Vacasa, Inc. VCSA has witnessed a tumultuous recent past with a precipitous drop of 48.8% over the last four weeks, signaling a dramatic decline in investor confidence and severe market pressure. However, beneath this glum façade lies an intriguing opportunity, as signs point towards a potential turnaround for the beleaguered stock.

Deciphering Oversold Stocks

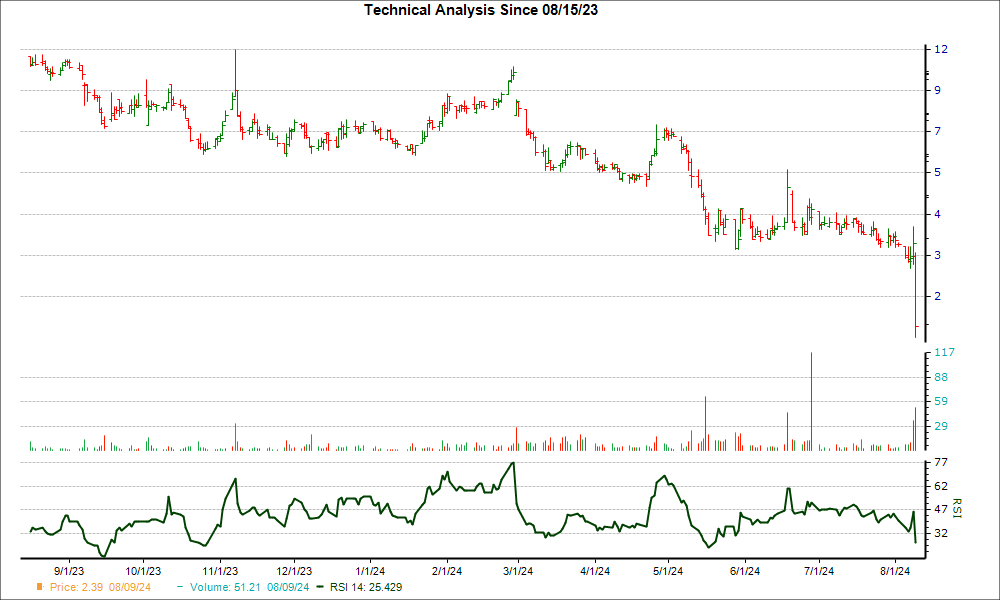

A pivotal tool in this assessment is the Relative Strength Index (RSI), a widely-used technical indicator that gauges whether a stock is oversold. The RSI acts as a momentum oscillator, quantifying the speed and magnitude of price movements, with readings ranging from zero to 100. Typically, a stock is deemed oversold when its RSI drops below 30.

Despite a stock’s fundamental strength, it can oscillate between being overbought and oversold, underscoring the cyclical nature of market dynamics. The RSI provides a rapid means to determine if a stock’s price is nearing a reversal point, presenting astute investors with an entry window to capitalize on an imminent upswing.

It is crucial to recognize the limitations of RSI as a standalone tool and exercise prudence by considering additional factors in investment decision-making.

The Case for a VCSA Reversal

With VCSA’s RSI standing at 28.87, there are compelling indications that the intense selling pressure may be tapering off, hinting at a potential revival as the stock seeks to reestablish equilibrium between supply and demand.

Furthermore, apart from the technical analysis, a fundamental shift is underway with Wall Street analysts collectively revising earnings estimates upwards for VCSA, reflecting a 13.4% surge in consensus EPS projections over the past month. Such positive momentum in earnings forecasts traditionally precedes stock appreciation in the short run.

Notably, VCSA presently boasts a Zacks Rank #2 (Buy), placing it within the top 20% of over 4,000 ranked stocks based on earnings estimate revisions and EPS surprises. This designation serves as a robust affirmation of the stock’s potential resurgence in the imminent future.

“Could this be the inflection point for Vacasa, beckoning a new chapter of price recovery and investor optimism?”