It’s often tough to stay focused on the positives amid the cacophony of negativity. Indeed, for investors, the ability to filter out the noise and concentrate on the essential factors is paramount. Alibaba is a prime example of this scenario. Despite recent financial reports showing imperfections, Alibaba boasts underlying strengths that should not be overlooked. Therefore, my outlook on BABA stock remains optimistic, given the company’s robust financial performance in the face of challenging conditions in China.

Alibaba, an e-commerce and delivery giant based in China, can be likened to its U.S. counterpart, Amazon. However, it operates in a markedly different environment shaped by unique challenges, including a sluggish economy post-COVID-19 lockdowns and ongoing turbulence in the Chinese real estate sector.

Venturing into the realm of social media, one might encounter an array of self-proclaimed experts casting shadows of doubt on Alibaba, often unfairly equating its performance to that of Amazon. Rather than succumbing to the negativity that permeates these platforms, investors can anchor their decisions in factual data and the consensus evaluations put forth by reputable analysts on Wall Street. This, I dare say, is a savvy strategy for engaging with Alibaba’s stock.

Unveiling the Challenges: Alibaba’s Recent Financials

Let’s address the elephant in the room: Alibaba’s financial performance in the second quarter of 2024 left much to be desired. Notably, the company witnessed a 15% year-over-year decline in operating income, amounting to $4.952 billion (all currency figures converted from the Chinese Renminbi). Furthermore, Alibaba’s net income plummeted by 27% to $3.306 billion, painting a rather bleak picture.

Despite this downturn, one glimmer of hope emerged in Alibaba’s Q2-2024 adjusted (non-GAAP) earnings, which stood at $2.26 per ADS (American Depository Share), marking a 5% year-over-year decrease. Additionally, adjusted (non-GAAP) EBITA only experienced a marginal 1% year-over-year slump to $6.197 billion. Yet, it becomes increasingly strenuous to cling onto positive narratives amidst these statistics.

In a snippet of optimism, The Wall Street Journal highlighted that Alibaba surpassed analysts’ expectations by recording an adjusted net profit decline of 9.4% to 40.69 billion yuan, compared to a consensus estimate of 37.88 billion yuan. A sliver of positivity in a sea of negativity.

However, Alibaba’s official statement failed to outline the rationale behind the drastic decrease in net income. According to The Wall Street Journal, burgeoning expenses in marketing, product development, general administrative costs, and an uptick in taxes contributed to the bottom-line impact. Going forward, vigilance over Alibaba’s expenditure patterns is recommended to prevent unbridled escalation.

Recognizing Alibaba’s Strengths Amidst Adversity

Amid the gloom, it is imperative not to overlook Alibaba’s commendable performance in the second quarter of 2024. Dismissing these strengths, as some do on social media, is a fallacy. By acknowledging these positives, investors can position themselves intelligently to maximize returns on Alibaba stock.

One standout feat was the 6% year-over-year growth in revenue for Alibaba’s Cloud Intelligence Group, attributed to robust expansion in public cloud services and increased adoption of AI-related products.

Delving further into the realm of AI, the number of paying users leveraging Alibaba Cloud’s AI platform surged by over 200% in Q2 2024 compared to the preceding quarter. This trajectory of growth echoes the tech prowess of Amazon, a formidable player in both cloud services and e-commerce.

Shifting focus to technology and e-commerce, Alibaba’s International Digital Commerce Group witnessed a noteworthy 32% year-over-year revenue upsurge to $4.031 million. With prudent financial management, Alibaba could potentially have reaped substantial profits in Q2 2024, had it not allocated significant capital towards marketing and product development initiatives. The efficacy of these investments remains to be seen.

Finally, Alibaba’s vigorous share repurchasing activities remain a conspicuous highlight. In Q2 2024, the company bought back a staggering 613 million ordinary shares totaling $5.8 billion.

Why does this matter? Share buybacks serve to shrink the available shares in circulation, potentially leading to a surge in share prices. As of June 30, 2024, Alibaba possessed 19,024 million ordinary shares outstanding, reflecting a net reduction of 445 million shares compared to the count from March 31, 2024.

