The recent revelation of revisions to employment data from April 2023 to March 2024 has sent shockwaves through the U.S. labor market, tarnishing its once seemingly unstoppable growth trajectory.

An astounding 818,000 nonfarm payrolls, previously celebrated in official government reports, have now evaporated into the ether of statistical revisions.

With this downward adjustment, the average monthly job gains are recalibrated to around 175,000, considerably lower than the initially touted 242,000.

Sectors such as professional and business services, leisure and hospitality, retail trade, and manufacturing bore the brunt of slashes with significant declines, while private education and health services, along with transportation and warehousing, saw positive upward revisions.

This wake-up call from the data reveals that the U.S. labor market may not have been as scorching hot as previously believed, even though the job gains remain robust, tallying approximately 2.1 million annually up to March 2024.

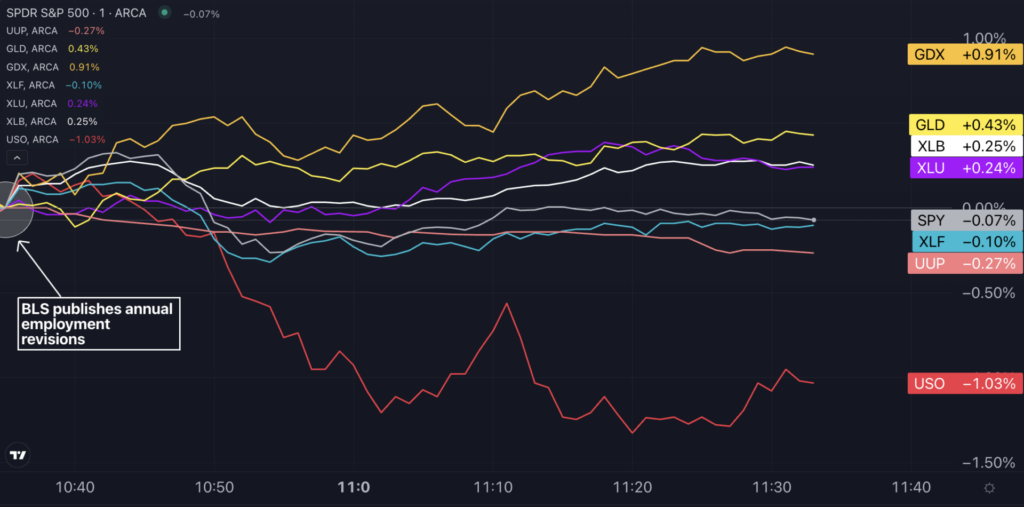

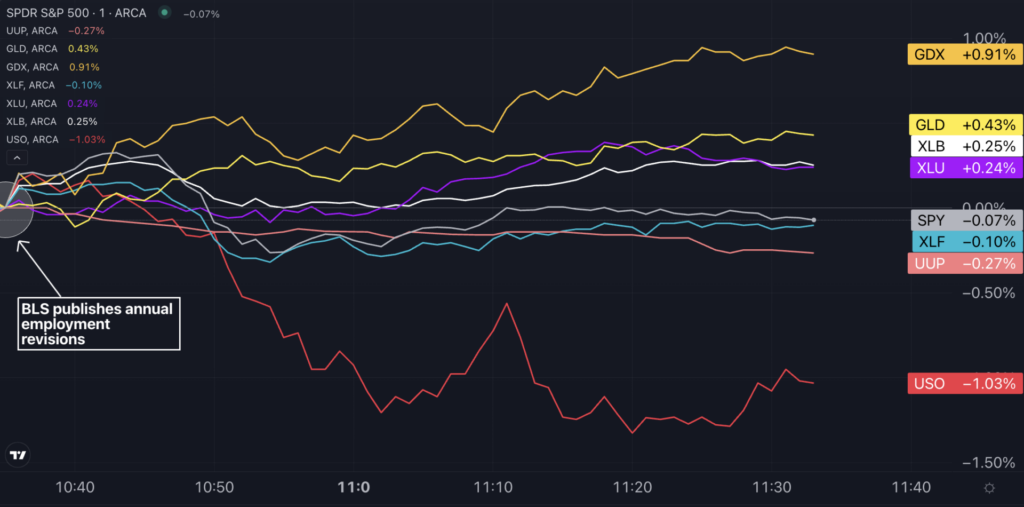

Reactions in the Market: Dollar Dips as Rate-Cut Expectations Rise, Metal and Utility Sectors Surge

The revised annual payroll figures have ignited expectations for more aggressive rate cuts by the Federal Reserve, prompting traders to wager increasingly on a hefty 50-basis-point cut in September. The probability of this occurrence, according to the CME Group Fed Watch tool, has climbed to 34.5%, up from the previous day’s 29%.

Market participants are now factoring in a scenario where the federal funds rate could hover around 4.25% to 4.5% by the year-end, implying a substantial one-percentage-point drop from current levels.

This shift in rate sentiment has triggered a downward spiral in the U.S. dollar, erasing its prior gains, while assets like gold have flourished in response. The SPDR Gold Trust, however, remained slightly in the red territory at 11:20 a.m. ET, down by 0.2%.

Conversely, commodities inclined towards economic growth, such as oil, witnessed a decline, with the United States Oil Fund slipping over 1% post-data release and down by 0.3% for the day.

Amidst these fluctuations, the S&P 500 maintained relative stability, though distinct movements surfaced within sectors. The Financial Select Sector SPDR Fund stumbled following the employment data revelation, while the Materials Select Sector SPDR Fund and Utilities Select Sector SPDR Fund celebrated gains.

On a sector-specific note, gold miners saw a reversal of fortunes, as the VanEck Gold Miners ETF flipped from losses earlier in the session to gains.

Charting the Responses of 7 ETFs to Revised Employment Statistics

Read Next:

Image created using artificial intelligence via Midjourney.