The world of investing is akin to a high-stakes poker game, with seasoned players like Warren Buffett often holding the winning hand. Berkshire Hathaway’s recent pivot away from Snowflake (SNOW) sent shockwaves through the market. Buffett’s decision to liquidate the entirety of his $1 billion stake in the cloud data warehousing company marks a significant chapter in the Snowflake saga.

Snowflake’s Journey

Snowflake, founded in 2012, burst onto the scene with an IPO that lured in heavyweights like Berkshire Hathaway in September 2020. With a market cap of $44.1 billion, the company faced a tumultuous ride, trading well below its IPO price and witnessing a nosedive of over 68% from its peak in December 2020.

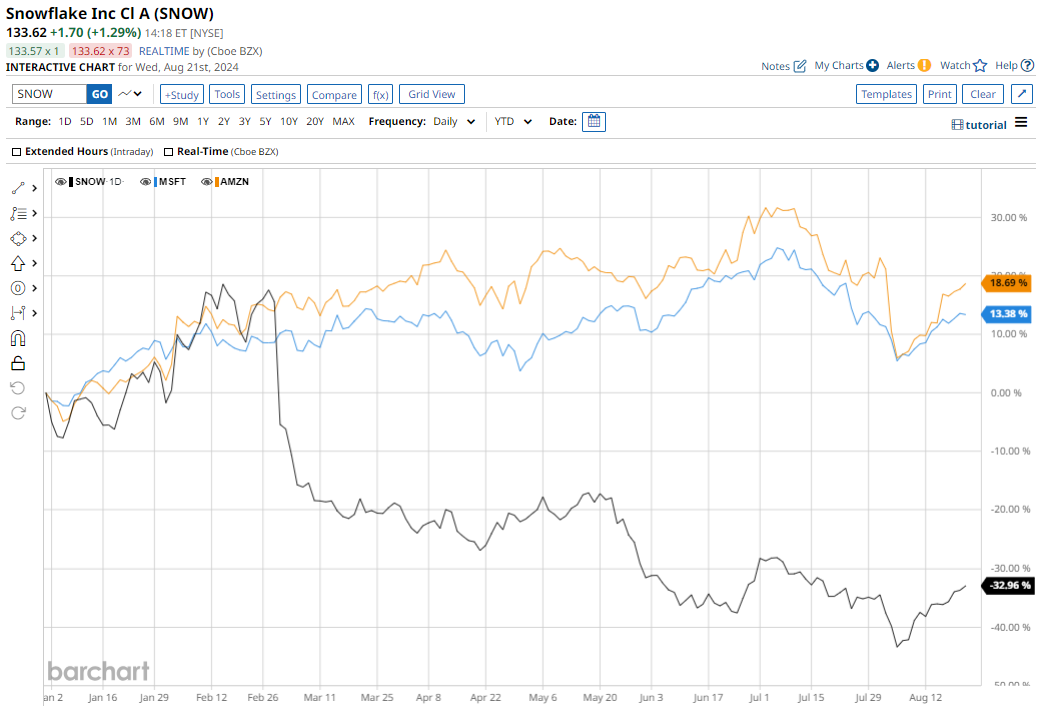

The company’s investments in artificial intelligence (AI) aimed to bolster its cloud data storage capabilities, but competing against tech giants like Microsoft and Amazon proved to be an uphill battle. Snowflake’s lackluster performance, with a 33% decline in its stock price this year, underscores the harsh reality of fighting for a slice of the cloud computing pie against industry behemoths.

Analysts and Market Sentiment

Following a recent cyberattack that tainted Snowflake’s reputation, analysts from Wells Fargo downgraded the stock and revised its price target downward. The company faces scrutiny over data security and challenges related to customer retention post-breach. Despite this, Wall Street sentiment remains cautiously optimistic, with a “Moderate Buy” rating and a consensus price target well above the current valuation.

As Snowflake braces for its upcoming Q2 earnings report, investors are on edge, anticipating the company’s performance against a backdrop of heightened competition and mounting operational expenses. The departure of its founder and the pressure to deliver profitability add layers of complexity to Snowflake’s narrative.

Assessing Snowflake’s Future

Snowflake stands at a crossroads, navigating stormy seas as it strives to steer the ship towards profitability and sustainable growth. With a new CEO at the helm and an industry landscape fraught with challenges, the company must execute flawlessly in the upcoming quarters to regain investor trust and drive its business forward.