As Tesla grapples with decreasing electric vehicle sales in a saturated market, the company’s focus on self-driving technology and RoboTaxi services has come under scrutiny. Truist analyst William Stein, ranked among the top on Wall Street, recently tested Tesla’s Full Self-Driving (FSD) software versions v12, v12.3.6, and v12.5. His verdict? The road to autonomous driving dominance might be longer than expected.

Underwhelming Performance of FSD Technology

Stein’s evaluation of FSD v12.5.1.1 in a recent Model 3 test drive revealed both positive and negative outcomes. While the latest version displayed more “human-like” behavior and improved driving maneuvers compared to its predecessors, Stein encountered critical flaws during the test drive.

The analyst was impressed by the smoother acceleration, deceleration, lane changes, and path planning of FSD v12.5.1.1. However, the software’s performance fell short when it made critical errors such as turning left from a non-turn lane through a red light and misalignment between lanes.

Challenges on the Journey to RoboTaxi

Despite some positive advancements, Stein concluded that FSD v12.5.1.1 does not address the core issues of achieving full autonomy or readiness for RoboTaxi operations. The glaring shortcomings observed during the test drive have left analysts questioning Tesla’s upcoming RoboTaxi event.

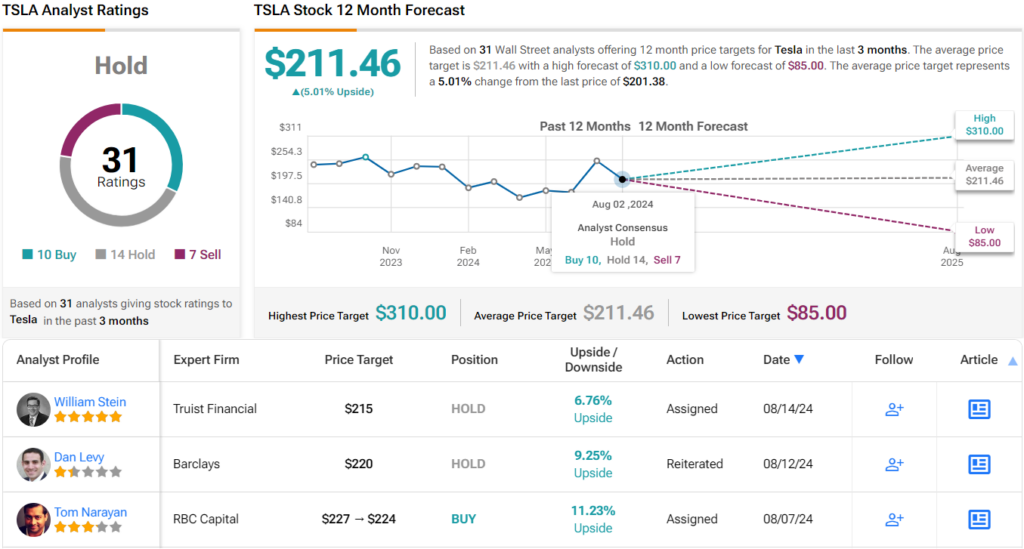

While Stein maintains a neutral rating on Tesla with a price target suggesting modest gains, the overall analyst consensus for the stock remains mixed. With a combination of Hold, Buy, and Sell recommendations, Tesla’s performance in the autonomous driving sector remains uncertain.

Analysts on the Sidelines

Amidst the evolving landscape of electric vehicle technology and autonomous driving, analysts like Stein are closely monitoring Tesla’s progress. The company’s ability to deliver reliable and efficient self-driving capabilities will be a significant factor in determining its long-term success in the market.

For investors seeking opportunities in the stock market, conducting thorough research and analysis is key. Tools like TipRanks’ Best Stocks to Buy provide valuable insights to make informed investment decisions.

Disclaimer: The views expressed in this article reflect the opinion of the featured analyst. It is essential to conduct personal research before engaging in any investment activities.