Netflix, the streaming giant known for its original content, has defied gravity with a staggering 40.5% jump in its stock price since the year began. This meteoric rise outpaces its peers in the entertainment industry, showcasing resilience in a volatile market landscape.

While concerns loom over a potential slowdown in user growth, a key metric closely tracked by investors, Netflix is navigating turbulent waters with finesse.

The Evolution of Netflix’s Performance in 2024

For third-quarter of 2024, Netflix anticipates a dip in paid net additions compared to the previous year, primarily due to the impact of paid sharing. This projection has prompted skepticism among market watchers, questioning the sustainability of Netflix’s upward trajectory.

Strategic Maneuvers in the Streaming Arena

Netflix has orchestrated a strategic symphony to fortify its market dominance amidst concerns over moderating user growth. The company’s relentless focus on creating top-tier original content has paid dividends, captivating audiences with blockbuster shows and movies that have earned critical acclaim and unwavering viewer loyalty.

Furthermore, exploring advertising-supported tiers has not only attracted cost-conscious consumers but also broadened Netflix’s revenue horizons, potentially leading to a more stable earnings landscape. Roadmaps like these have helped Netflix carve a distinctive niche in a saturated market.

An aggressive international expansion strategy, particularly in regions like India, South Korea, and Europe, has been fruitful, with overseas subscribers now constituting the majority of Netflix’s user base. This globalization effort underscores Netflix’s commitment to diversification and growth.

Embracing diverse storytelling from different corners of the world, like the compelling array of Danish and Southeast Asian content, Netflix is broadening its viewers’ horizons and enriching its content library. This strategic move aims to appeal to a global audience, fostering engagement and retention.

Exploring Untapped Revenue Avenues

Netflix is venturing beyond its traditional subscription model by delving into mobile gaming, merchandise licensing, and experimental theatrical releases. While these ventures are nascent, they present promising pathways for future revenue diversification and business expansion.

The company’s optimistic revenue outlook for 2024, coupled with a burgeoning suite of revenue streams, underscores Netflix’s commitment to growth and adaptation in a rapidly evolving industry landscape.

Confronting Continual Industry Challenges

Despite Netflix’s robust performance, it faces stiff competition from industry heavyweights like Disney’s Disney+, Warner Bros. Discovery’s HBO Max, and a slew of other streaming services. The battle for eyeballs against traditional TV, online platforms like YouTube, TikTok, and the gaming sector poses a formidable challenge to Netflix’s sustained growth and profitability.

Moreover, the surge in Netflix’s stock price has caused its valuation multiples to expand, potentially capping future growth opportunities for investors. As Netflix’s stock trades at a premium relative to its historical valuation benchmarks, maintaining its leadership status amid intense competition remains a critical focal point.

Reflections on the Road Ahead

While Netflix’s stock has commanded attention with its remarkable ascent, the company’s ability to navigate the complexities of moderating user growth through innovation and international expansion will be pivotal for its future trajectory. Netflix’s secure footing in the streaming landscape suggests that the ship may not be sinking just yet, advising investors to bide their time.

The Streaming Giant: Netflix’s Performance Evaluation

Exploring Netflix’s Soaring YTD Performance

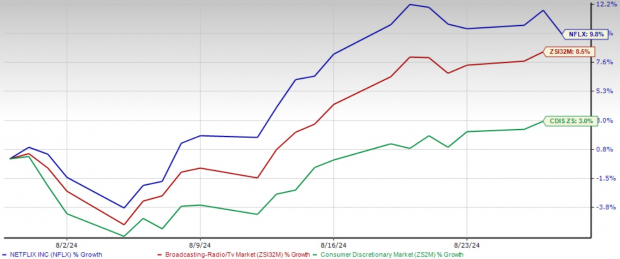

Netflix, Inc. (NFLX) has witnessed a remarkable growth trajectory year-to-date, with its stock price surging by a substantial 40.5%. Such an upward trend typically catches the eye of investors seeking substantial returns through astute financial placements. This enhanced market value has significantly bolstered the company’s position within the streaming industry.

Challenges on the Horizon: Slowing User Growth

However, while the recent surge in stock performance is noteworthy, Netflix faces a notable challenge in the form of diminishing user growth. This potential decline in subscriber acquisition may temper the stock’s bullish run in the near future. Investors need to keep a close eye on this developing trend that could influence the company’s financial outlook and stock price.

Predictive Analysis: The Quest for a Favorable Entry Point

For investors considering entering the market and taking a position in Netflix, timing is key. With Netflix currently holding a Zacks Rank #3 (Hold), the search for an opportune entry point becomes imperative. Navigating the unpredictable waters of the stock market requires a strategic approach and thorough analysis to capitalize on potential gains while mitigating risks.

Evaluating Competing Industry Players

As industry competitors like Warner Bros. Discovery, Inc. (WBD) and The Walt Disney Company (DIS) vie for market dominance, the landscape of the streaming industry is evolving rapidly. By understanding the performance and growth strategies of key players in the market, investors can make informed decisions on where to allocate their financial resources for optimal returns.

Seeking Growth Opportunities: A Deeper Dive into Market Trends

Unearthing investment opportunities often involves delving beneath the surface of mainstream market trends to identify hidden gems poised for exponential growth. By exploring the industry’s under-the-radar stocks and emerging market trends, investors can position themselves strategically to capitalize on potential growth prospects and maximize their investment returns.

Innovating for Future Success: Netflix’s Strategic Initiatives

Netflix’s ability to innovate and adapt to changing market dynamics will be central to its future success. By continuously fine-tuning its content offerings, expanding its subscriber base, and embracing technological advancements, Netflix can cement its position as a leader in the streaming industry and drive sustained growth in the long run.