Insiders, including officers, directors, and significant stockholders, possess internal information due to their relationship with a company. Recent notable insider buying activities have been observed in several companies, namely Intel (INTC), Yum China (YUM), and Energy Transfer (ET), with the CEOs of these firms acquiring shares. Let’s delve into these transactions for investors looking to follow the footsteps of company insiders.

Intel’s Struggles

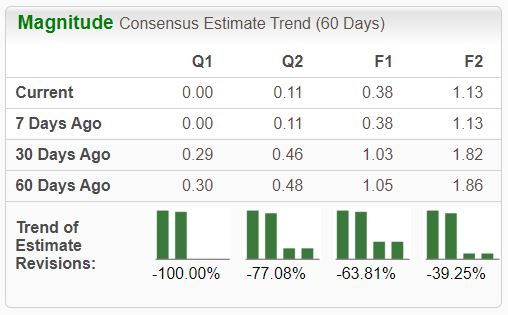

Intel has faced challenges in aligning with the semiconductor industry and witnessed a substantial decrease of nearly 60% in its stock value in 2024. Despite being rated a Zacks Rank #4 (Sell), CEO Pat Gelsinger displayed confidence by purchasing 12.5k shares post the latest quarterly results.

Following a trying period, Gelsinger expressed optimism about future prospects, emphasizing key product milestones and transformative strategies. However, potential investors are advised to await positive earnings revisions before considering a position.

Yum China’s Resilience

After spinning off from Yum! Brands in late 2016, Yum China has emerged as a strong player. CEO Joey Wat recently acquired 3.8k shares amid the company’s positive performance. The stock witnessed a 13% surge following robust quarterly results.

The latest earnings release highlighted record sales and profit figures, maintaining Yum China’s position as a Zacks Rank #3 (Hold) stock.

Energy Transfer’s Growth

Operating primarily in the U.S., Energy Transfer has seen a 23% increase in its stock value in 2024. Co-CEO Thomas Long’s acquisition of 20k shares signals confidence in the company’s future despite downward earnings estimates.

While currently holding a Zacks Rank #3 (Hold), positive revisions in earnings forecasts could bolster investor sentiment towards Energy Transfer.

Key Takeaway

Insider purchases often provide valuable insights into a company’s long-term prospects. The recent CEO buys in Intel, Yum China, and Energy Transfer indicate a vote of confidence from within these organizations.