Investors witnessed a surge in the shares of high-volatility companies on the market today, driven by optimism surrounding a potential rate cut by the Federal Reserve in September. As anticipation for lower interest rates grows, so does the hope that the economy may avoid a severe recession, if one materializes at all.

Shares of Tesla (NASDAQ: TSLA) soared by 5.4%, Lucid (NASDAQ: LCID) by 5.9%, and Quantumscape (NYSE: QS) by 6.3%, reflecting a bullish trend in the market.

The Relationship Between Inflation and Interest Rates

The market closely monitored the release of the producer price index (PPI) today, which revealed a modest 0.1% increase in July, below the anticipated 0.2%. The year-over-year increase of 2.2% in PPI was notably lower than June’s 2.7% surge.

The upcoming consumer price index (CPI) report scheduled for tomorrow will play a vital role in determining the trajectory of interest rates. If CPI remains steady or below the expected 0.2% monthly rise, the Federal Reserve might lean towards a rate cut to manage inflation and stimulate economic growth.

With the 10-year U.S. government debt rate declining by 33 basis points over the past month, market participants are increasingly convinced of an impending rate cut.

Interest Rates and Electric Vehicle Market Dynamics

Investors are placing bets on lower interest rates driving increased demand for electric vehicles (EVs). These hopes are buoyed by the assumption that reduced borrowing costs will spur consumers to make big-ticket purchases.

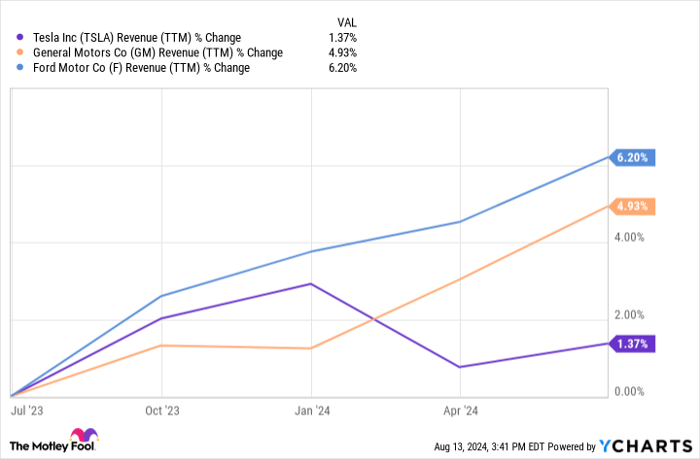

However, the correlation between interest rates and consumer behavior is more complex than a simple cause-and-effect relationship. Rising sales at traditional automakers like Ford and General Motors, despite higher interest rates, raise questions about the unique dynamics of the EV market.

When scrutinizing the stock market multiples and free cash flow of Tesla and its competitors, it becomes evident that underlying industry challenges—such as heightened competition and weakening demand for EVs—may outweigh the impact of interest rate changes.

A Cautionary Perspective on the Market Rally

Until Lucid and Quantumscape demonstrate robust production scalability and profitability, their stocks will remain highly speculative. Tesla, on the other hand, must prove its capacity to drive sales without resorting to heavy price discounting.

Despite the temporary optimism buoying these stocks, the fundamental challenges facing the EV sector warrant caution. The current market exuberance may not offer a sustainable investment opportunity.

Considerations for Investing in Tesla

Prior to considering an investment in Tesla, it is prudent to weigh the following:

The Motley Fool Stock Advisor analysts have identified what they perceive as the top 10 stocks for investors to buy now, with Tesla notably absent from the list. This strategic analysis underscores the potential for substantial returns from alternative investment opportunities.

Reflecting on historical success stories like Nvidia’s inclusion in this list in 2005, which translated to a substantial return on investment, emphasizes the importance of astute stock selection for long-term wealth creation.

The Stock Advisor service doesn’t just promise lucrative returns, but has consistently outperformed the S&P 500 since its inception in 2002, reiterating the credibility of its investment recommendations.