Wyndham Hotels & Resorts, Inc. WH announced the debut of its first Trademark Collection hotel in South Korea, introducing the La Vie D’or Hotel and Resort to the vibrant South Korean hospitality landscape. With this inauguration, Wyndham Hotels & Resorts expands its footprint in South Korea to over 30 hotels, solidifying its Trademark Collection presence in the Asia Pacific region with almost 20 distinctive properties.

Tranquil Oasis in Hwaseong-si

Located in the picturesque city of Hwaseong-si, South Korea, a mere half-hour journey from Seoul, La Vie D’or Hotel and Resort beckons travelers seeking solace and luxury. Spanning 330,000 square meters, this sprawling resort boasts a nine-hole golf course, a fitness center, rejuvenating saunas, inviting swimming pools, and a variety of exquisite dining options.

Visitors can bask in the glory of nearby attractions such as the historic Yungneung and Geolleung Royal Tombs, the serene Yongjusa Temple, all while having convenient access to the bustling cities of Seoul and Suwon. For business guests, the resort offers state-of-the-art conference facilities, high-speed Wi-Fi, and easy proximity to corporate giants like Samsung Electronics and Hyundai-Kia Motors.

The allure of South Korea’s expanding travel and tourism market, which witnessed a resurgence post-pandemic and attracted approximately 11 million visitors in 2023, presents a lucrative opportunity for Wyndham’s latest venture. With the sector projected to reach a robust $13.66 billion by 2024, the opening of La Vie D’or Hotel and Resort aligns seamlessly with the government’s efforts to enhance the tourism sector and cater to the evolving needs of business and leisure travelers.

Strategic Expansion Tactics

Emphasizing strategic growth and diversification, Wyndham is committed to expanding its geographic reach and product offerings across various market segments by leveraging its diverse brand portfolio. This strategic focus underpins the company’s disciplined capital allocation strategy, which prioritizes investments in high-return businesses, strategic collaborations, and strategic acquisitions.

In the second quarter of 2024 alone, Wyndham Hotels & Resorts unveiled over 18,000 rooms globally, marking a notable 16% year-over-year growth. As of June 30, 2024, the company boasted a global room count of 884,900, a 4% increase from the prior year. Noteworthy expansions during this period included the launch of ECHO Suites in Spartanburg, SC, situated in the bustling heart of the 12th fastest-growing county in the United States, noted for attracting 80 economic development projects in the past three years.

Wyndham’s global development pipeline as of June 30, 2024, featured nearly 2,000 hotels with approximately 245,000 rooms, reflecting a commendable 7% year-over-year ascent. A significant portion of this pipeline, approximately 58%, is dedicated to international expansion, underscoring the company’s commitment to global growth and market diversification.

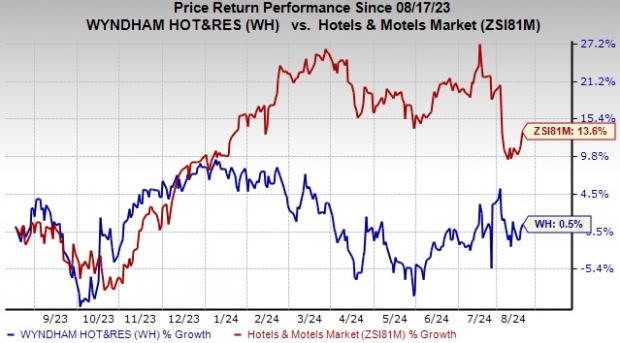

Image Source: Zacks Investment Research

Despite underperforming the Zacks Hotels and Motels industry with a modest 0.5% stock increase over the past year, Wyndham Hotels & Resorts’ ongoing expansion initiatives are poised to fuel growth in the foreseeable future, driving increased value for investors and stakeholders.

Strategic Insights and Investment Outlook

Wyndham Hotels currently holds a Zacks Rank #3 (Hold), signaling a steady investment outlook amidst its strategic expansion endeavors in South Korea and beyond.

Noteworthy picks in the Zacks Consumer Discretionary sector include:

Royal Caribbean Cruises Ltd. RCL, with a Zacks Rank of 1 (Strong Buy), boasting a remarkable 18.5% trailing four-quarter earnings surprise and a 61% stock surge over the past year.

La-Z-Boy Incorporated LZB upholds a Zacks Rank of 1, with a solid 15.3% trailing four-quarter earnings surprise and a commendable 36% stock appreciation in the previous year.

DoubleDown Interactive Co., Ltd. DDI showcases a Zacks Rank of 1, accompanied by a remarkable 22.1% trailing four-quarter earnings surprise and a significant 60.8% stock growth in the past year, highlighting promising investment potential in the interactive entertainment sector.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.