Industry Dynamics and Growth Drivers

The Broadcast Radio and Television industry is navigating choppy waters amidst an upheaval in consumer viewing habits, marked by an exodus from traditional avenues towards digital platforms. Giants like Netflix, Fox, Roku, and TEGNA are capitalizing on this shift with a blend of innovative content offerings tailored for the digital realm. Their success hinges on a diversified content portfolio catering to the ever-evolving small screens. With enhanced internet infrastructure and technological breakthroughs, these industry stalwarts are poised for a prolonged spree of robust growth.

A Glimpse into Industry Trends

Adapting to Consumer Evolution: The industry is undergoing a tectonic shift, steering towards personalized content delivery models through over-the-top services, complementing traditional linear TV. The resultant increase in ad revenues, bolstered by targeted advertising and a plethora of platforms, has opened up new revenue streams for the players in this space.

Embracing Digital Transformation: The surge in digital viewership has paved the way for content personalization via AI and machine-learning techniques. Leveraging consumer data, industry participants are primed to engage users at a deeper level while optimizing pricing strategies.

Macroeconomic Hurdles and Innovation: Despite facing headwinds from economic uncertainties, intensified by inflation and stiff competition from tech majors, advertising remains a pivotal revenue source for the industry. Navigating through turbulent terrains, companies need to innovate and embrace digital disruptions to stay afloat.

Impact of Skinny Bundles: The advent of low-cost streaming services has reshaped consumption patterns, compelling industry players to revamp their offerings with ‘skinny bundles.’ While these alternatives drive user engagement, they present a challenge to revenue growth due to their economic pricing structures.

Spotlight on Zacks Industry Rank

The Zacks Broadcast Radio and Television industry finds itself in a challenging position, ranked at #192 within the larger realm of industries. An underwhelming earnings outlook and a downward earnings trajectory underscore the industry’s predicament. Despite the somber industry sentiment, certain stocks bear watching, poised to defy market expectations and chart a promising trajectory.

Comparative Analysis and Market Performance

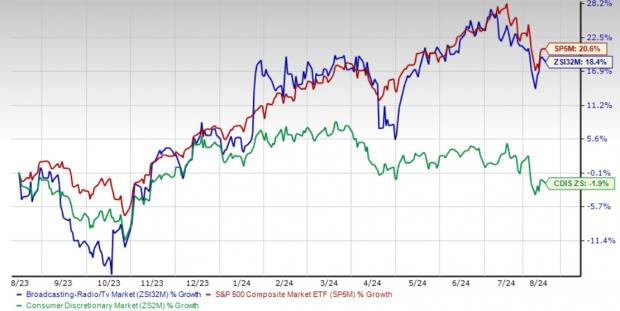

Over the past year, the Broadcast Radio and Television sector has trailed both the S&P 500 Index and the broader Consumer Discretionary segment, grappling with a 1.9% decline against the benchmark’s growth of 20.6% and 18.4%, respectively. However, the valuation metrics suggest an intriguing narrative, highlighting the industry’s quest for resilience amidst market volatility.

One-Year Price Performance

Evaluating Valuation Metrics

Assessed through the lens of trailing 12-month EV/EBITDA, the Broadcast Radio and Television industry’s valuations stand at 17.05X, trailing the S&P 500’s 17.92X and the sector’s 8.63X. This spectrum signals the industry’s ongoing quest for equilibrium amid tumultuous market conditions.

With a historical valuation range spanning from 7.26X to 42.87X over the past five years, the industry’s ability to innovate and adapt to evolving market horizons will prove paramount in navigating the unchartered waters ahead.

EV/EBITDA Ratio (TTM)

The Broadcast Buzz: Analysis of Top Radio and Television Stocks

TEGNA: Champion of Local News and Content

TEGNA has emerged as a key player in the U.S. broadcasting market, boasting a diverse portfolio of NBC, CBS, ABC, and FOX stations. By focusing on content creation rather than traditional TV broadcasting, TEGNA has strategically positioned itself to navigate the stormy waters of cord-cutting threats plaguing the Pay-TV industry. With a Zacks Rank #2 (Buy), TEGNA remains a strong contender in the market.

Investments in digital initiatives and streaming services have positioned TEGNA to tap into new revenue streams. The recent uptick in the Zacks Consensus Estimate for 2024 earnings to $3.13 per share showcases the company’s potential for growth, despite a 9.8% decline in shares year-to-date.

Price and Consensus: TGNA

Netflix: Streaming Giant on the Rise

Netflix, with a Zacks Rank #3 (Hold), continues to expand its subscriber base globally while bolstering revenue through innovative strategies like password-sharing crackdowns and ad-supported tiers. The company’s robust content portfolio, coupled with investments in localized and foreign-language content production, has been pivotal in driving growth.

The Zacks Consensus Estimate for 2024 earnings of $19.08 per share reflects a positive trajectory for Netflix, which has seen a 33.1% increase in shares year-to-date.

Price and Consensus: NFLX

Fox: Capitalizing on Live Programming Demand

Amidst the growing demand for live programming, Fox has positioned itself as a frontrunner with offerings like Fox News and Fox Business Network. The recent expansion of Tubi to the United Kingdom underscores Fox’s commitment to catering to diverse viewer needs.

While the Zacks Consensus Estimate for Fox’s fiscal 2025 earnings has seen a slight dip to $3.72 per share, the stock has shown a strong 31.4% increase year-to-date.

Price and Consensus: FOXA

Roku: The Streaming Platform Leader

Roku, a Zacks Rank #3 company, has solidified its position as a top TV streaming platform, leading in hours streamed across the U.S., Canada, and Mexico. The Roku Channel’s growing user base and strategic partnerships have been key drivers of its success.

Despite a 38.3% decrease in shares year-to-date, Roku’s narrowing loss estimate for 2024 to $1.45 per share indicates potential for a turnaround.

Price and Consensus: ROKU

Exploring New Investment Horizons

As investors navigate the volatile terrain of the stock market, the appeal of radio and television stocks remains strong. With companies like TEGNA, Netflix, Fox, and Roku showcasing resilience and innovation in the face of industry challenges, opportunities for growth and stability are ripe.

As history has shown, adaptability and forward-thinking strategies are imperative in the ever-evolving media landscape. With strategic investments, targeted growth initiatives, and a finger on the pulse of consumer trends, these companies are poised to weather the storms and thrive in the broadcast realm.