Amidst a turbulent cannabis sector, marked by a 15.24% decline in the MSOS ETF post the DEA’s rescheduling delay till December 2nd, the market grapples with volatility. The looming U.S. presidential election, with starkly contrasting views on cannabis policy, adds further uncertainty. However, a few cannabis penny stocks, priced lower than a McDonald’s Big Mac, have displayed remarkable resilience.

Navigating Financial Challenges

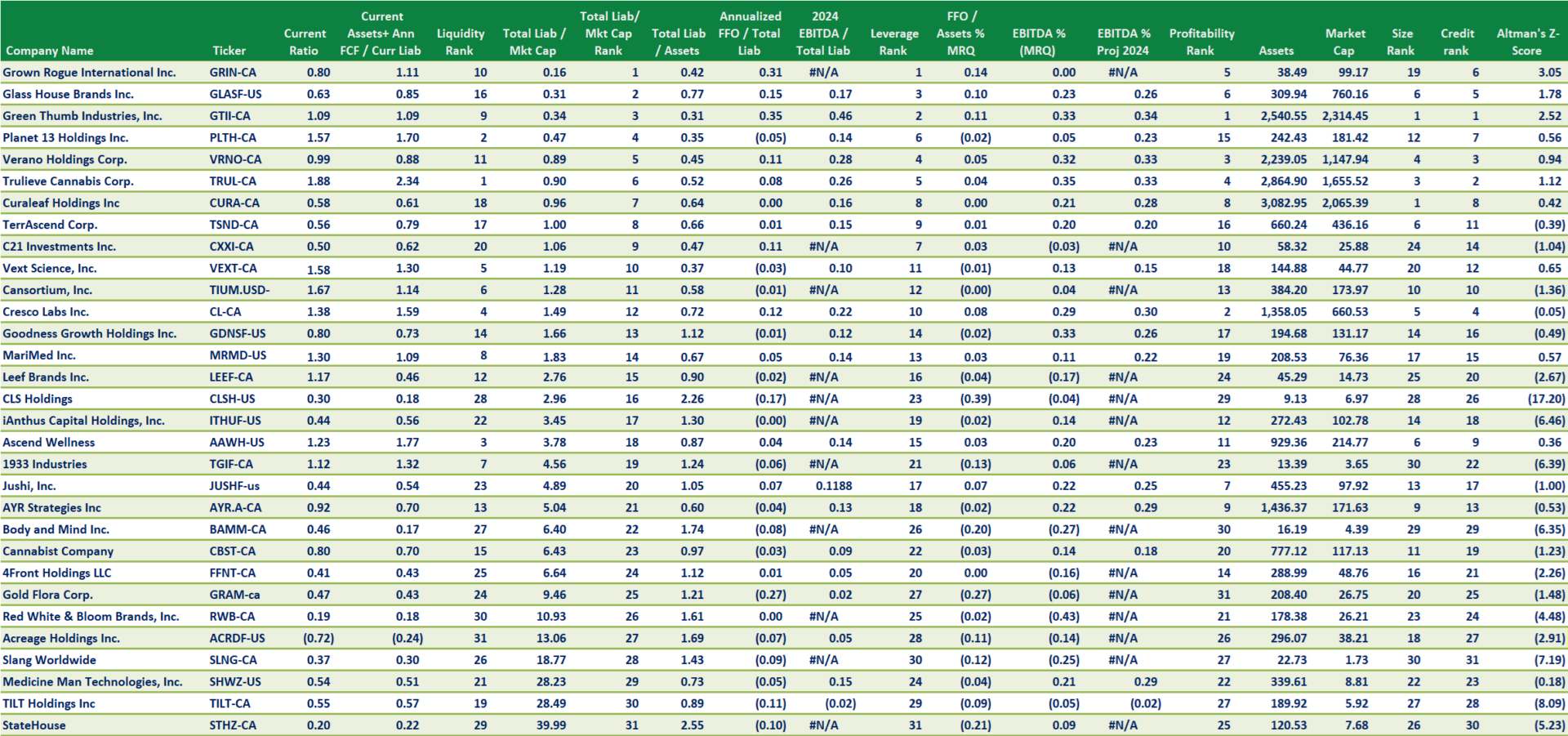

As per insights from Viridian Capital Advisors, the cannabis sector’s median debt-to-EBITDA ratio stands at 2.98 times for analyzed companies, indicating sustainable debt levels amidst hurdles like the 280e tax code. Despite this, the top quartile of companies in the sector exhibits unsustainable leverage ratios, depicting ongoing financial turbulence.

Nevertheless, companies showing improvement amidst the chaos have strategically managed liquidity and trading volumes to leverage market fluctuations:

- Vext Science weathered market volatility with stable trading volumes, despite a 5.88% dip in stock price to $0.16. The company reported an 8% revenue drop year-over-year but remains optimistic about future growth, especially with strategic expansions in Ohio and operational efficiencies in Arizona resulting in a positive adjusted EBITDA of $1.08 million in Q2 2024.

- C21 Investments saw its stock price surge by 11.5295% to $0.2399, reflecting robust market dynamics. Despite a marginal revenue increase of 1% year-over-year amidst inflationary pressures, the company maintained strong transaction volumes, reporting positive cash flow from operations and free cash flow even with a net loss of $1.4 million.

- IAnthus Capital Holdings reported an 8.7838% stock price decrease to $0.0135 but showcased financial resilience with improved credit metrics. With an 11.1% revenue rise to $43.0 million in Q2 2024, alongside a gross profit increase and enhanced working capital, the company is on a positive trajectory for growth.

Credit Challenges for Some

While certain players thrived, others like TerrAscend, AYR Strategies, and MariMed faced credit downgrades. Companies such as Red White & Bloom, Acreage, and Slang Worldwide reported distressing total liabilities to market cap ratios exceeding 10, indicative of financial distress.