Investors often turn to the opinions of Wall Street analysts to navigate the turbulent waters of the stock market. These analysts, operating within the brokerage firms, can impact a stock’s journey with a mere change in their ratings. But does their guidance hold the key to financial success?

Before delving into the enigma of brokerage recommendations, let’s explore Workday (WDAY) and dissect the insights provided by these financial titans.

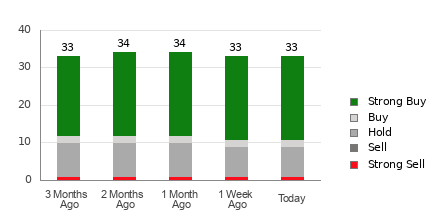

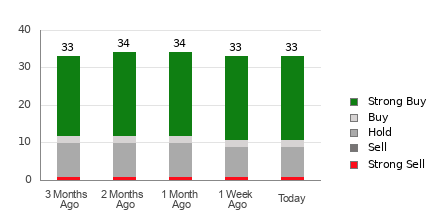

Workday currently boasts an average brokerage recommendation (ABR) of 1.67, falling between Strong Buy and Buy on a scale ranging from 1 to 5. This evaluation takes into account the actual Buy, Hold, or Sell recommendations issued by 33 brokerage firms. Out of these, 22 recommendations stand as Strong Buy, while two are categorized as Buy. This data implies that a substantial 66.7% of all recommendations peg Workday as a Strong Buy, demonstrating Wall Street’s optimism toward the stock.

The Story Behind Wall Street’s Perspective on WDAY

Despite the encouraging ABR for Workday, prudence suggests not hinging an investment decision solely on this metric. Studies reveal the limited efficacy of brokerage recommendations in steering investors toward stocks with the highest growth potential.

Why the skepticism? Research unravels a clear bias embedded within brokerage firms towards stocks they cover, often resulting in an inflated positive rating by their analysts. Astonishingly, for every “Strong Sell” endorsement, these firms furnish five “Strong Buy” recommendations, reflecting a skewed perspective that may not align with the interests of retail investors.

Consequently, it is advisable to use brokerage recommendations as a litmus test to validate personal analysis or a more reliable tool adept at foreseeing stock price movements.

One such tool is the Zacks Rank, a meticulously audited stock assessment system that categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This evaluation methodology, rooted in earnings estimate revisions, serves as a dependable gauge of a stock’s short-term price trajectory. Therefore, juxtaposing the Zacks Rank with ABR could serve as a potent weapon in your investment arsenal.

Distinguishing the Zacks Rank from ABR

While both ABR and Zacks Rank adopt a scale from 1 to 5, they diverge fundamentally in practice.

ABR solely rests on broker recommendations, manifesting as decimal figures like 1.28. Conversely, the Zacks Rank is premised on a quantitative model revolving around earnings estimate revisions and is expressed in whole numbers from 1 to 5.

Broker recommendations often lean towards an upbeat sentiment due to the analysts’ vested interests, misleading investors more than guiding them. In contrast, the Zacks Rank, propelled by earnings estimates, exhibits a strong correlation with short-term stock price fluctuations, supported by empirical evidence.

Moreover, the gradations within the Zacks Rank are evenly distributed across all stocks for which analysts furnish earnings forecasts, maintaining equilibrium across the assigned ranks. This differs starkly from ABR, which may lack real-time updates but is quickly responsive to analysts revising earnings outlooks to mirror evolving business dynamics.

Assessing Workday’s Investment Viability

Extrapolating on the earnings estimate alterations for Workday, the Zacks Consensus Estimate for the existing year has ascended by 7.1% in the last month, culminating at $6.93.

The widespread optimism among analysts regarding the company’s earnings trajectory, evidenced by a harmonious uptick in EPS projections, could propel the stock to new heights shortly.

This substantial consensus estimate revision, coupled with other factors influencing earnings forecasts, has landed Workday a favorable Zacks Rank #2 (Buy). For further insights into potential investment opportunities, refer to the updated Zacks Rank #1 (Strong Buy) listing.

Thus, the Workday’s ABR equivalent to Buy renders itself a valuable compass for investors navigating the tumultuous waters of the stock market.

Unveiling Hidden Opportunities in the Stock Market

Handpicked by Zacks experts, these 5 stocks are projected to skyrocket by +100% or more in 2024. Despite the unpredictability inherent in stock recommendations, historic performances boast impressive gains like +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in the report dodge the mainstream attention of Wall Street, establishing a lucrative chance to dive into budding prospects.

Discover Potential Home Runs Today

Want exclusive insights from Zacks Investment Research? Feel free to download the latest recommendations regarding the 7 Best Stocks for the Next 30 Days.

For a comprehensive stock analysis of Workday, Inc. (WDAY), access the Free Stock Analysis Report

For more details, visit Zacks Investment Research.