Revolutionizing Serica Energy’s Operations

OpenText is ushering in a new era for Serica Energy, one of the top 10 oil and gas producers in the U.K. Through its OTEX Content Cloud and Extended ECM for Engineering solutions, OpenText is poised to optimize and secure the operational processes of Serica Energy, ensuring the content security required for safe and efficient operations in the U.K.

Powerful Solutions for Enhanced Efficiency

OpenText’s Content Cloud and Extended ECM for Engineering solutions provide a robust portfolio of enterprise content management solutions. These solutions empower organizations to streamline, automate, and simplify their information lifecycle management processes. The comprehensive offerings include records management, e-signatures, archiving, and digital file conversion capabilities, facilitating seamless integration into business processes and analytics.

Strategic Collaboration Driving Innovation

OpenText’s strategic collaboration with key industry players such as Alphabet, Microsoft, SAP, and Salesforce underscores its commitment to innovation. By leveraging partnerships and expanding its presence in cloud computing and artificial intelligence domains, OpenText continues to enhance its offerings and reach new heights in the tech industry.

Challenges Amidst Innovation

Despite its strong position and solid portfolio, OpenText faces challenges from heightened competition in the cloud and artificial intelligence sectors. The company is up against industry giants with vast resources, leading to intense competition and market share battles. Additionally, macroeconomic uncertainties and inflationary pressures pose risks to enterprise spending, impacting OpenText’s growth trajectory.

Looking Ahead

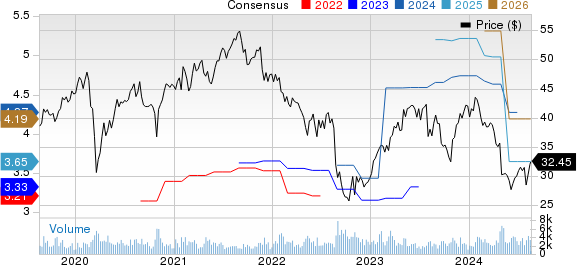

While OpenText’s cloud solutions have garnered praise from customers, it must navigate the current economic landscape to realize the full potential of its offerings. With a Zacks Rank #3 (Hold) at present and a year-to-date share price decline of 22.8%, OpenText remains resilient amidst evolving market dynamics.