Analyst Consensus: A Bullish Stance on Alibaba Stock

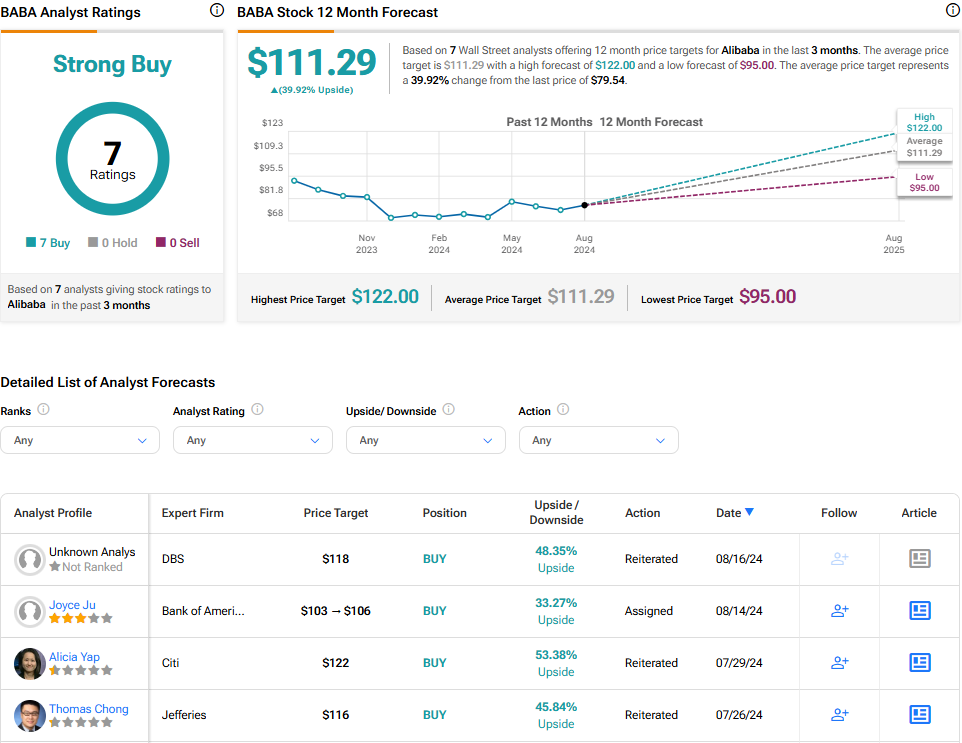

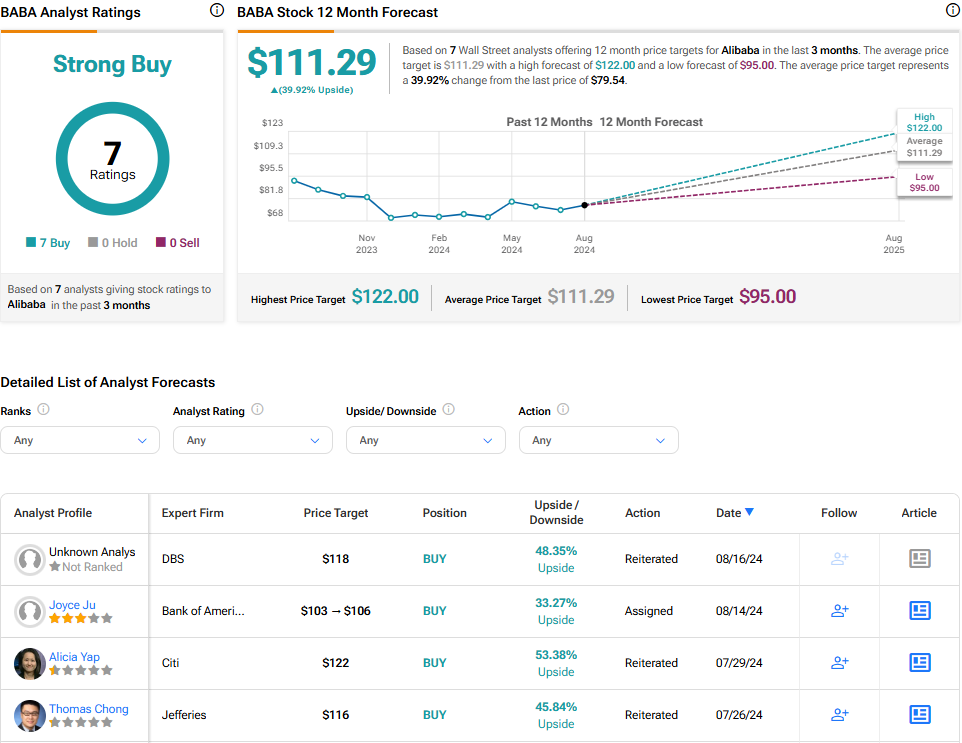

Per TipRanks, BABA garners a Strong Buy rating based on seven unanimous Buy recommendations issued by analysts in the last three months. The average price target for Alibaba stands at $111.29, signaling a potential upside of 39.9%.

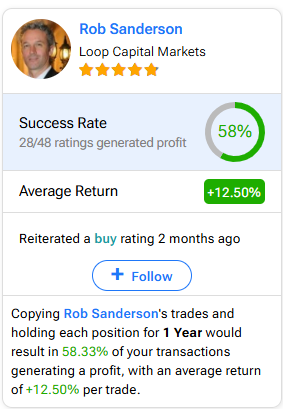

For those contemplating analyst guidance on BABA stock trading decisions, the most profitable analyst covering the stock over a one-year timeframe is Rob Sanderson of Loop Capital Markets. Sanderson boasts an average return of 12.5% per assessment with a success rate of 58%. Further insights can be gleaned by clicking on the image below.

Final Thoughts: Embracing Alibaba’s Potential

Following Alibaba’s quarterly results, market sentiment towards the stock remained tepid, with minimal fluctuations reflecting the varied nature of the company’s performance.

Looking ahead, an optimistic outlook emerges as the market gradually recognizes Alibaba’s strengths over the long term. It is advisable to delve deeper into Alibaba’s performance metrics, especially pertaining to its Cloud AI platform and International Digital Commerce Group.

In light of Alibaba’s robust share repurchasing activities and the promising aspects of its operational units, maintaining a discerning eye on investment decisions could yield favorable outcomes. Therefore, amidst the naysayers and detractors, considering a position in BABA stock could prove strategically sound.