With the artificial intelligence (AI) market skyrocketing to a value of $200 billion in 2023 and poised to reach close to $2 trillion by 2030, the allure of investing in this sector remains irresistible. The 37% compound annual growth rate of the industry beckons companies and investors to reap the rewards of providing AI tools, services, and hardware for years to come.

For both fresh investors in the AI arena and seasoned ones eyeing expansion, a deep dive into the market-driving enterprises is an essential move. Here are two AI stocks that stand out as prime choices for August.

Exploring Advanced Micro Devices

The role of chipmakers in the realm of AI cannot be overstated. The recent advancements in the chip industry have finally unlocked the potential to bring to life AI concepts that have long been in the making. Graphics processing units (GPUs) have emerged as the linchpin for training AI models and fueling large language models like OpenAI’s ChatGPT. Industry giants such as Advanced Micro Devices (AMD) and its rival Nvidia have significantly profited from the soaring sales of GPUs over the past year.

AMD, though tardy in joining the AI fray compared to Nvidia, has made substantial strides in 2024, positioning itself to secure a lucrative share of the market. The company’s second-quarter 2024 earnings report revealed a remarkable 9% year-over-year revenue surge. Notably, there was a whopping 115% spike in data center revenue attributed to AI GPU sales. Moreover, the client division, encompassing central processing unit (CPU) sales, experienced a robust 49% revenue growth compared to the previous year.

With a notable 18% increase in total operating income and an 81% surge in quarterly free cash flow in 2024, AMD is amassing a significant cash reserve, enabling continued investments in AI to bridge the gap with Nvidia. The pivotal Q2 2024 for AMD underscored that AI has become its primary business focus, with data centers driving the bulk of revenue growth. The company is poised for expansion across various AI sectors, from AI-enabled PCs to cloud computing and self-driving technology.

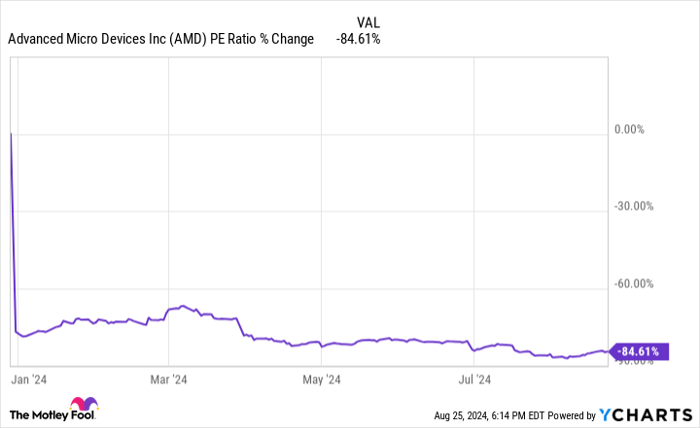

Data by YCharts

While AMD’s price-to-earnings ratio (P/E) may appear steep at 189, a notable 85% decrease since the year’s commencement indicates a favorable trend. This P/E is substantially below the 12-month average of 462, alongside a 52% rise in AMD’s stock. Hence, the stock presents an attractive value proposition, especially in light of its robust growth potential in AI. As AMD continues delivering positive quarterly results, its stock remains a compelling long-term investment that warrants fervent acquisition.

Unveiling Alphabet’s AI Potential

Alphabet, featuring under the tickers NASDAQ: GOOG and NASDAQ: GOOGL, is a sleeping giant in the AI domain this year. The company has aggressively entered the rapidly expanding realm of cloud computing, a pivotal sector within AI. Boasting a diverse product portfolio encompassing YouTube, Android, Google, and Chrome, Alphabet enjoys myriad opportunities to showcase its generative software capabilities.

The recent launch of the Google Pixel 9 in mid-August underscores Alphabet’s AI prowess, with features like AI-based photo editing and the Gemini AI assistant anchoring its position in the burgeoning AI smartphone market. Alphabet has strategically planted seeds across various industry segments, setting the stage for substantial gains in the foreseeable future.

Alphabet’s astute AI strategy mirrors its successful approach in dominating the advertising sphere. The company reigns supreme in the $740 billion digital advertising market by leveraging the strength of its product lineup, including Google, Chrome, and YouTube. This same winning formula is now being replicated in the AI landscape.

Over the past year, Alphabet has integrated generative features into Google Search, Android, Cloud, and YouTube. Positioning itself as a premier AI provider to global businesses and consumers, Alphabet’s products like Pixel 9 embody AI hardware innovation.

Data by YCharts

Despite a 19% year-to-date stock surge, Alphabet boasts the most appealing stock value among its peers. With a P/E of 24, Alphabet’s stock emerges as a bargain in the AI landscape, signaling a prime opportunity not to be overlooked this August. The company’s mammoth potential and robust service offerings position it for significant growth in the coming years.