Navigating the Impact of Interest Rate Cuts on Investment Choices

In a whirlwind of market uncertainty following the Federal Reserve’s rigorous rate-tightening approach in March 2022, investors have been eagerly anticipating a potential policy shift towards rate reductions. Despite false alarms, the elusive rate cut might finally materialize at the upcoming Federal Open Market Committee (FOMC) meeting in September. Fed Chair Jerome Powell’s recent hints at policy adjustments in his notable speech at the Jackson Hole Symposium hint at a possible upcoming rate cut.

Exploring Investment Opportunities Amidst Rate Cuts

As U.S. interest rates are poised to decline, the financial landscape presents promising opportunities for various stocks. Growth stocks are set to reap benefits as lower interest rates augment the present value of their future cash flows. Furthermore, rate-sensitive sectors such as real estate and automotive industries are likely to witness heightened demand, driven by the allure of purchasing high-value assets like homes and vehicles through loans.

Interestingly, amidst dwindling fixed-income yields, dividend stocks are regaining their appeal among investors seeking consistent returns on their investments. The allure of dividends is resurging as interest rates begin their descent from peak levels.

Ford’s Robust Dividend Yield Position

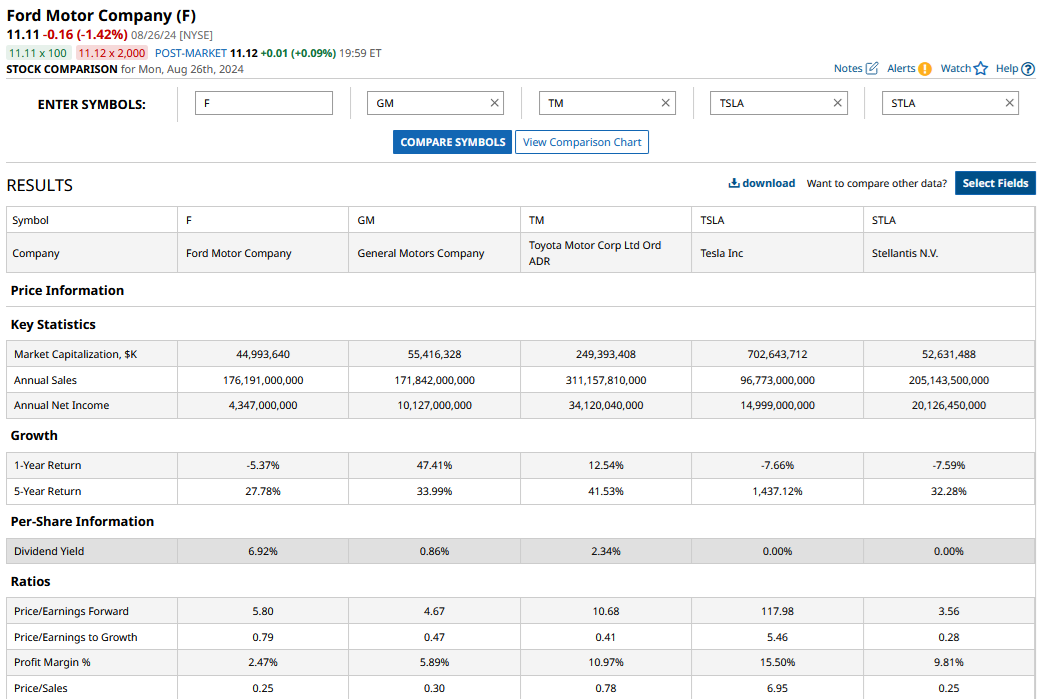

A standout in the dividend stocks arena is automotive behemoth Ford (F), offering a substantial dividend yield of 5.4%, surpassing the average yield of an S&P 500 Index constituent by fourfold. While Ford and its industry counterpart General Motors (GM) both exhibit strong cash flows, their divergent capital allocation strategies set them apart.

Ford’s commitment to returning 40%-50% of free cash flows to shareholders, accompanied by periodic special dividends, underscores its dedication to shareholder value. Ford’s recent special dividend distributions following substantial free cash flow generation signify its robust dividend policy.

Ford’s Strategic Financial Fortitude

Marking its resurgence as a dividend dynamo post the pandemic-induced suspension, Ford’s sound financial performance is exemplified by its 2023 free cash flows of $6.8 billion. The company’s upward adjustment of its 2024 adjusted free cash flow guidance by $1 billion during its Q2 earnings call indicates a trajectory of financial strength and stability.

With Ford’s well-structured dividend payout strategy, the sustainability of its 2024 dividends is reinforced, enhancing investor confidence in its dividend capabilities. Additionally, the prospect of a forthcoming special dividend further underscores Ford’s financial prowess, despite suggestions favoring stock buybacks due to its current valuation scenario.

Assessing Ford’s Market Performance and Prospects

Trading at a significantly low next 12-month (NTM) price-to-earnings (PE) multiple of 5.7x, Ford’s valuation may seem enticing. Yet, continuous market apprehensions regarding its internal combustion engine (ICE) business profitability have kept its valuation suppressed for an extended period, leading to underwhelming market performance in 2024.

While Ford’s EV segment faces challenges marked by substantial losses, the company’s strategic shift towards hybrid models highlights its adaptive approach in the evolving automotive landscape. By streamlining its product strategy and focusing on profitable market segments, Ford aims to achieve pre-tax profitability swiftly on new models, bolstering its competitive edge.

A Prudent Investment in Ford’s Potential

Despite enduring operational difficulties, Ford emerges as an appealing investment choice. With undeniably attractive valuations amidst soaring market metrics, Ford’s strategic realignment under CEO Jim Farley’s guidance positions it favorably for long-term growth prospects. Capitalizing on a diverse portfolio encompassing ICE, hybrid, and EV vehicles, Ford stands resilient amidst market fluctuations, with its over 5% dividend yield offering an additional allure to investors.