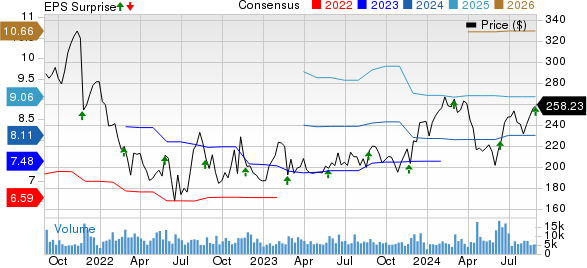

Autodesk ADSK surpassed expectations in the second quarter of fiscal 2025, reporting non-GAAP earnings of $2.15 per share, exceeding the Zacks Consensus Estimate by 7.5% and showing a robust 12.6% annual improvement.

Revenues for the quarter amounted to $1.5 billion, surpassing the consensus estimate by 1.54% and growing impressively by 11.9% compared to the preceding year. The company experienced widespread growth across various products and regions in Architecture, Engineering, and Construction (AEC) and manufacturing, although it faced challenges in the media and entertainment segment due to the enduring impact of the Hollywood strike.

Revenue Breakdown

The majority of Autodesk’s revenues (93.6%) came from subscriptions, totaling $1.4 billion, marking a 10.9% increase annually. Maintenance revenues contributed 0.7% to total revenues, declining by 21.4% to $11 million. Other revenues, accounting for 5.7% of the total, surged by 41% to $86 million during the reported period.

Recurring revenues made up 97% of the company’s Q2 fiscal 2025 revenues, with a net revenue retention rate falling within the 100-110% target range on a constant currency basis.

Geographically, revenues from the Americas (44% of total revenues) increased by 12.4% year over year to $662 million, while revenues from EMEA (37.9% of total revenues) grew by 12.6% to $570 million. Revenues from the Asia-Pacific region (18.1% of revenues) rose by 9.2% to $273 million. Billings for the quarter stood at $1.24 billion, increasing by 13% from the previous year.

Product Revenue Analysis

Autodesk’s product offerings spanning four main families — Architecture, Engineering, and Construction; AutoCAD and AutoCAD LT; Manufacturing; and Media and Entertainment (M&E) — demonstrated growth in the second quarter. AEC accounted for 47.4% of revenues, seeing a 13.7% rise to $713 million. AutoCAD and AutoCAD LT contributed 25.8% to revenues, achieving a 6.9% increase to $389 million. Manufacturing revenues (19.7% of total) rose by 15.6% to $296 million, while M&E revenues (5.1% of total) increased by 4.1% to $77 million.

Operational Performance

Autodesk reported a non-GAAP operating income of $560 million, reflecting a substantial 14.5% year-over-year growth. The non-GAAP operating margin expanded by 1 percentage point to reach 37%.

Financial Position and Outlook

As of July 31, 2024, Autodesk held cash and cash equivalents of $1.87 billion, which slightly decreased from the prior quarter. Deferred revenues saw a 13% decline to $3.69 billion, whereas unbilled deferred revenues surged to $2.17 billion, marking a significant increase from the previous year. Remaining performance obligations (RPO) rose by 12% to $5.86 billion, with current RPO reaching $3.9 billion, an 11% increase.

Operating cash flow for the quarter amounted to $212 million, a $77 million increase year over year. Free cash flow stood at $203 million, up by $75 million compared to the same period in fiscal 2024.

Guidance for Fiscal 2025

Autodesk anticipates revenues for fiscal 2025 to be within the range of $6.08 billion to $6.13 billion, indicating an approximately 11% growth rate. Billings are forecasted to reach $5.88-$5.98 billion, translating to a 13-15% year-over-year increase. Non-GAAP earnings per share are expected to fall between $8.18 and $8.31, with the company targeting a non-GAAP operating margin of 35-36%.

Free cash flow for the fiscal year is estimated to be in the range of $1.45-$1.5 billion. For the third quarter of fiscal 2025, Autodesk projects revenues between $1.555 billion and $1.57 billion, with non-GAAP earnings anticipated in the range of $2.08-$2.14 per share.

In Conclusion

The market awaits Autodesk’s future performance with measured optimism, given the company’s strong Q2 results and promising outlook. Investors will keep a close eye on how the organization navigates the evolving landscape and capitalizes on opportunities for sustained growth and success.