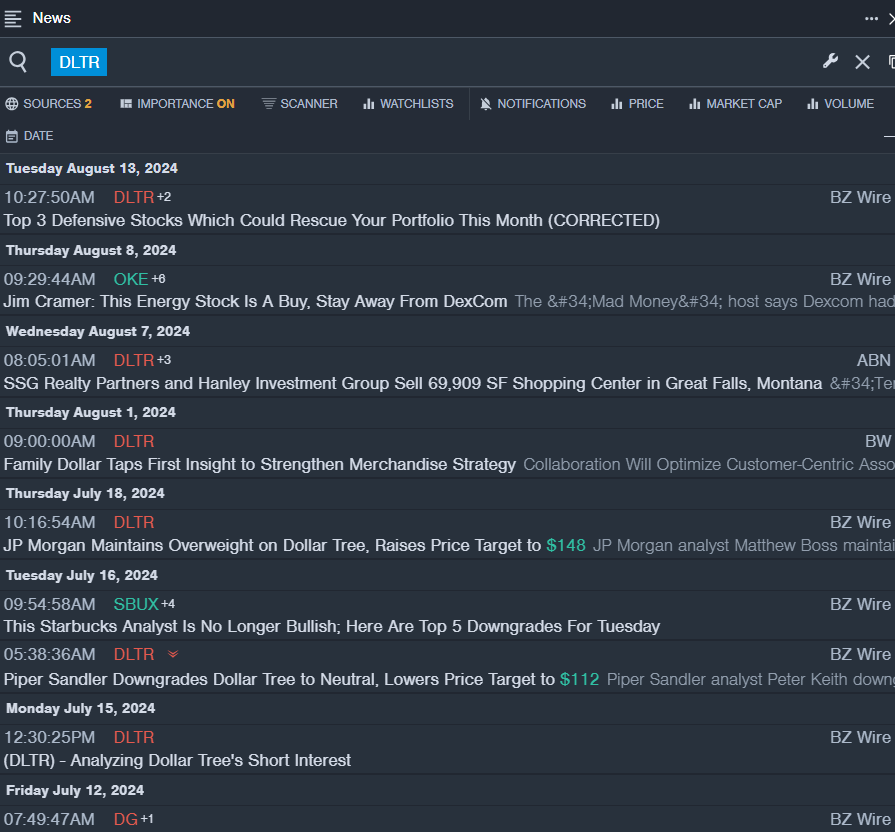

Dollar Tree Inc (DLTR)

- Amidst the churning tides of market sentiment, Dollar Tree Inc stands out – a beacon of hope for the cautious investor. Despite a turbulent downturn, whispers of recovery linger in the air. On July 18, JP Morgan painted a bullish picture, urging investors to seize the opportunity, raising the price target to $148. Shedding 10% in value over the past month, Dollar Tree finds itself resting at a 52-week low of $91.83.

- RSI Value: 27.53

- DLTR Price Action: Tracking the latest moves, Dollar Tree’s stock closed at $93.90 on Monday, perhaps hinting at a renaissance on the horizon.

Estee Lauder Companies Inc (EL)

- In the tempest of market fluctuations, Estee Lauder Companies Inc emerges as a steadfast vessel, weathering the storm with resilience. On Aug. 13, Telsey Advisory Group reaffirmed their faith in the company, maintaining a Market Perform rating with a price target of $115. Despite prevailing headwinds, Estee Lauder witnessed a 15% decline over the past month, standing at a 52-week low of $86.05.

- RSI Value: 18.84

- EL Price Action: Closing at $86.20 on Monday, Estee Lauder’s defiance in the face of adversity hints at a tale of resurgence waiting to unfold.

Vital Farms, Inc. (VITL)

- A phoenix rising from the ashes, Vital Farms, Inc. reveals a narrative of potential redemption. Bolstered by encouraging quarterly results on Aug. 8, the company’s shares encountered a setback of 27% against the backdrop of a challenging month. Echoing a sentiment of cautious optimism, Vital Farms finds itself at a 52-week low of $10.30, poised for a transformative journey.

- RSI Value: 27.47

- VITL Price Action: Closing at $30.96 on Monday, Vital Farms’ journey embodies the resilience and potential for revival amidst turbulent times.

As the stock market arena continues its frenzied dance, these defensive stocks present a compelling narrative of redemption and resilience. With caution as their compass and opportunity as their guide, investors may find solace in the steadfastness of these market warriors.