The realm of business services is shining brightly on the Zacks Rank #1 (Strong Buy) list, boasting 19 flourishing stocks in a sector garnering consistent strong buy ratings.

Among these top-ranking stocks lie some gems in the Zacks Technology Services Industry, residing comfortably in the top 30% of around 250 Zacks industries. Seizing this opportune moment involves looking into two technology services companies that have recently debuted on the stock market and are showing great promise.

Sofi Technologies SOFI

Priced below $10, Sofi Technologies is an attractive choice, expanding as a consumer-centric financial hub. Going public in 2021, Sofi has emerged as one of the most multifaceted fintech entities in the United States, offering a wide array of services including loans, credit cards, investment opportunities, insurance policies, and banking facilities.

Of notable interest is Sofi’s imminent pivot towards profitability, with projected earnings of $0.09 per share for fiscal year 2024 compared to a – $0.36 adjusted loss per share last year. Furthermore, the outlook for Fiscal Year 2025 hints at a 182% surge in EPS to $0.26.

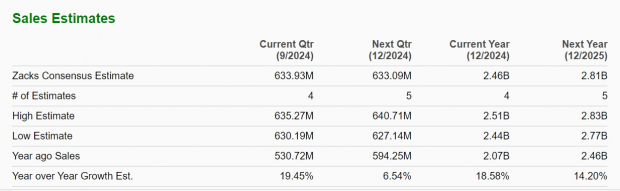

Sofi’s rapid revenue growth underscores its potential for future earnings, with total sales set to escalate by 18% this year and an additional 14% in Fiscal Year 2025, reaching $2.81 billion.

Image Source: Zacks Investment Research

Qifu Technology QFIN

Having launched its IPO recently, Qifu Technology stands tall as a major player in the fintech landscape of China. Specializing in credit technology, Qifu offers a comprehensive range of tech solutions to aid financial organizations, consumers, and businesses across the entire loan cycle.

Impressively, Qifu’s stock has surged by nearly +60% year to date, outperforming major indices and even overshadowing Chinese tech giants like Alibaba BABA and Baidu BIDU who have seen declines of -8% and -35% respectively.

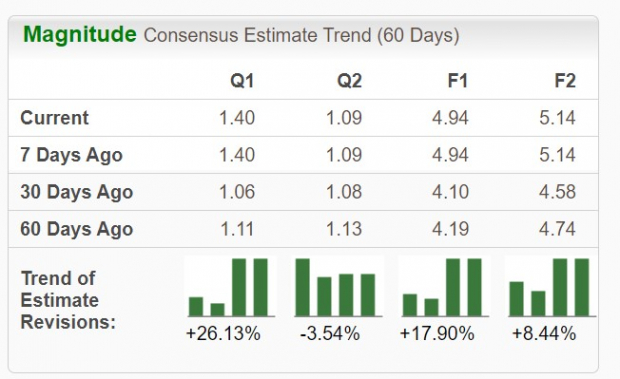

Image Source: Zacks Investment Research

Investor interest in Qifu is at a peak, as the company is already profitable with annual earnings expected to escalate by 34% in FY24, reaching $4.94 per share compared to $3.68 in 2023. Looking ahead, FY25 EPS is anticipated to climb a further 4%. Moreover, the significant surge in earnings estimate revisions for FY24 and FY25 over the past 60 days hints at a bright future for Qifu.

The cherry on the cake is Qifu’s stock price, currently trading under $30 at merely 5X forward earnings, a stark contrast to the S&P 500’s 23.7X, as well as Alibaba at 8X and Baidu at 10.1X.

Image Source: Zacks Investment Research

Final Thoughts

Just like Qifu, Sofi also boasts a robust trend of rising earnings estimate revisions. With their promising trajectory, now might just be the perfect moment to invest in these nascent technology services companies, positioning yourself for potentially lucrative returns in 2024 and beyond.

5 Stocks on the Brink of Doubling

Handpicked by a Zacks expert as the prime contenders to achieve +100% or more growth in 2024, each of these stocks has the potential to become a market standout. While not every pick hits the jackpot, previous recommendations have seen remarkable surges of +143.0%, +175.9%, +498.3%, and even +673.0%.

This curated list is populated with stocks flying under the Wall Street radar, offering an ideal opportunity to establish a foothold in potentially game-changing investments.

Seek Out These 5 Potential Heavy Hitters Today >>

Qifu Technology, Inc. (QFIN) : Free Stock Analysis Report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report