Endeavour Silver Encounters Hurdles in Guanacevi Mine Site

Endeavour Silver Corp. saw a setback as processing came to a grinding halt at the Guanacevi mine site. The culprit? A trunnion failure in the primary ball mill on Aug 12, 2024, which forced a suspension of material processing at the mill.

To combat this obstacle, Endeavour Silver Corp. swiftly made modifications at the plant, repurposing one of the regrind mills as a substitute primary ball mill. However, mining operations will soldier on at a clipped rate of 400 tons per day (tpd) during this interim phase. The aim remains safeguarding the ore body’s stability and longevity. While operating under constraints, the facility has the potential to churn out approximately 500 tpd, a half of its usual capacity of 1,200 tpd.

Strategies During Operational Slowdown

During this period of restricted processing, the focus shifts towards delivering the highest-grade ore to the mill while stockpiling the rest. Contract mining and local third-party material procurement will remain stalled until plant operations are back to full steam.

These makeshift solutions serve as the financial tourniquet for Endeavour Silver Corp. until the primary mill is restored to its former glory.

Impact and Adjustments on Production

The hiccup in operations translates to heightened operating costs and all in-sustaining costs during the 15-week interval, contrary to previous projections. Notably, operating expenses and all additional sustaining costs displayed an uptick year on year in the initial half of 2024.

Anticipate a dip in Guanacevi mine’s silver production by 0.9 million to 1.1 million ounces and 2,000-3,000 gold ounces from the original expectations. The silver production projection for 2024 now hovers between 4.4-4.6 million ounces, alongside gold production ranging from 36,000-38,000 ounces.

Endeavour Silver’s silver-equivalent production for 2024 is estimated between 7.3 million and 7.6 million ounces. This number is a marked increase from the 4.4 million silver-equivalent ounces churned out in the first half of 2024.

Outcome of Second Quarter 2024

The second quarter of 2024 saw Endeavour Silver quarter production of 2.16 million ounces in silver-equivalent, reflecting a 5% dip compared to the previous year. The organization produced 1.3 million ounces of silver, a 12% regression from the same quarter in 2023. This was primarily due to a 12% and 17% drop in silver output at the Guanaceví and Bolañitos mines, respectively, owing to lower grades.

Contrastingly, gold production experienced a 7% uptick year over year, totaling 10,549 ounces. This surge can be accredited to elevated gold grades mined at Guanaceví and Bolañitos, coupled with amplified gold content in third-party feed processed at Guanaceví. Gold output at the Guanaceví mine enjoyed a 9% annual growth to 4,243 ounces, while the Bolañitos mine output escalated by 6% to 6,306 ounces.

Stock Performance Amid Challenges

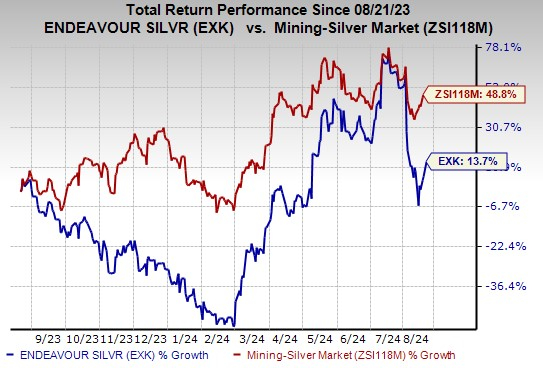

EXK shares demonstrated a 13.7% rise over the past year, a modest ascent compared to the industry’s 48.8% growth trajectory.

Stocks to Consider in Basic Materials Space

Endeavour Silver currently holds a Zacks Rank #3 (Hold).

Alternatives to consider from the basic materials domain encompass Carpenter Technology Corporation, IAMGOLD Corporation, and Eldorado Gold Corporation. Presently, CRS, IAG, and EGO boast a Zacks Rank #1.

Noteworthy is Carpenter Technology’s fiscal 2025 earnings, estimated at $6.06 per share, with recent estimates trending upwards by 17% within the last 60 days. The stock has delivered an average trailing four-quarter earnings surprise of 15.9%, with a remarkable 155.9% surge in shares over the year.

Similarly, IAMGOLD’s 2024 earnings are predicted at 39 cents per share, marking a 44% increase in consensus estimates in the past 60 days. The company boasts an impressive average trailing four-quarter earnings surprise of 200% and saw shares spike by 137% in the past year.

Lastly, Eldorado Gold’s 2024 earnings are forecasted at $1.32 per share, showing a 22% growth in consensus estimates over the past 60 days. The company’s average trailing four-quarter earnings surprise stands at a staggering 430%, paired with a 103% increase in shares over the year.

To access additional information, you can visit the link: Endeavour Silver Restarting Guanacevi Mill