When it comes to making investment decisions, are Wall Street analysts the guiding light for investors, or is there more than meets the eye behind their recommendations?

Let’s dive into what the financial titans of Wall Street opine about Netflix (NFLX) before delving into the reliability of brokerage recommendations and how investors can leverage this data.

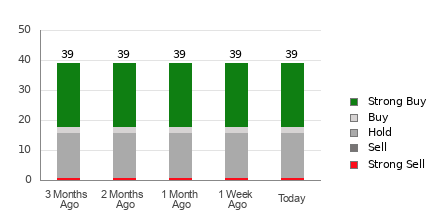

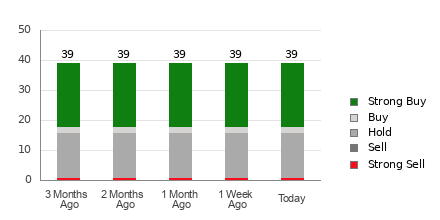

Currently, Netflix holds an average brokerage recommendation (ABR) of 1.91, falling between a Strong Buy and Buy rating, based on the consensus of 39 brokerage firms. This includes 21 Strong Buy and 2 Buy recommendations, accounting for 53.9% and 5.1% of all ratings, respectively.

Analyzing Shifts in Brokerage Recommendations for NFLX

While the ABR signals a bullish sentiment towards Netflix, it is imperative not to base investment decisions solely on this metric. Studies have demonstrated the limited success of brokerage recommendations in identifying stocks with significant price appreciation potential.

Why is that? Brokerage analysts, influenced by their firms’ interests, often display a strong positive bias when rating a stock. These firms tend to issue five “Strong Buy” ratings for every “Strong Sell,” indicating a misalignment with retail investors’ interests.

Thus, it is advisable to view brokerage recommendations as a validation tool for individual research or a complement to proven indicators for predicting stock price movements.

The Zacks Rank, a proprietary stock rating tool with a credible audited track record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), providing valuable insights into a stock’s near-future performance. Therefore, intertwining the ABR with the Zacks Rank can aid in making astute investment choices.

The Distinction Between ABR and Zacks Rank

Although the ABR and Zacks Rank share a 1 to 5 scale, they serve divergent purposes.

Broker recommendations solely influence the ABR, often presented in decimals. Conversely, the Zacks Rank is a quantitative model leveraging earnings estimate revisions, denoted by whole numbers (1 to 5).

Historically, brokerage analysts have tended towards optimistic ratings due to their firms’ interests, leading to potential investor misguidance. Conversely, the Zacks Rank hinges on earnings estimate revisions, which exhibit a strong correlation with short-term price movements.

Moreover, the Zacks Rank uniformly applies its ratings across all stocks with earnings estimates from analysts, maintaining equilibrium among the five ranks assigned.

Another contrasting factor is the timeliness of information. While the ABR might lack real-time updates, the Zacks Rank promptly reflects earnings estimate revisions, thus serving as a timely indicator of future price trends.

Should Investors Consider NFLX?

Reviewing earnings estimate revisions for Netflix, analysts maintain a consensus estimate of $19.08 for the current year, unchanged over the previous month.

Stable analyst sentiments towards Netflix’s earnings potential, depicted by a static consensus estimate, could indicate the stock mirroring broader market performance in the short run.

Based on recent changes in consensus estimates and other factors, Netflix currently holds a Zacks Rank #3 (Hold). For a list of Zacks Rank #1 (Strong Buy) stocks, click here.

Thus, exercising caution with the Buy-equivalent ABR for Netflix might be a prudent choice for investors.